President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

China Soybean Imports Robust in July, But Soy a Lower Component of U.S. Farm Exports

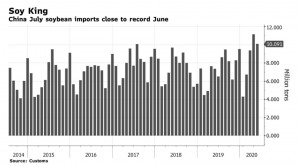

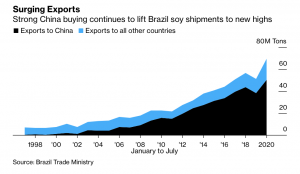

Bloomberg News reported on Thursday that, “China’s soybean imports were the second highest on record in July as processors increased purchases of cheaper Brazilian supplies and demand for hog feed recovered.

“The country imported 10.09 million tons last month, up from 8.64 million tons a year earlier, and near June’s record of 11.16 million tons, according to customs data. Purchases were just above the 10.08 million tons in July 2017. Imports in the first seven months rose 18% on year to 55.14 million tons.”

The Bloomberg article noted that, “Chinese imports are seen staying strong through August, as crushers buy aggressively from top supplier Brazil on healthy crush margins.”

However, last week’s article added that,

China has shifted to U.S. soybeans to cover needs in fourth quarter as Brazilian supplies dry up and prices become less competitive

Reuters writers Hallie Gu and Dominique Patton reported on Friday that, “China’s soybean imports rose 18% this year through July versus a year ago, as large volumes of soybeans bought cheaply from top supplier Brazil arrived in the country, according to data from the General Administration of Customs.”

The Reuters article indicated that, “Soybean shipments were expected to remain large in coming months, on good profits and healthy demand from the livestock sector, traders and crushers said.

“China has been working to boost the country’s pig production after the deadly African swine fever outbreaks, first discovered in the country in August 2018, decimated its massive herd.”

More specifically regarding U.S. exports to China, Reuters columnist Karen Braun explained on Friday that, “U.S. soybean sales to China for the upcoming marketing year sit at a six-year high after last month’s blistering sales pace.

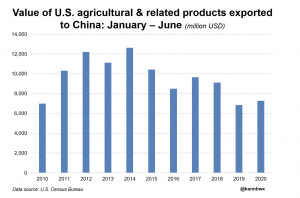

However, the oilseed occupied an unusually light share of total American farm exports to China during the first half of 2020, which explains why the Asian country is seemingly very far behind on fulfilling promises made in the Phase 1 trade agreement.

“Between January and June, the United States had shipped $7.3 billion worth of agricultural and related products to China, according to data published on Wednesday by the U.S. Census Bureau. That is up 6% from the first half of last year, which was an 11-year low, but is down 25% from 2017, the benchmark outlined in Phase 1.”

Ms. Braun added that, “U.S. soybean exports to China in H1 2020 were valued at $1.36 billion, some 19% of the all-product total. That is their lowest H1 share since 1999, and it is well off the 10-year first-half average of 39%.”

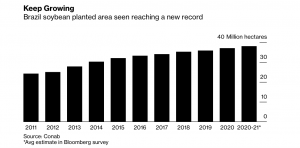

Meanwhile, Bloomberg writer Tatiana Freitas reported last week that, “Brazil is set to tighten its grip on the title of top soybean nation, expanding planted area by the equivalent of 2 million football fields as a currency slump boosts local prices.

“Producers in the South American farming powerhouse will seed a record 37.9 million hectares (93.6 million acres) with soy in the planting season starting next month, according to the average estimate of 10 analysts surveyed by Bloomberg.

“That’s a million hectares, or 3%, more than the previous season. Output should be close to 130 million tons, strengthening Brazil’s lead over the U.S. as this year’s worst-performing major currency makes Brazilian oilseed more attractive to Chinese buyers.”

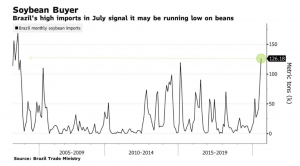

Also last week, Bloomberg writers Tatiana Freitas and Dominic Carey reported that, “Demand for Brazilian soybeans is so strong that the world’s biggest producer is on track to import a record amount of the oilseed.

“Imports through July almost tripled from the same period last year to 398,000 metric tons. While the incoming amount is a fraction of the 51.2 million tons shipped out of Brazil in the same span, the growth reveals an unusual situation: Brazil is running short of soybeans.”

The Bloomberg article noted that, “Processing industries are bringing the oilseed from Paraguay for crushing as exports continue breaking records. The weakness of the Brazilian real — this year’s worst-performing major currency — helped boost the nation’s exports amid robust Chinese demand. Local consumption is also strong on higher use for feed and biodiesel.”

More broadly with respect to U.S., China relations, Bob Davis reported on the front page of Saturday’s Wall Street Journal that, “The Trump administration’s cascade of actions taken against Beijing represent a new chapter in U.S.-China relations, one marked by increasing confrontation and few efforts to de-escalate the tensions.”

The Journal article pointed out that, “In recent days, the White House has piled one anti-China initiative on top of another in sectors including finance, technology and national security. They include starting the process of delisting Chinese companies in the U.S., planning to shutter two of the most popular Chinese apps— WeChat and TikTok—sanctioning Hong Kong leader Carrie Lam, sending a cabinet official to Taiwan and closing the Chinese consulate in Houston.”

Mr. Davis stated that, “There are still some constraints on how far the Trump administration is willing to push confrontation now. During the two-year trade war with China, the president often backed away from provocative actions when markets sank. His concern about the markets is only magnified in the run-up to the election, say Trump officials, particularly as the economy is struggling to regain its footing after the steepest downturn in over 70 years of record-keeping.

“U.S-China trade, which was the heart of the confrontation through 2019, is now one of the stabilizing elements. The two sides signed a phase one trade accord, which the president has touted as one of his big achievements. U.S. Trade Representative Robert Lighthizer and his Chinese counterpart, Vice Premier Liu He, are scheduled to meet by videoconference to discuss the accord around Aug. 15.

“But it’s far from clear the pact will hold through the election. ‘You know, I made a trade deal, and it’s a wonderful deal,’ Mr. Trump told Fox Business Network’s Lou Dobbs on Tuesday. ‘But after this happened’–referring to the coronavirus pandemic—’I don’t feel the same about the deal.'”