As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Many Producers ‘Fighting for Survival’ in 2026, Survey Shows

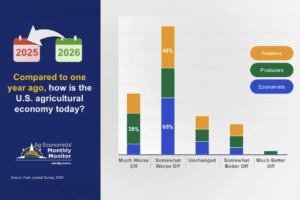

AgWeb’s Tyne Morgan reported that “the U.S. ag economy enters 2026 in a clear crop-sector recession, but the deeper crisis is one of confidence. High input costs, weak prices, policy uncertainty and eroding trust in data have pushed many producers from planning for profitability into fighting for survival. Economists largely view the downturn as cyclical and manageable through optimization, while farmers experience it as a structural stress test on their operations and livelihoods.”

In the first Farm Journal Ag Economists’ Monthly Monitor of 2026, economists “pointed to a familiar but intensifying split in the ag economy: strength in livestock, particularly beef cattle, versus persistent financial stress across much of the row-crop sector,” Morgan reported. “Tight cattle supplies and strong global demand for animal protein continue to support profitability in the livestock sector, even as economists warn that future prospects remain uncertain. At the same time, global surpluses of corn, soybeans and wheat, combined with weak export demand for certain commodities, are weighing heavily on crop prices.”

“Across nearly all responses, margin pressure emerged as a dominant concern,” Morgan reported. “Elevated input costs, rising interest rates and tightening access to operating loans are pushing break-even costs above market prices for many producers, especially in grain production.”

“When asked a simple but heavy question: ‘What can you do to be successful in 2026,’ farmers didn’t sugarcoat the challenge. Their answers reflect pressure, fatigue and uncertainty. But underneath the blunt language is a clear, consistent strategy emerging across operations: protect cash, defend ROI and stay flexible long enough to outlast the cycle,” Morgan reported. “While several producers said they’re looking to diversify as a key to success, the most dominant theme was cutting costs to the bone, especially when it comes to capital spending. Farmers repeatedly emphasized zero, or near-zero, capex, delaying equipment upgrades and scrutinizing every purchase.”

Farmers Turning to More Debt in Challenging Ag Economy

Agri-Pulse’s Noah Wicks reported that “farmers are increasingly turning to debt to make it through a challenging farm economy. According to USDA’s most recent farm income forecast, farm sector solvency is expected to weaken this year as value of debt outpaces assets. The forecast suggests debt-to-asset ratios will increase from 13.49% in 2025 to 13.75% in 2026.”

“‘Over the last year and a half or two, there has definitely been some tightening in terms of the overall ag economy and some amount of additional pressure by way of credit conditions and repayment,’ said Nate Kauffman, senior vice president and Omaha branch executive for the Kansas City Fed,” according to Wicks’ reporting. “Liquidity also is likely to decline in 2026, the Economic Research Service forecast says. Working capital, or cash available to cover operating expenses after paying off debt due within a year, is expected to drop from $154.9 billion in 2025 to $140.6 billion in 2026.”

The USDA Economic Research Service reported that “total farm sector debt is forecast to increase in 2026 relative to 2025 with increases forecast for both real estate and non-real estate debt. Farm real estate debt is expected to reach $404.3 billion in 2026, a 4.8-percent increase in nominal dollars (2.8-percent increase in inflation-adjusted dollars) from 2025. Farm non-real estate debt is expected to reach $220.4 billion in 2026, a 6.0-percent increase in nominal terms and a 4.0-percent increase in inflation-adjusted dollars.”

Ag Economist Survey Results Similar to this Month’s Ag Economy Barometer

The Ag Economists’ Monthly Monitor reflects much of the same sentiment seen in the Purdue University-CME Group Ag Economy Barometer released earlier this month.

Bloomberg’s Michael Hirtzer reported that “US farmer sentiment fell by the most in nearly six years in January as operators who have been relying more on loans turned pessimistic on exports of crops like soybeans.”

“The monthly survey of 400 operators with production value of at least $500,000 found farmers are increasing the amount they are borrowing, with more than half expected to use the Trump administration’s $12 billion aid package to pay down debt,” Hirtzer reported. “The Purdue University-CME Group Ag Economy Barometer plummeted to a reading of 113, with the net drop the biggest since April 2020, during the coronavirus outbreak.”

Purdue University’s Michael Langemeier and Joana Colussi reported that “the percentage of producers who expected there to be bad financial times in the next twelve months increased from 47% in December 2025 to 59% in January 2026, while the percentage of producers who thought U.S. agriculture would have widespread bad times during the next five years increased from 24% to 46%.”