A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

U.S. Farm Bankruptcies Increased 46% in 2025

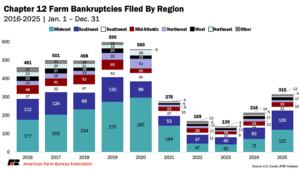

The American Farm Bureau Federation’s Samantha Ayoub reported that “the U.S. Courts report that 315 farm bankruptcies were filed in calendar year 2025, up 46% from 2024. While still down from recent highs, this is the second year in a row of increased filings.”

“The most recent farm income forecast confirmed that the farm economy has faced extreme financial pressure, with little relief in sight. Significant losses are expected across crop sectors for another year, and many livestock sectors are also tightening margins,” Ayoub reported. “The Midwest and Southeast each filed 121 and 105 Chapter 12 cases, respectively, far outpacing any other regions. This is a 70% increase in filings for the Midwest, and a 69% increase in the Southeast.”

“Deep losses across commodities common in these two regions have compounded after years of declining receipts and rising expenses. For example, rice farmers are expected to lose over $200 per acre in loss, even after supplemental assistance. The nation’s leading rice producing state, Arkansas, leads the U.S. in Chapter 12 filings in 2025 with 33 filings, more than double 2024 and the most in the state in the 21st century,” Ayoub reported. “Georgia follows with 27 filings, up 145% from 2024, reflecting both losses per acre in principal row crops and limited support for high-cost specialty crop production. Other Southeast states with double-digit bankruptcies include Texas and Louisiana with 12 each, and Florida with a 200% increase from 2024 to 16 filings.”

“In the Midwest, principal row crop losses combined with weakening dairy, hog and poultry markets have led to double-digit Chapter 12 filings in Iowa (18, +220%), Nebraska (17, +29%), Missouri (16, +167%), Wisconsin (16, +700%), Minnesota (13, +300%) and Kansas (11, +10%),” Ayoub reported. “Other states with significant increases in filings in 2025 include Montana, with 200% more filings, and Pennsylvania with a 160% increase in filings. While California was unchanged from 2024, they tie for fourth-highest number of filings with 17 in 2025, reflecting continued price and cost pressures on their diverse agricultural industries.”

Farm Loan Sizes Also Increased in 2025, Reflecting Tough Ag Economy

Pro Farmer Editors reported that “strong credit demand from U.S. farmers pushed the average size of operating loans to a record and pushed up lending volumes in 2025, according to the National Survey of Terms of Lending to Farmers conducted by the Federal Reserve.”

“According to estimates from the survey, the volume of new farm operating loans rose nearly 40% from the previous year in the fourth quarter and grew by an average of more than 20% in 2025,” Pro Farmer reported. “While the rise in non-real estate lending during the fourth quarter was attributed to operating expenses, increased feeder-livestock lending also contributed to growth in activity throughout most of 2025, the survey found.”

“Adjusting for inflation, the average size of farm operating loans during 2025 was 30% larger than the prior year, following similar growth during 2024,” Pro Farmer reported. “Loan sizes have grown alongside elevated production expenses and pushed operating loan volumes well above the average of the past two decades, Kreitman noted.”

While farm loan sizes grew in 2025, the Kansas City Federal Reserve’s Ty Kreitman reported that “as the size of notes grew, maturities (payment length) for most types of non-real estate farm loans increased in 2025. The average maturity of farm operating loans during 2025 increased by about 3 months compared with 2024 and reached record highs in the fourth quarter. The average maturity on machinery and equipment loans also increased over the past year and hit the highest level since 2021.”

Ag Economy Strain Likely to Continue in 2026

Ayoub reported that “a fourth consecutive year of expected declines in farm income will continue to strain agriculture, placing further reliance on credit options that are growing thin. For many families, excessive debt loads could be met with little flexibility as Chapter 12 eligibility prohibits them from using the tool specifically designed to accommodate downturns in the farm economy. Instead, we will likely continue to see increases in both bankruptcy and farm closures, further straining the remaining farms – and the food, fiber and fuel supply chain for all Americans.“