President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

Fertilizer, Wheat, Sunflower Oil Prices Climb- Sec. Vilsack Rejects CRP Acreage Flexibility Request

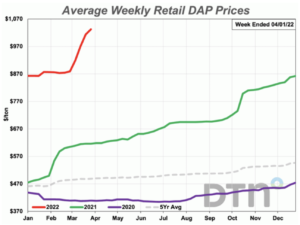

DTN writer Russ Quinn reported yesterday that, “Retail fertilizer prices tracked by DTN for the last week of March 2022 are moving significantly higher again. All fertilizers were higher with some double digits higher compared to last month.

“Leading the way higher was DAP. The phosphorus fertilizer was 17% more expensive compared to last month and had an average price of $1,033/ton.

“DAP prices are now at the highest level in the history of DTN’s data set.”

Quinn added that, “Most fertilizers continue to be considerably more expensive than one year earlier.”

97 House Republicans, includ. @RepBost, @RodneyDavis, @RepMaryMiller & @RepLaHood, have sent letter to @POTUS urging admin. to "review all available options to lower the cost of fertilizer." pic.twitter.com/863o6oUcC8

— Tim Eggert (@TimothyMEggert) April 5, 2022

And Reuters News reported yesterday that, “Russia plans to continue setting quotas for fertiliser exports during the next winter grain sowing, due this autumn, and during the next spring grain sowing in spring 2023, an official said on Tuesday.”

Also yesterday, Bloomberg’s Tatiana Freitas reported that, “Brazil is getting its last wave of much-needed fertilizer from Russia before supplies plunge due to the Ukraine war, potentially hurting harvests in the biggest grower of crops from coffee to sugar to soybeans.

“Dozens of Russian vessels laden with fertilizer are heading to Brazil, with a final ship unloading May 5, according to StoneX analysts. After that, it’s anyone’s guess where Brazil, which imports 85% of the fertilizer it needs, will get supplies as war disrupts shipments in Russia, the top supplier.”

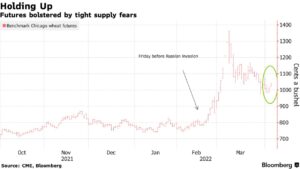

Meanwhile, Bloomberg writers Kim Chipman and Megan Durisin reported yesterday that, “Wheat in Chicago surged as U.S. drought and trade route obstacles in Ukraine threaten to tighten global grain supplies.”

“Adding to concern are record-high fertilizer prices that could lead some growers to skip applying the chemicals, potentially hurting grain quality,” the Bloomberg article said.

Dow Jones writer Kirk Maltais reported yesterday that, “Wheat for May delivery rose 3.5% to $10.45 1/4 a bushel on the Chicago Board of Trade Tuesday, responding to both record-poor conditions for winter wheat in the U.S. Plains and the specter of more sanctions on Russian exports.”

In other developments regarding wheat, Reuters writer Sarah El Safty reported yesterday that, “Egypt, often the world’s top wheat buyer, saw a rise in imports of the grain from Russia in March despite supply and payment disruptions following its invasion of Ukraine that also drove traders to seek shipments from other suppliers.

“Egypt received 479,195 tonnes of wheat from Russia in March, 24% up from the same month last year, according to freight data seen by Reuters. Ukrainian wheat imports stood at 124,500 tonnes, down 42% year-on-year.”

Earlier this week, Reuters writer Mayank Bhardwaj reported that, “India’s wheat exports hit 7.85 million tonnes in the fiscal year to March, an all-time high and a sharp increase from 2.1 million tonnes in the previous year, traders said, as Russia’s invasion of Ukraine cuts off rival Black Sea supplies.”

And today, Bloomberg writer Sybilla Gross reported that, “Never mind soaring fertilizer costs or snarled supply chains — of all the inputs Australian farmers are considering ahead of the next crop, there’s one that matters more than the rest: prospects for abundant rainfall.

“Undeterred by lofty prices for many inputs right now, growers Down Under ‘aren’t really holding back on the area,’ according to Thomas Elder Markets grains analyst Andrew Whitelaw, who said months of heavy rain had boosted soil moisture in the east, while Western Australia had also ‘received a good dump of rain.’ With the outlook pointing to another wet season, that’s stirring optimism about production just as seeding kicks off, Whitelaw said.

“With the war in Ukraine slashing exports from the Black Sea, one of the world’s top growing areas, and with wheat prices up about 30% since the Friday before the Russian invasion, the world now needs Australian wheat more than ever.”

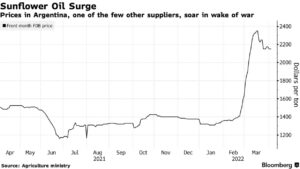

In news regarding oilseeds, Bloomberg’s Megan Durisin and Francine Lacqua reported yesterday that, “Ukraine’s sunflower-oil sector — the world’s largest — is suffering major cutbacks to plantings and exports because of the Russian invasion, the biggest producer said.

“Farmers are kicking off the spring sowing season, and plantings could fall 20%, with yields also decreasing, Ievgen Osypov, chief executive officer of Kernel Holding SA, said Tuesday in an interview on Bloomberg Television. Together, that means the combined output of grains and oilseed could fall to a maximum of 60 million tons, compared with more than 100 million tons last season, Osypov said.”

And Tarso Veloso Ribeiro indicated yesterday at Bloomberg that, “Fighting around Mariupol has damaged a Cofco Corp. sunflower seed crushing plant in the Ukraine, which produces almost 10% of the country’s supply, according to a person familiar with the matter.”

Also yesterday, Bloomberg writer Kim Chipman reported yesterday that, “U.S. farmers may plant twice as many additional acres with sunflowers as the government forecast, according to a trade group, with prices soaring in the wake of Russia’s war with Ukraine.”

On the issue of Conservation Reserve Program flexibilities, DTN Ag Policy Editor Chris Clayton reported earlier this week that, “Agriculture Secretary Tom Vilsack has written the president and CEO of the National Grain and Feed Association saying he shares concerns about the Ukraine war and impact on grain production and exports, but USDA sees only potentially ‘marginal’ potential benefits from suggestions to opening up the Conservation Reserve Program for planting crops this year.”

The DTN article stated that, “USDA added in the letter from Vilsack that USDA will continue to exercise CRP flexibility for haying and grazing due to drought or natural disasters.

“”While it is clear there are no significant short-term gains to be realized from opening the program to crop production, I want to emphasize that USDA will continue to monitor the crisis in Ukraine and its global reverberations.'”