President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

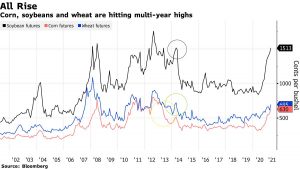

Corn, Wheat and Soybean Prices Continue to Surge, China Buys U.S. Corn for Fourth-Quarter Shipment

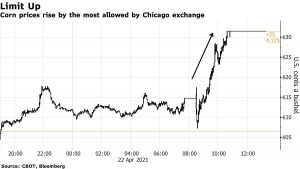

Bloomberg writers Kim Chipman and Breanna T Bradham reported on Thursday that, “Corn extended its ascent to the highest in almost eight years, leading a rally in crop futures on bets that voracious Chinese demand, rebounding economies and adverse weather will leave silos depleted.

“Corn jumped by the exchange limit, with wheat following and soybeans topping $15 a bushel for the first time since 2014. Cold and drought in some regions are stoking concern there won’t be enough grain and oilseed to satisfy China’s massive need for livestock feed or to meet growing biofuel demand as the world economy recovers from the virus pandemic.”

“Corn futures in Chicago rose as much as 4.1% to $6.315 a bushel, the highest since May 2013. Benchmark wheat in Chicago gained 5.3% to $7.105, the highest settlement price in almost seven years,” the Bloomberg article said.

#Illinois Grain Bids- April 22nd, https://t.co/S5XWBLFj2Q @USDA_AMS

— Farm Policy (@FarmPolicy) April 22, 2021

Central Illinois Average Price:

* #Corn 6.53

* #Soybeans 15.42 pic.twitter.com/FzmKDn9ul4

Also on Thursday, Bloomberg writers Isis Almeida, Michael Hirtzer, and Alfred Cang reported that,

China has already started buying U.S. corn from the harvest that farmers will start gathering in the fall, in the latest sign of tight global supplies.

“The Asian nation, the world’s largest commodity importer, bought American corn for shipment in the fourth quarter, according to people familiar with the matter who asked not to be identified because the deals are private. Crops for the fall harvest are currently just being planted and traders estimate sales to China were at least 1 million metric tons.”

The Bloomberg article added that, “China is forecast to import 28 million tons from all countries in the 2020-2021 season, the USDA’s Being office said in a report this week. While purchases are expected to drop to 15 million tons the following year, it’s still double a quota set by the World Trade Organization that allows firms in China to import the grain at a lower duty rate.”

In addition, Reuters writers Gus Trompiz and Michael Hogan reported on Thursday that, “Chinese buyers are thought to have booked at least half a million tonnes from the next French wheat harvest, as China looks widely to cover grain import needs heightened by a domestic corn deficit, traders said.

“The sales were believed to be the first confirmed deals involving the 2021 crop and suggest China will remain a major outlet for French wheat for a third consecutive season.”

Meanwhile, Reuters writers Tom Polansek and Karl Plume reported on Thursday that, “The Biden administration hopes to convince farmers to set aside four million more of acres of land for conservation this year by raising payment rates in an environmental program, but farmers said surging crop prices make it a tougher sell.

“The push to enroll more land into the 36-year-old Conservation Reserve Program is a part of the administration’s campaign to counter climate change.”

Polansek and Plume noted that, “Still, farmers said the potential for big profits from crop production will make them reluctant to take land out of production. U.S. corn and soy futures notched fresh multi-year highs on the Chicago Board of Trade on Thursday.

‘Unless you’ve got some really tough soil like in southern Illinois – roll-y, rocky ground – you’re going to have a hard time getting anybody to sign up anything for CRP,’ said Dave Kestel, who grows corn and soybeans in Manhattan, Illinois.

“The National Grain & Feed Association, which represents grain processors and exporters, warned the USDA not to try to enroll large tracts of productive farmland into the conservation program because the voracious international demand for commodities would simply lead farmers in competing exporting countries to increase plantings.”