President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

Fall Out From Russian Invasion Pressures Food Prices Even More, as “Farmers are Facing Increasingly Tough Margins”

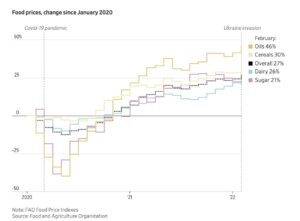

Wall Street Journal writers Nate Rattner and Andrew Barnett reported yesterday that, “Russia’s invasion of Ukraine threatens a significant portion of the world’s food supply when prices were already at their highest level in years.”

“The conflict has sent wheat futures prices soaring and is putting pressure on a still-recovering global supply chain, setting the stage for an increase in already inflated consumer prices,” the Journal article said.

Rattner and Barnett explained that, “The potential pain from a loss of agricultural exports, however, is likely to be felt disproportionately world-wide. Countries in the Middle East and North Africa rely on the nearby Black Sea as a trading route and source of imports from Russia and Ukraine.”

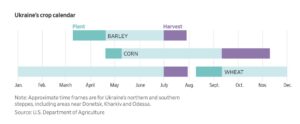

With respect to Ukrainian agricultural dynamics, the Journal writers indicated that, “Most wheat, barley, and sunflower exports are complete by February, according to the food policy and research institute, but Ukrainian maize exports typically remain heavy through the spring into the early summer. Crops grown in the 2022 season are at risk, with barley planting starting in March and maize in April. Winter wheat isn’t typically planted until late summer.”

Rattner and Barnett added that, “The conflict also has secondary effects on prices people pay for food, such as higher transportation costs because of fuel-price inflation. Even before the invasion, farmers were struggling to handle higher fertilizer costs. Russia, a major supplier of fertilizer to the world, recently cut exports to guarantee supplies for farmers at home.”

And in a further supply chain complication, Reuters writers Rod Nickel and Ann Maria Shibu reported today that, “Canadian Pacific Railway (CP) halted operations and locked out workers over a labor dispute early on Sunday, with each side blaming the other for a halt that will likely disrupt shipment of key commodities at a time of soaring prices.”

Meanwhile, Bloomberg writers Elizabeth Elkin, Pratik Parija, Tarso Veloso Ribeiro, and Millie Munshi reported yesterday that,

The price of everything that goes into producing crops is surging, threatening to further fan global food inflation.

“Food production costs were already high. The pandemic snarled supply chains, making it more difficult — and expensive — to get parts and supplies that are vital for growing crops. Then Russia’s invasion of Ukraine took things to another level, sending markets soaring for fertilizers and for the fuels needed to run farm machinery. Inflation is so rampant that even with rising food prices, farmers are facing increasingly tough margins.”

The Bloomberg article noted that, “Oil’s surge past $100 a barrel has sent diesel futures in Europe and the U.S. to the highest in decades…[and]…the Green Markets North American Fertilizer Price Index has doubled in the last 12 months to reach a record.

For the week ending March 14, the U.S. average #diesel fuel price increased 40.1 cents from the previous week to $5.25 per gallon, 205.9 cents above the same week last year, https://t.co/C0csnePKgC @USDA_AMS pic.twitter.com/qm62SinXcE

— Farm Policy (@FarmPolicy) March 18, 2022

“Supplies for seeds and other chemicals like pesticides are also ‘extremely tight,’ Corteva Inc. Chief Executive Officer Chuck Magro said at a recent conference.”

“Farmers in Iowa, the biggest U.S. state for corn, are paying triple what they did two years ago for anhydrous ammonia, a widely-used nitrogen fertilizer,” the Bloomberg article said, adding that, “Urea has surged 143% to almost $930 a ton, while diesel costs are up 133% to $4.43 a gallon, according to March figures from the U.S. Department of Agriculture.

#Iowa Production Cost Summary, March 8th, https://t.co/feNu6gCgz8 pic.twitter.com/Zp2cTSF5bS

— Farm Policy (@FarmPolicy) March 17, 2022

“‘None of them individually are a total game-changer, but when you add all these prices together, we’re going to handle more dollars for the same opportunity of margin that we had a year ago,’ [Iowa farmer Chris Edgington] said.”

#Illinois Production Cost Summary- March 10th, https://t.co/mtlWapwyoi pic.twitter.com/RLVQnoJlAg

— Farm Policy (@FarmPolicy) March 17, 2022

Writing today at The Financial Times Online, James Fernyhough reported that, “Milk prices are soaring on the expectation that a tight market will be hit by further disruption to fertiliser and feed supplies and inflationary pressures following Russia’s invasion of Ukraine.”

“New Zealand company Fonterra, the world’s biggest dairy exporter, said last week it was paying farmers 30 per cent more for milk than it did a year ago and predicted the price would rise further,” the FT article said.

And Bloomberg writers Irina Anghel and Megan Durisin reported today that,

Nations around the world are waking up to the threat of a global food crisis and taking steps to secure their own supplies.

“War between Russia and Ukraine, two of the grains powerhouses, has sparked panic about shortages, soaring prices and a potential squeeze on Russian fertilizer. That’s triggered export restrictions from Asia to the Americas, while the European Union signaled it’ll pivot its ‘whole approach’ to agriculture policy to ensure food security.”