As 2026 ushers in a fresh start, agricultural economists say the U.S. farm economy has stopped sliding, but it’s far from fully healed.The December Ag Economists’ Monthly Monitor shows month-to-month…

Ukrainian Farmers Have Planted 20% of Spring Crops; IGC Lowers Corn Production Outlook for 2022/23

Reuters News reported yesterday that, “Ukrainian farmers have sown 2.5 million hectares of spring crops so far in 2022, 20% of the expected area, the agriculture ministry said on Thursday, adding that areas of intense conflict could see a drop of 70% of the sowing area.

“Ukraine has said the 2022 spring sowing area could fall 20% due to the Russian invasion.

“The ministry said the decrease could reach 30% to 40% in the northern regions as they will need to be de-mined.”

The Reuters article stated that, “‘The most difficult situation is in the temporarily occupied regions and where active hostilities continue: Luhansk, Donetsk, Zaporizhia and Kherson,’ the ministry quoted deputy minister Taras Vysotskiy as saying.

“He said the sowing area in those places could fall by 60% to 70%.

“The ministry gave no 2022 grain harvest forecast or outlook for exports.”

“Jakob Kern, the World Food Programme’s emergency coordinator in Ukraine, on Tuesday cited estimates that 20% of planted areas in Ukraine will not be harvested in July and that the spring planting area will be about a third smaller than usual,” the Reuters article said.

Vitaly’s farm is very close to Russia’s new eastern front. But he ploughs on. Workers in helmets and flak jackets go out to tend to the crops. A missile landed in his field the other day. What did he do? Pulled it out with his tractor

— James Longman (@JamesAALongman) April 21, 2022

And wait for the couple at the end #Ukraine pic.twitter.com/MogAEi2YoM

Dow Jones writer Yusuf Khan reported yesterday that, “Ukraine should aim to export food to the Middle East and North Africa in order to avoid food shortages in the region despite Russia’s war affecting shipping in the Black Sea, Taras Vysotskyi, the country’s deputy minister of agrarian policy and food, said Thursday.”

The Dow Jones article noted that, “Mr. Vysotskyi highlighted that 20% of Ukraine’s spring grain crop had already been sown, which analysts have noted as a positive sign given that many farmers are working around landmines within fields.

“The Ministry of Agrarian Policy expects that at least 60-70% of crops will be sown on time this spring, although this figure falls to 30-40% ‘where active hostilities continue’ in regions such as Luhansk, Donetsk, Zaporizhia and Kherson.”

Meanwhile, Reuters News reported yesterday that, “Russia will be able to increase exports in the new July-June season due to high carry-over stocks in the south of the country, a record crop forecast and the expiry of a state export quota, consultancy Sovecon forecast on Thursday.

“Russian exporters have largely managed to resolve problems with logistics and the transfer of payments caused by Western sanctions imposed on Moscow since late February and are exporting wheat from the Russian side of the Black Sea and sporadically from the Azov Sea.”

In other news, Reuters writer Nigel Hunt reported yesterday that, “The International Grains Council [IGC] on Thursday forecast that global corn (maize) production would fall by 13 million tonnes in the 2022/23 season to 1.197 billion tonnes reflecting smaller crops in Ukraine and the United States.

“The inter-governmental body, in its first full assessment of the 2022/23 season, forecast Ukraine’s corn crop falling to 18.6 million tonnes, down from the prior season’s 41.9 million.”

Hunt noted that, “The IGC forecast a decline of one million tonnes in global wheat production in 2022/23 to 780 million tonnes, with a smaller crop in Ukraine (19.4 million vs 33.0 million) largely offset by larger crops elsewhere, including Russia (82.5 million vs 75.0 million) and Canada (31.6 mln vs 21.7 mln).”

2022/23 #wheat production projected fractionally lower y/y, with anticipated declines in Australia, Ukraine, Morocco, China and North Africa outweighing gains elsewhere. Difficult weather and reduced fertiliser use may contribute to below-trend yields. pic.twitter.com/tPUcmonxqb

— International Grains Council (@IGCgrains) April 21, 2022

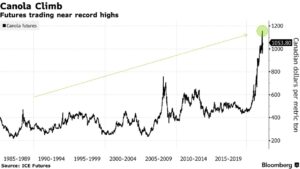

Also yesterday, Bloomberg writers Jen Skerritt and Dominic Carey reported that, “Surging fertilizer costs and fear of drought are keeping Canadian farmers from planting more canola, despite record prices and growing demand.

“Acres of the oilseed, used in everything from salad dressings to deep frying, will probably decline 2.7% from a year earlier to 21.9 million, according to a Bloomberg survey of eight analysts. The biggest drop since 2019 comes as canola futures are trading near all-time highs amid strong demand and disrupted trade flows from Russia’s invasion of Ukraine.”

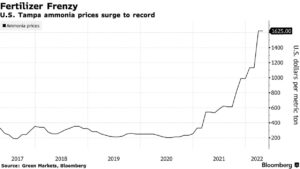

And Bloomberg writer Maria Cervantes reported yesterday that, “A shortage of fertilizers is threatening to create a hunger crisis in Peru as political upheaval distracts authorities from scouring for alternative supplies amid the war in Ukraine, food producers warn.

“Peru’s agricultural industry is facing a deficit of 180,000 metric tons of urea, a key nitrogenous fertilizer, with output of staples such as of rice, potato and corn set to fall as much as 40% unless a solution is found in the coming months, according to Eduardo Zegarra, an agrarian economist and researcher at think tank GRADE.”

Reuters writer Naveen Thukral reported today that, “The most-active corn contract on the Chicago Board of Trade (CBOT) has added 7.4% in three weeks of gains.”

The Daily U.S. Agricultural Weather Highlights report from the USDA’s Office of the Chief Economist noted on Thursday that in the Corn Belt: “…[E]xtensive fieldwork delays continue, despite the brief return of mild, dry weather…to date, planting activities have been sharply limited by low soil temperatures or wet fields, or a combination of both, especially in the northern and eastern Corn Belt.”