The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

ERS: “U.S. Wheat Prices Surging,” Markets Are in Flux – – FT Notes Ukraine Spring Planting Fears

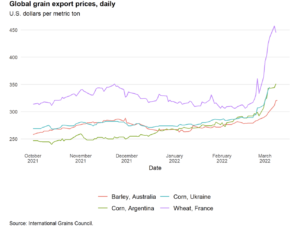

Last week, in its March Wheat Outlook report, the USDA’s Economic Research Service (ERS) stated that, “Wheat prices are surging globally in the wake of the conflict between Russia and Ukraine.

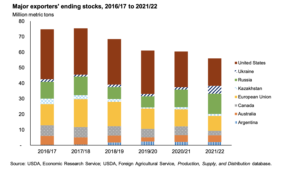

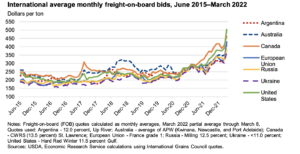

“Prior to this development, prices were already elevated, influenced by relatively tight supplies in key exporting countries. Major exporter ending stocks (Argentina, Australia, Canada, the European Union, Kazakhstan, Russia, Ukraine, and the United States) are collectively projected as the lowest since 2012/13. Prices are surging even higher as the conflict is raising significant questions about the ability of Russia and Ukraine to continue exporting.”

With respect to U.S. wheat exports, ERS explained that, “With global wheat prices historically elevated and volatile, it is expected that importers will ration demand by at least delaying some purchases. It is also possible that some importers may eventually turn to U.S. wheat when other exporters lack sufficient supplies. However, the current large price premium for U.S. wheat over other key competitors reduces the likelihood of a significant pivot towards U.S. wheat in the near-term. Weighing these considerations, U.S. exports have been lowered 10 million bushels to 800 million this month, which would be the lowest U.S. exports since 2015/16.”

And in its March Feed Outlook report last week, ERS pointed out that, “A sharp cut in Ukrainian corn exports is bound to trigger substantial changes in global corn markets. This cut is expected to be partly offset by higher exports by the other major corn suppliers, with the United States projected to have the largest rise in corn exports of 2.0 million tons. However, this increase is not projected to make up for all the lost Black Sea corn exports, and global corn trade is projected lower. This reduction, combined with the fairly low level of global corn stocks in major exporting countries and geopolitical uncertainty, has generated a grain price spike. Substantially higher prices are expected to ration demand for grain and reduce imports in a number of countries.”

McConnell, Michael, Olga Liefert, Angelica Williams, and Claire Hutchins, Feed Outlook: March 2022, FDS-22c, U.S. Department of Agriculture, Economic Research Service, March 11, 2022.

Meanwhile, Financial Times writers Emiko Terazono, Roman Olearchyk, Daniel Dombey, Andy Bounds and Jude Webber reported yesterday that, “Consumers around the world will feel the ‘enormous impact‘ of Russia’s war on Ukraine through sharply higher food prices and significant disruption to agricultural supply chains, according to industry executives and leading European officials.

John Rich, executive chair of Ukraine’s leading food supplier MHP, said he feared for the vital spring planting season, which is critical not only for domestic supplies in Ukraine but also the huge quantities of grains and vegetable oil that the country exports around the globe.

“The success of the planting season would be decided by ‘military action in the next week or two,’ he added, warning that it would be jeopardised if Russia’s army moved into the west of the country, which has remained relatively unscathed.”

The FT article added that, “The EU gets half its corn from Ukraine and a third of its fertilisers from Russia. Belarus, Russia’s ally, is another key fertiliser supplier. Fertiliser prices have risen sharply, with the surging price of natural gas, the main ingredient for nitrogen fertilisers, also threatening supplies.”

Regarding Western Ukraine, Valerie Hopkins reported on the front page of today’s New York Times that, “For weeks, Western Ukraine has been a safe haven for millions of Ukrainians who have fled battle zones, as well as businessmen, journalists, diplomats and others. But with bombings in Lutsk and another Western city, Ivano-Frankivsk, early Friday, violence and death pierced the sense of security that many had taken for granted.”

“Ukraine’s vast western region has stirred more concern in recent days following intermittent reports that Belarus, only 90 miles to the north, might begin to commit forces to the war,” the Times article said.

Washington Post columnist Anthony Faiola indicated in today’s paper that, “Since the Russian assault began, countries from Hungary to Indonesia have moved to bar the door to exports, corralling grains and cooking oils to feed their own and risking a round of trade protectionism that could deepen global supply and price woes.”

Failoa also stated that, “If the war halts planting in the rich, black soils of Ukraine, wheat shortages will worsen in the coming months.

The FAO’s preliminary assessment is that, due to the war, 20 percent to 30 percent of wheat, corn and sunflower seed will either not be planted or go unharvested during Ukraine’s 2022-2023 season.

“Critically, Russia is also a major exporter of fertilizer, the price of which has already been soaring. Significant disruptions of Russian exports could see that price jump more — further driving up the cost of food production globally.”

Reuters News reported yesterday that, “Ukraine plans to start sowing spring grains in the coming days and has enough grain in stocks to ensure the population has enough bread, deputy agriculture minister Taras Vysotskiy said on Saturday.”

A Reuters News article from today reported that, “Ukraine’s government will introduce a plan to support the crop sowing campaign in an effort to safeguard food supplies amid Russia’s invasion, Prime Minister Denys Shmygal said on Sunday.

“He said Ukraine had sufficient volumes of basic food products for the next few months. ‘But we must also think about the future. Therefore the government is implementing a plan to support the sowing campaign, which should start soon where possible,’ he said in a statement.”

And a separate Reuters News article yesterday reported that, “Ukraine, a major global producer of agricultural products, has banned exports of fertilisers given the Russian invasion, the agriculture ministry said on Saturday.”