The U.S. ag economy enters 2026 in a clear crop-sector recession, but the deeper crisis is one of confidence. High input costs, weak prices, policy uncertainty and eroding trust in…

Corn, Soybean Price Increases Boost Farm Income- Upend Global Trade Flows, La Nina a Variable

Reuters writer Tom Polansek reported last week that, “A surge to eight-year highs in U.S. corn and soybean prices is boosting farmers’ incomes and their demand for land, tractors and tools. It is a turnaround for the agricultural sector after farmers struggled for years with a series of challenges: an oversupply of grain, former President Donald Trump’s trade war with China and then the pandemic.”

The Reuters article noted that, “[Bret Hays, a farmer in Malvern, Iowa, in Mills County] is sowing crops this spring with his first new planter in about a dozen years, a hulking Deere & Co (DE.N) machine that costs nearly $350,000.

“It is a stark contrast to 2019 when he cleared sand and debris left in his fields from floods and crop prices slumped during the U.S.-China trade war. Now, soaring grain prices make it easier to swallow the price tag of the planter he ordered last year and to pay off debt.

The uptick in the agricultural economy began last year when commodity prices started climbing as China accelerated imports of U.S. crops.

Mr. Polansek noted that, “Values for good-quality Midwest farmland rose 4% in last year’s fourth quarter from the third quarter, while repayment rates for non-real-estate farm loans notched their first year-on-year increase in seven years, according to the Federal Reserve Bank of Chicago.

“Low interest rates, a lack of farmland for sale and record-large aid payments to farmers from the Trump administration are helping push up farmland values.”

And Associated Press writer Scott McFetridge reported last week that, “The USDA has forecast that those [2020] agricultural exports will remain strong later this year, and coupled with greater demand for livestock feed and ethanol, corn prices have roughly doubled from just over $3 a bushel in spring 2020 to about $6 a bushel now, the highest price in eight years.

“Thanks to that good news and continued low interest rates, the value of farmland continued a long-term increase, with average prices in Iowa up 7.8% from September to March, according to the Realtors Land Institute’s Iowa chapter.”

The AP article pointed out that, “Pauline Van Nurden, a University of Minnesota extension economist, said farmers were relieved the outlook seems so bright after years of low prices, followed by two tumultuous years.”

Beyond the impact on farm income, higher prices for key commodities are also having an effect on resourcing decisions.

Late last week, Bloomberg writers Isis Almeida, Michael Hirtzer, and Kim Chipman reported that, “Feeding the world’s chickens, pigs and cows has gotten so expensive it’s upending global trade flows.

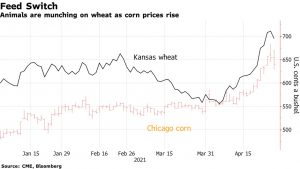

As grain prices surge, American chicken giant Perdue Farms Inc. took the rare step of buying soybeans, an American staple, from rival Brazil. BRF SA, Brazil’s top poultry producer, turned to neighboring Argentina for corn, while feed makers in China and the U.S. are buying wheat more commonly used for bread.

The Bloomberg writers explained that, “These tactics and others by the world’s top food companies highlight how tight the global market has become. A gauge of grain prices is at an eight-year high, boosting the cost of feeding animals and signaling higher meat prices could be coming for consumers. Still, keeping up with rising meat demand as the world recovers from the pandemic has industry executives saying the rally is far from over.”

Nonetheless, the Bloomberg article pointed out that, “Feed makers and meat packers could soon get some relief. While U.S. acreage estimates disappointed the markets earlier this year, prices have surged since the survey was carried out. That will likely spur more plantings.”

With elevated international prices seen eliciting a significant supply response in key producers, 21/22 world #soybean output is projected to increase y/y, to a new high. pic.twitter.com/OvPwX8aOpC

— International Grains Council (@IGCgrains) April 29, 2021

In other news regarding commodity supply variables, Reuters writers Maximilian Heath and Hugh Bronstein reported last week that, “Argentina’s stalled soy harvest is set for a boost from a period of expected dry weather, meteorologists and grains analysts said, after recent heavy rains in key farming areas had slowed down farmers gathering in their crops.”

The Reuters article stated that, “Argentina, the world’s top supplier of processed soy, is set to produce 43 million tonnes of the oilseed in the 2020/21 harvest, the Buenos Aires grains exchange estimates, which was knocked earlier in the season due the effects of a drought.

“In recent weeks, however, the focus of attention has been on the significant delay in soybean harvesting due to heavy rains in important agricultural areas, which set off alarms regarding potential production losses.”

Also with respect to weather related supply issues, Bloomberg’s Brian K Sullivan, Fabiana Batista, and Jasmine Ng reported late last week that, “Global prices for food and crops are at multi-year highs and there’s a culprit far larger than human commerce: La Nina.

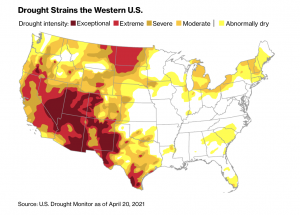

“This year, the weather pattern has already made its mark in North and South America as well as Australia and Indonesia. Characterized by the cooling of the equatorial Pacific, La Nina triggers atmospheric gyrations that cause water scarcity in some places and floods in others. And the prospect of drought across the U.S. — and difficult weather just about everywhere else — is roiling commodities markets. Combined with falling yields and growing demand from China, the result is soaring food prices and fears of inflation among world governments.”

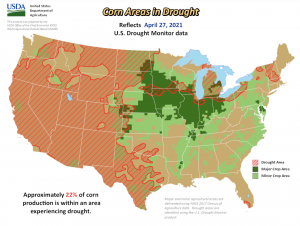

The Bloomberg article stated that, “More than 48% of the contiguous U.S. was gripped by some level of drought through April 27 and just over 68% was abnormally dry, according to the U.S. Drought Monitor. Drought is particularly dug in across the U.S. West, but it reaches through the Great Plains and into parts of Iowa, Illinois, Michigan, and even New England.

“One reason for concern is that drought can be self-perpetuating. When land is dry, the sun’s energy is focused on heating the air instead of evaporating water. That raises temperatures, which leads to more dryness, which allows drought to spread even further.

“The problem is already affecting winter wheat across the Great Plains and it could creep into the corn and soybean areas of the western Midwest as summer nears, said Don Keeney, an agricultural meteorologist at Maxar Technologies Inc. With rains averaging 40% to 45% of normal levels, the Midwest ‘is drier than a lot of people think,’ he said.

“Crop areas in the Mississippi Delta region are also dry, but they could be helped later this year as the remnants of Atlantic hurricanes and tropical storms move up the center of the U.S.”