Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

DTN: Fertilizer Prices Cool Slightly

DTN writer Todd Neeley reported on Tuesday that, “Most retail fertilizer prices tracked by DTN cooled off a bit during the first week in February, as five of the eight fertilizers reported small price drops.

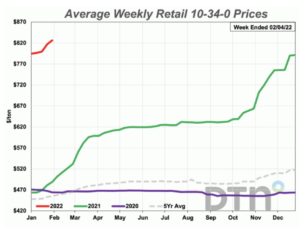

“The price of 10-34-0 was the only fertilizer tracked by DTN to record a price increase compared to one week ago, rising by about 1% to $826 per ton. The fertilizer hit the $800-per-ton level for the first since March 2012 two weeks ago.

“Coming off an all-time record-high price, anhydrous dropped from $1,492 to $1,487 per ton in this week’s update.”

Mr. Neeley noted that, “Four other fertilizers reporting small price drops were led by urea, falling from $910/ton last week to $905 for this update; MAP from $936/ton to $933; potash from $814/ton to $813; and UAN28 from $601/ton to $600. UAN32 was the only fertilizer tracked by DTN to remain unchanged at $699/ton.”

Higher production expenses are expected to put a dent in 2022 forecast net farm income.

According to USDA’s Economic Research Service (ERS), most individual expense items are forecast to increase in 2022.

#fertilizer, @USDA_ERS webinar pic.twitter.com/EogJ6tEKpP

— Farm Policy (@FarmPolicy) February 4, 2022

Along with fertilizer costs, fuels and pesticide expenses are expected to increase, although seed costs are are seen as slightly lower in 2022, according to ERS.

Average U.S. diesel and gasoline prices per gallon increased in the week ended Feb. 7. Diesel prices climbed to $3.95 per gallon, and gasoline prices rose to $3.44 per gallon https://t.co/S6sJzsJurV pic.twitter.com/oIURzJSQby

— St. Louis Fed (@stlouisfed) February 9, 2022

Meanwhile, a recent update from the Federal Reserve Bank of St. Louis pointed to rising prices for diesel and gasoline.

And DTN writer Emily Unglesbee reported this week that, “Ohio farmer Keith Peters’ herbicide bill is more than double what he paid last year. Oklahoma farmer Zack Rendel is eyeing Liberty (glufosinate) price quotes almost five-fold what he paid last winter for the same chemistry.

“Iowa farmer Jay Magnussen, who also works as an agronomist and purchasing manager for Archer Co-op, has been allocated only 20% of the glufosinate he ordered for the co-op, at more than double the wholesale price he paid last year. Glyphosate is in slightly better supply, but with prices around $60 per gallon, he has customers cutting back on its use.”

The DTN article explained that, “The issues that led to these widespread pesticide shortages are complex. Analysts point to continued pandemic production disruptions, labor shortages, shipping costs and delays and lingering effects from severe weather last year. What does seem clear is that the pesticide shortages and their accompanying price spikes are here to stay in 2022, DTN found in interviews with analysts, farmers, retailers and agrichemical companies.

“Glyphosate and glufosinate remain the most affected active ingredients. Both are in high demand, with glyphosate remaining the base of many weed control programs and glufosinate now a post-emergence spray option for all the major herbicide-tolerant soybean varieties on the market. But, overall, year-over-year prices are up for most ag chemical active ingredients, including fungicides and insecticides.”

Similarly, Bloomberg writer Elizabeth Elkin reported on Wednesday that, “Farmers are going to be paying more for herbicides and pesticides as they grapple with higher costs for fertilizer, seeds and fuel.

“Agriculture chemical company FMC Corp. said it’s raising prices to counter what Chief Executive Officer Mark Douglas called ‘significant’ increased costs for making and distributing crop protection products. The move follows similar efforts announced last week by U.S. rival, Corteva Inc.”