Republican U.S. lawmakers plan to create a task force to study potential year-round sales of higher-ethanol E15 gasoline blends in the U.S., after an attempt to pass such legislation in…

China Seeks Policy to Stabilize Pork Production, as Chinese Soy Imports Fell in July

Late last week, Bloomberg News reported that, “China will initiate a warning guidance system for hog breeders that will encourage them to make changes to their population of sows in an attempt to maintain sustainable output of the meat.

The government aims to keep nationwide breeding sows at around 43 million, the Ministry of Agriculture and Rural Affairs said on Friday. That could translate to pork production of 55 million tons, an annual supply deemed ‘normal,’ it said.

The Bloomberg article explained that, “Under the new guidance warning system, China will encourage breeders to replenish productive sows or eliminate low-producing ones when year-on-year changes in monthly herd numbers surpass 5%. Should monthly herd numbers fall by 10% from the previous year or if breeding farms lose money for more than three months, China will urge the local government to start rescue measures in a timely manner, the ministry said.”

China has increased biosecurity measures and has been implementing best-practices to shield pig populations from viruses, such as African Swine Fever, where pockets of the disease still persist.

Meanwhile, Reuters News reported recently that, “China’s soybean imports fell in July from the same period the previous year, customs data showed on Saturday, as poor crushing margins weighed on demand.

“The world’s top buyer of the oilseed brought in 8.67 million tonnes of soybeans in July, down 14.1% from 10.09 million tonnes the previous year, data from the General Administration of Customs showed, as sliding hog margins curbed appetite for soymeal.

“For the first seven months of the year, soybean shipments totalled 57.63 million tonnes, up 4.5% from the same period in the previous year, customs data showed.”

The Reuters article added that, “But soybean demand was expected to slow over the rest of the year, however, analysts and traders said, as falling hog margins and more wheat substitution in feed crimped appetite for soymeal, the major protein source in animal recipe.”

Top 10 U.S. export markets for #soybeans, by volume https://t.co/V85OpkE44w @USDA_ERS pic.twitter.com/3b9uxgyBm3

— Farm Policy (@FarmPolicy) August 6, 2021

Top 10 U.S. export markets for #wheat, by volume https://t.co/V85OpkE44w @USDA_ERS

— Farm Policy (@FarmPolicy) August 6, 2021

* #China pic.twitter.com/uKz9TR1np1

China is set to remain the driver of growth in global feed demand for #maize (#corn) in 2021/22, but the pace of increases in domestic uptake may decelerate amid elevated usage of substitutes and following the previous year’s post-ASF recovery in the national hog herd. pic.twitter.com/9DlccloP7j

— International Grains Council (@IGCgrains) July 29, 2021

In a closer look at corn balance sheet variables, Bloomberg News reported recently that, “For a third ‘WASDE’ in a row, analysts are expecting the U.S. Department of Agriculture to cut estimates for U.S. corn yields. In both June and July, it defied forecasts, keeping its estimate unchanged even as drought expanded in the western half of the country, hurting crops in affected fields.

Approximately 37% of #corn production is within an area experiencing #drought, @usda_oce pic.twitter.com/EiVUgvmw78

— Farm Policy (@FarmPolicy) August 5, 2021

“But the third time might just be the charm for analysts, with corn’s yield potential coming into focus from farmers sharing crop data with the government.”

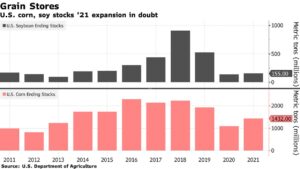

The Bloomberg article noted that, “Supply shocks might be necessary to push up corn and soybean prices beyond the peaks hit earlier this year. Markets have been relatively quiet in the days prior to WASDE’s release on Thursday, amid uncertainty on harvests and demand. While it’s been hot and dry in the western U.S., conditions have been milder and wetter in the east. As of now, the USDA is projecting small increases in ending supplies of corn and soybeans in the coming shipping season.”

More narrowly regarding corn and soybean exports, Bloomberg writer Jonathan Gilbert reported on Friday that, “Snaking its way through thousands of miles of South American rainforest and pampas and past sprawling soybean and corn farms, the Parana River is the main thoroughfare for Argentine commerce. Some 80% of the country’s crop exports flow through its muddy waters en route to the Atlantic Ocean.

“So when the river’s levels fell to the lowest since the 1940s — the result of years of scorching drought that scientists attribute to climate change — it deepened the strains on an economy that was already struggling to recover from its pandemic collapse.

“Grains traders suddenly found themselves forced to scale back how much they pile onto cargo ships, afraid to get them stuck in the river’s shallow banks, and then either add to their load once they reach deeper sea ports or contract out more vessels. Both are expensive, time-consuming options that have hamstrung an industry that pulls in more than $20 billion annually from exports. Gustavo Idigoras, head of Ciara-Cec, a crop export and processing group whose members include Cargill Inc. and Glencore Plc, called it an ’emergency situation’ that will likely last through the end of the year.”

Mr. Gilbert pointed out that, “The setbacks to Argentine exports have global implications. The nation is a powerhouse of oilseed and grain production, the world’s No. 1 shipper of soybean meal for feeding livestock and soybean oil for cooking and biofuels. It’s the third biggest exporter of corn.”