The number of U.S. farms shrank by 15,000 in 2025, bringing the total to 1.865 million, USDA said (last week) in its Land in Farms report. This continues a long-lasting…

Ag Economy to Improve Slightly in 2026, USDA Projects

Agri-Pulse’s Oliver Ward, Kim Chipman, and Steve Davies reported that “the Agriculture Department is anticipating a slightly easier 2026 for U.S. ag producers, with prices for major commodities nudging higher and input and labor costs moderating, according to USDA Chief Economist Justin Benavidez.”

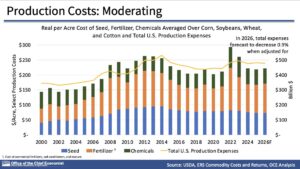

“Benavidez, who joined the department in January, presented his first annual forecast at USDA’s Agricultural Outlook Forum in Arlington, Virginia, on Thursday, offering an improved economic picture in 2026,” Ward, Chipman and Davies reported. “‘For the first time in several years, the cost of production is beginning to moderate,’ he said. Once adjusted for inflation, the total costs of seed, fertilizer and chemicals is set to fall 0.9%, Benavidez said.”

“Meanwhile prices are set to rise modestly, with USDA anticipating corn, soybeans and wheat all set to rise 10 cents per bushel, Benavidez noted. Cotton, meanwhile, could increase three cents per pound, he said,” according to Ward, Chipman and Davies’ reporting. “‘The story for the year is progress being made on the price,’ Benavidez said. ‘We’re not hitting it out of the park. We’re not solving everyone’s problems in terms of pricing overnight, but price is generally expected to move modestly higher.'”

AgWeb’s Tyne Morgan reported that “after multiple years of relentless increases, USDA now forecasts production expenses to moderate. Benavidez points to a key inflection point: inflation-adjusted costs. ‘We’ll see cost of production moderate for the first time in several years,’ he says. ‘When adjusted for inflation, total cost of production will decline marginally.'”

“That doesn’t mean every farmer will see lower costs in 2026,” Morgan reported. “‘Certain producers are obviously going to see that nominal cost still go up marginally, in the neighborhood of 1% on average,’ he adds.”

“Behind the recent volatility, Benavidez says, lies a longer-term structural issue,” Morgan reported. “‘We are still working very hard to get out of what is really a 15-year discrepancy in that cost of production and price received for crops,’ he says. ‘We’ve had some black swan events that have masked a long-term gap in cost of production and price received.’ Closing that gap will require more than cost control. Benavidez says it will require more sources of demand.”

Growers to Plant More Soybeans, Less Corn in 2026

Bloomberg’s Michael Hirtzer, Elizabeth Elkin, and Ilena Peng reported that “US growers will boost soybean plantings this spring and scale back on corn, the most widely grown American crop, after the revival of stalled exports of the beans to China.”

“Farmers will plant 85 million acres of soybeans this year, up from 81.2 million last year, the US Department of Agriculture said Thursday in the agency’s first outlook of the year,” Hirtzer, Elkin and Peng reported. “Expectations for more soybean acres this spring reflect ‘stronger profitability compared to other crops, along with expected crop rotations across the Corn Belt and the Delta,’ the USDA said.”

“Meanwhile, corn acres will drop to 94 million, from 98.8 million last year,” Hirtzer, Elkin and Peng reported. “Wheat acres will slip to 45 million, from 45.3 million last year. Overall, planting of the three principal crops will ease 1% while the prices farmers receive are forecast to rise slightly.”

Acreage Expectations for the 2026/27 Crop Year #AgOutlook26 pic.twitter.com/5GPSl5jpuy

— Dept. of Agriculture (@USDA) February 19, 2026

Progressive Farmer’s Chris Clayton reported that “along with lower planted acreage, USDA’s initial look at the 2026 corn crop also lowers the projected corn yield 3.5 bushels for the 2026-27 crop to 183 bushels per acre (bpa). Production would decline from 17.02 bb to 15.755 bb, down about 7% from the record 2025-26 crop. Still, the new crop estimate would come in as the second largest, just behind last year’s crop.”

For soybeans, “the yield is projected to hold steady at 53 bpa, the same as the 2025-26 crop,” Clayton reported. “…Total production for the 2026-27 crop is projected at 4.45 bb, up 188 mb from 4.262 bb in the 2025-26 crop.”

Corn Exports to Fall, Soybean Exports to Rise in 2026

Reuters’ Karl Plume reported that “the USDA forecast 2026/27 corn exports at 3.1 billion bushels, down 200 million bushels from 2025/26 due to rising competition from South American suppliers, while soybean exports were seen rising by 125 million bushels to a two-year high of 1.7 billion bushels.”

“Demand from U.S. soybean processors that crush beans into soymeal for livestock feed and soyoil for food and biofuel was projected at a record 2.655 billion bushels,” Plume reported. “U.S. wheat stocks were forecast at 933 million bushels by the end of the 2026/27 marketing year, nearly unchanged from a year earlier as lower exports following bumper crops in rival suppliers Argentina and Australia offset a drop in U.S. production.”

“The USDA projected wheat exports for 2026/27 at 850 million bushels, down 50 million from the current marketing year,” Plume reported.