Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

Federal Reserve: Observations on the Ag Economy- July 2020

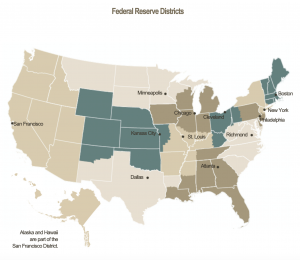

On Wednesday, the Federal Reserve Board released its July 2020 Beige Book update, a summary of commentary on current economic conditions by Federal Reserve District. The report included several observations pertaining to the U.S. agricultural economy.

* Sixth District- Atlanta– “Agricultural conditions remained weak. Mostly drought-free conditions prevailed. On a month-over-month basis, June’s production forecast for Florida’s orange crop was down from the previous month and last year, while Florida’s grapefruit production forecast was down from the previous month but remained ahead of last year. The USDA reported that in May, year-over-year prices paid to farmers were up for rice, soybeans, and eggs but down for corn, cotton, cattle, broilers, and milk. On a month- over-month basis, prices increased for cotton, rice, cattle, and broilers but decreased for corn, soybeans, eggs, and milk.”

* Seventh District- Chicago–

The COVID-19 pandemic continued to weigh on agriculture incomes.

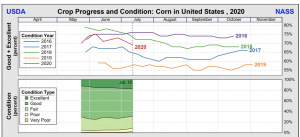

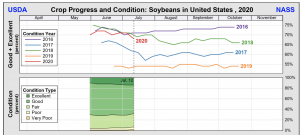

“That said, farm incomes received a boost from some commodity price increases and CARES Act payments. Corn and soybean prices moved up after a USDA report that the number of corn acres planted was smaller than expected.

Daily #Grain Review, July 14th https://t.co/UK12S8p4wv @USDA_AMS

— Farm Policy (@FarmPolicy) July 15, 2020

* Central #Illinois: #Corn- #Soybean Prices.

* 2020, 2019, and five-year average. pic.twitter.com/Zm62XWeZo2

“Following a smooth planting season, corn and soybean crops were off to an excellent start.

“Specialty crops were also in decent shape. Meat production rebounded to levels near that of a year ago as packing plants reopened and began running extra shifts.

Weekly #Livestock, #Poultry & #Grain Market Highlights, https://t.co/wnR9OVBc0a @USDA_AMS

— Farm Policy (@FarmPolicy) July 13, 2020

* #Pork production.

* #Beef production. pic.twitter.com/W2nuzMt671

“Nevertheless, contacts reported a large backlog of hogs to slaughter. Cattle and hog prices fell and were below year ago levels. Milk prices at the farm gate stayed below last year’s levels in spite of some upward movement in dairy prices. Cheese demand surged, pushing prices to high levels. Ethanol margins widened, but some facilities remained closed and others were operating below full capacity. Demand for sites to locate renewable energy assets, recreational ground, and rural housing helped keep farmland values mostly stable.”

* Eighth District- St. Louis– “District agriculture conditions remain unchanged relative to the previous reporting period. Between the end of May and end of June, the percentages of corn and soybeans rated fair or better increased modestly, while the percentages of cotton and rice decreased modestly. The percentages of corn, rice, and soybeans rated fair or better are significantly above their values a year ago, while the percentage of cotton rated fair or better slightly decreased. Agriculture contacts have indicated that, in the past month, agribusinesses have not experienced significant shortages or slowdowns in demand and have remained open due to their essential status.

However, there is some concern that additional financing may be necessary to bridge gaps in cash flows if the overall economic slowdown is prolonged.

* Ninth District- Minneapolis– “District agricultural conditions remained poor. Producers reported that disruptions in trade with China were creating ‘headwinds’ in grain markets. Recent declines in milk prices dealt a blow to already suffering dairy producers. In contrast, the majority of the District’s corn and soybean crops were in good or excellent condition as of late June.”

* Tenth District- Kansas City– “The Tenth District farm economy remained weak despite some signs of stabilization in markets for key agricultural commodities. By late June, all U.S. meat packing plants were operational, but COVID-19 continued to impede supply chain functions. Capacity utilization and meat production at packing plants increased slightly since May, but appeared to remain limited somewhat by modified operations. Alongside production constraints, demand for meat was expected to decrease in 2020 as a result of broader economic weaknesses, putting additional downward pressure on cattle and hog prices. Ethanol production rebounded slightly in June, but remained about 20 percent lower than a year ago and continued to weigh on corn prices.

District contacts reported that farm borrower liquidity weakened considerably alongside lower commodity prices, but government aid programs could provide a moderate degree of support to agricultural credit conditions.

* Eleventh District- Dallas– “Soil moisture conditions remained favorable across most of the district, except for the Texas Panhandle area where there was drought. Wheat remained a bright spot with production up from last year, though prices were lower.

While overall crop conditions were favorable, lower-than-profitable prices were leading agricultural producers to rely on government support payments to supplement farm income.

“On the livestock side, meat packers were adjusting to the new operating environment and have ramped production back up. Dairy prices rose as the industry made a concerted effort to curb production in response to lower restaurant demand.”

* Twelfth District- San Francisco– “Agriculture sector activity remained weak on balance over the reporting period. While yields were generally solid for most crops, including wheat, potatoes, and fruit, domestic sales were mixed and foreign sales poor. This combination of strong crop yields and subdued demand further deteriorated profit margins for many growers. Contacts in the Pacific Northwest and Mountain West reported continued weakness in domestic wholesale distributors’ and restaurants’ demand for grains and potatoes. On the other hand, fruit and vegetable growers in California noted moderately higher demand from domestic grocery stores. On the export side, the strong dollar and continued tepid foreign demand due to the COVID-19 outbreak limited export sales for growers across the District. For example, California nut exports fell further after planned holiday celebrations around the summer solstice in China were cancelled.”