Republican U.S. lawmakers plan to create a task force to study potential year-round sales of higher-ethanol E15 gasoline blends in the U.S., after an attempt to pass such legislation in…

USDA Agricultural Projections to 2029- Focus on Corn, Soybeans

On Friday, the U.S. Department of Agriculture released its 10-year projections for the food and agricultural sector. The report noted that, “While agricultural crop prices are tending to trend upwards only slowly in nominal terms, U.S. trade disputes with China that existed at the time of these projections were formulated have dampened expectations, particularly for soybeans. These projections assume the trade disputes to continue the duration of the projection period. Planted acreage drops slightly overall compared to recent years, primarily due to expected lower soybean plantings, while corn and wheat plantings are expected to remain mostly unmoved.” Today’s update highlights aspects of the report that focused on corn and soybeans.

Background

In part, the baseline update explained that, “The report uses as a starting point the short-term outlook from the October 2019 World Agricultural Supply and Demand Estimates report and the narrative discusses conditions as of that release date. Recent agreements and discussions such as the Phase One deal with China, the USMCA agreement, and a Japan-U.S. free trade agreement were not considered for these projections. The macroeconomic assumptions were completed in August 2019.”

Corn

The baseline report stated that, “U.S. corn production is projected to mostly grow over the next decade from yield growth, as well as relative prices are likely to encourage corn over soybean plantings. Expanding meat production is expected to boost feed usage and use for food, seed, and industrial is projected to increase over the baseline period.

Planted area is expected to increase sharply in the near-term and then recede to 89.0 to 88.5 million acres for the rest of the projection period, similar to more recent years, as markets adjust to a new trade equilibrium and demand for U.S. soybeans grows again.

“Through the baseline period, supply and use are both projected to increase by 7.0 percent.”

With respect to ethanol, the report stated that, “Corn-based ethanol production is projected to rise slowly over the entire period. Constraints on the expansion of higher ethanol blends (E15 and E85), rising fuel efficiency, rising oil costs, and changing consumer lifestyles resulting in lower miles driven all support a decline in domestic ethanol consumption. Increasing ethanol exports are assumed to more than offset trends in domestic use.”

While addressing long-term corn exports, USDA explained that, “In 2020/21, U.S. corn exports are expected to be 53.3 million tons (2.1 billion bushels), compared to 29.6-36 million tons for Ukraine, Brazil, and Argentina, the next largest exporters…[and]…Despite continued competition from Brazil, Argentina, and Ukraine, growing domestic feed use, and slowly increasing demand for ethanol, the United States’ market share of global corn trade will rise slightly from 30.5 percent to 31.6 percent by 2029/30. This is well below the shares prior to 2010, when the United States last exceeded 50 percent of global export market share.”

“Modest growth in nominal corn prices is projected over the coming decade but is restrained by ending stocks significantly higher than during the past decade. Real prices are expected to drop slightly over the projection period,” the report said.

Soybeans

Friday’s report noted that, “After dropping sharply in 2019/20 due to weather-related planting issues and trade tensions with China, U.S. soybean plantings are projected to rebound and remain relatively steady over the course of the decade. Plantings are projected to remain in the mid-80-million-acre range, supported by slowly rising prices and net returns.”

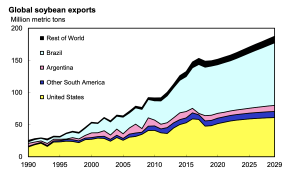

U.S. soybean exports were subdued in 2019/20 after climbing rapidly between 2012/13 and 2017/18 but recover to recent highs by the middle of the projection period as producers and exporters adjust to the new trade environment. Brazil continues to capture market share, and the U.S. share of trade drops from 34.0 to 32.5 percent between 2020/21 and 2029/30.

The update pointed out that, “With the U.S. limited in China’s market, soybean shipments partially expanded to alternative foreign markets and increased volumes held in storage in the 2018/19 marketing year. Nominal soybean prices dropped in the 2018/19 marketing year but are expected to rebound with lower production in 2019/20. Prices decline again into the early part of the projection period before slowly rising as exporters swap trading partners. Brazil is expected to ship most of its soybeans to meet China’s demand, under the assumption that the trade tensions with China will continue throughout the decade. As a result, the U.S. is expected to supply much of the rest of the world. The demand for soybeans in the rest of the world is not expected to grow as fast as in China. Yet emerging economies will continue to expand the use of soybeans as a feedstock as per capita incomes are expected to continue to rise and food preferences to change, generating an increased demand for animal proteins.”

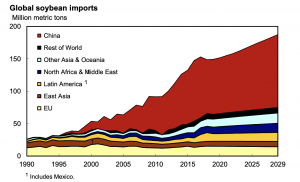

The baseline report added that, “China’s soybean imports have risen steadily since the late 1990s through 2017/18, and are expected to account for about 60.0 percent of world soybean trade by 2029/30. China’s imports are projected to increase from 86.1 million tons in 2020/21 to 112.5 million tons in 2029/30, accounting for 74.0 percent of the increase in trade. The projections assume that China will continue to meet the rising demand for edible vegetable oils and protein in feed by importing soybeans while supporting domestic production of food and feed grains.”

Turning to world soybean exports, USDA stated that,”Brazil’s soybean exports are projected to rise 21.8 million tons (29 percent) to 97.4 million tons during the projection period (2020/21 to 2029/30), strengthening its position as the world’s leading soybean exporter. Soybeans remain more profitable to produce than other crops in most areas of Brazil.”

The baseline report also noted that, “The U.S. share of global soybean exports is about 34 percent in 2020/21 and projected to decrease to 32.5 percent by 2029/30. U.S. soybean exports are projected to increase from 51.6 million tons in 2020/21 to 61.0 million tons by 2029/30.”