Republican U.S. lawmakers plan to create a task force to study potential year-round sales of higher-ethanol E15 gasoline blends in the U.S., after an attempt to pass such legislation in…

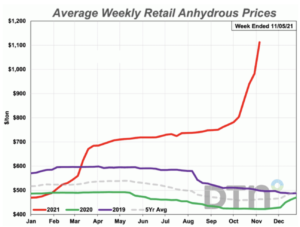

Fertilizer: “Supply Disruptions Push Prices to New Highs”

Last week, DTN writer Katie Micik Dehlinger reported that, “The average retail price of anhydrous set a record this week at $1,113/ton after increasing 38% from last month. The seven other major fertilizers tracked by DTN for the first week of November saw increases ranging from 9% to 36% as supply disruptions push prices to new highs. DTN considers a monthly price change of 5% or more to be significant.”

The DTN article explained that, “This year, high prices are more related to supply chain issues and worries about shortages than increased demand. The entire fertilizer complex is seeing higher prices, but the largest movers this month are nitrogen products.

The average price of UAN28 is 36% higher than last month at $545/ton. UAN32 is 32% more expensive at $604/ton, while urea is up 26% at $820/ton. All are new records for DTN’s database.

And on Friday, Bloomberg writer Elizabeth Elkin reported that, “Fertilizer prices keep soaring to unprecedented heights, signaling escalating costs for farmers and consumers around the world.

“The Green Markets North American Fertilizer Price Index rose 4.4% to $1,094.35 per short ton on Friday, surpassing a record set a week earlier. Prices for New Orleans urea, a popular nitrogen fertilizer, jumped 8.3% to $812 per short ton as major producer CF Industries Holdings Inc. warned of continued shortages.

“Crop-nutrient prices have been soaring as an energy pinch in Europe makes natural gas, the main feedstock for most nitrogen fertilizer, more costly. China and Russia are restricting nutrient exports to ensure sufficient domestic supplies. U.S. consumers already are seeing the steepest inflation since 1990.”

CHART OF THE DAY: Fertilizer prices continue to go higher across the world, as China, Russia and others restrict exports, and production costs surge because expensive natural gas (and output in Europe goes down as some plants closed). The chart below is New Orleans urea price pic.twitter.com/vjTwoBvaDW

— Javier Blas (@JavierBlas) November 12, 2021

The Bloomberg article pointed out that, “As fertilizer and other input costs rise, Bloomberg’s Green Markets anticipates American farmers next year will switch 2.5 million acres from corn to soybeans, which is less fertilizer-intensive.”

#Fertilizer Prices Have Skyrocketed

— Farm Policy (@FarmPolicy) November 11, 2021

-- November #Corn & #Soybean Outlook Update https://t.co/kqpJEh8eUZ @PUCommercialAg pic.twitter.com/UeIwXRQQUN

Meanwhile, Jiyoung Sohn and Vibhuti Agarwal reported in Friday’s Wall Street Journal that, “A coal shortage that led to an energy crisis in China is rippling beyond its borders, threatening to disrupt supply chains and farming in countries that rely on its exports of a chemical used in fertilizer and diesel exhaust systems.

“India and South Korea are experiencing shortages of urea, which is produced using coal, since China placed new restrictions on exports. It is widely used in India as a fertilizer and in South Korea to produce urea solution, which is used to reduce diesel emissions in vehicles and factories.”

#Fertilizer and Seed Costs per Bushel of Corn

— Farm Policy (@FarmPolicy) November 11, 2021

-- November #Corn & #Soybean Outlook Update https://t.co/kqpJEh8eUZ @PUCommercialAg pic.twitter.com/0y378gSIoe

The Journal article noted that, “Satnam Singh, who farms wheat on 1.5 acres in the northern Indian state of Punjab, said rumors of shortages have prompted panicked farmers to buy urea and another fertilizer essential for winter-sown wheat, diammonium phosphate, at almost twice the original price. ‘Prices have gone through the roof. It’s a big problem,’ Mr. Singh said.

“In some places, farmers have been unable to buy fertilizer even after standing in long lines for days, said Vikram Singh, joint secretary of the All India Agricultural Workers Union, warning that the shortages could disrupt the growing season and lead to rising food prices.”