Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University's monthly…

Highlights from USDA Trade and Commodity Outlook Reports

Following this month’s release of the USDA’s Long-Term Projections, on Thursday, the Department released its quarterly Outlook for U.S. Agricultural Trade. This update provided an overview of agricultural trade based on the 2020 fiscal year, which began in October, months before the U.S. and China signed the Phase-One trade agreement. Recall that Phase One farm purchase commitments are based on the calendar year.

In part, the Trade Outlook report noted that, “U.S. agricultural exports in Fiscal Year (FY) 2020 are projected at $139.5 billion, up $500 million from the November forecast, as higher soybean, wheat, and poultry export forecasts more than offset reductions in corn and soybean meal.

Soybean and wheat exports are projected up $400 million each on higher volumes. Corn exports are forecast down $500 million due to strong competition from Brazil, Argentina, and Ukraine.

More narrowly, the report stated that, “Exports for China are raised $3.0 billion from the November forecast to $14.0 billion, largely based partly on higher projected volumes for soybeans. The current outlook for exports to China is tempered by significant uncertainties surrounding the Covid-19 outbreak, which may affect the timing of China’s purchases under the Phase One Agreement during the calendar year.”

Bloomberg writers Isis Almeida and Mike Dorning reported on Thursday that, “It’s either going to be a boom fourth quarter for U.S. farmers, or that extra $12.5 billion in American agriculture purchases promised by China for this year isn’t happening.”

The article indicated that, “The agency is predicting a $3.9 billion bump for exports to China in the year ended Sept. 30, leaving a whopping amount of corn, pork, soy and other purchases to be made in the last three months of the year to reach the trade accord goal.”

The Bloomberg article explained that, “To be fair, there’s some fine print here. First, U.S. Agriculture Secretary Sonny Perdue said at the forum that purchases are likely to be higher than those estimates, which were laid out by USDA Chief Economist Robert Johansson.

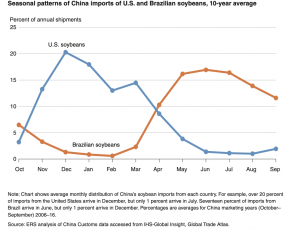

“Second, the USDA figures don’t include shipments of commodities including ethanol and seafood, which are part of the trade deal. And lastly, the fourth quarter is typically when Chinese purchases pick up anyway due to the timing of grain and oilseeds harvests. Soybeans have historically made up a large bulk of Chinese purchases.”

The Bloomberg article added that, “‘It’s certainly feasible to get to the phase-one commitments in a number of different pathways,’ [Johansson] said, adding that he believed purchases would be weighted toward the fourth quarter. ‘Whether they do or they don’t will depend on a number of things.'”

In related developments, Reuters News reported late last week that, “The U.S. government expects China to honour its commitments to buy more U.S. goods under a trade deal signed by the world’s two largest economies in January despite the fast-spreading coronavirus outbreak, a senior U.S. official said on Thursday.”

And Bloomberg writers Isis Almeida and Alfred Cang reported last week that, “China is back in the market for American agricultural commodities after issuing a list of products that will be eligible for tariff waivers, according to people familiar with the matter.

“American exporters sold four sorghum cargoes to China after buyers bid for supplies to be shipped in the first half of the year, said the people, who asked not to be identified because the information is private. Importers also inquired about more sorghum supplies and other products such as soybeans on Wednesday, a day after asking about wheat prices in a move that sent Chicago futures rallying.”

On Monday, Reuters News reported that, “China’s customs office said on Monday it had conditionally lifted a ban on beef and beef products from U.S. cows more than 30 months old, following Beijing’s pledge to increase farm purchases from the United States under their Phase 1 trade deal.”

“The trade move also comes as China battles severe meat shortages after an African swine fever cut the country’s massive pig herd by more than 40%, while measures to contain the coronavirus outbreak further hit supplies of livestock and poultry in the world’s most populous nation,” the Reuters article said.

Meanwhile, on Friday, USDA released Commodity and Livestock Outlook reports that were prepared by the Members of the Wheat, Feed Grains, Rice, and Oilseeds Interagency Commodity Estimates Committees.

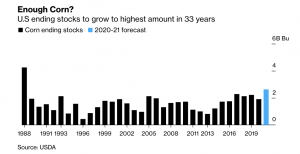

Bloomberg writers Isis Almeida and Michael Hirtzer provided a recap of key portions of the Commodity Outlook on Friday, and reported that, “Donald Trump’s trade truce with China is expected to push American soybean stockpiles to the lowest since the trade war began.

“But corn stocks are going in the opposite direction, ballooning to the highest in three decades.”

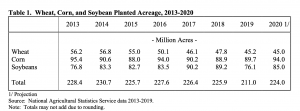

Soybean reserves will fall 25% in the coming season to the lowest since 2016-17, the U.S. Department of Agriculture forecast at its outlook forum in Arlington, Virginia. Higher exports, especially to top importer China, will add to increased domestic demand to eat up stocks.

The Bloomberg article stated that, “Current prices and yield prospects have increased bets that farmers will sow the yellow grain over the oilseed. The USDA on Thursday said corn plantings would likely climb to the highest in four years. While soybean acres should also rise, they are projected to stay below pre-trade war levels.”

In other developments, Wall Street Journal writer Josh Zumbrun reported on Friday that, “President Trump said the U.S. would consider a third round of aid payments for American farmers who have borne the brunt of retaliation for U.S. tariffs for much of the past two years.

IF OUR FORMALLY TARGETED FARMERS NEED ADDITIONAL AID UNTIL SUCH TIME AS THE TRADE DEALS WITH CHINA, MEXICO, CANADA AND OTHERS FULLY KICK IN, THAT AID WILL BE PROVIDED BY THE FEDERAL GOVERNMENT, PAID FOR OUT OF THE MASSIVE TARIFF MONEY COMING INTO THE USA!

— Donald J. Trump (@realDonaldTrump) February 21, 2020

“Although the U.S. has said farmers would benefit from its signing of a phase-one trade deal with China and its ratification of the new U.S.-Mexico-Canada Agreement, Mr. Trump raised the possibility that new aid payments may be necessary until those deals bear fruit. The USMCA was signed in late January and the China deal didn’t take effect until Feb. 14.”

President's tweet means I have to recalibrate everything on Phase 1 agreement impacts. Prez clearly signaling high risk that China does not meet ag purchasing targets in 2020 due (apparently) to #Coronavirius https://t.co/5aAjYbxoq1

— Scott Irwin (@ScottIrwinUI) February 24, 2020

“Officials previously said they hoped the trade deals finalized earlier this year would make a third bailout unnecessary,” the Journal article said.