A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Food Protectionism “Unleashed,” While Ukrainian Corn Finds Romanian Black Sea Export- Planting Continues

Ana Swanson reported on the front page of today’s New York Times that, “Ukraine has limited exports of sunflower oil, wheat, oats and cattle in an attempt to protect its war-torn economy. Russia has banned sales of fertilizer, sugar and grains to other nations.

“Indonesia, which produces more than half the world’s palm oil, has halted outgoing shipments. Turkey has stopped exports of butter, beef, lamb, goats, maize and vegetable oils.

Russia’s invasion of Ukraine has unleashed a new wave of protectionism as governments, desperate to secure food and other commodities for their citizens amid shortages and rising prices, erect new barriers to stop exports at their borders.

Swanson explained that, “The measures are often well intended. But like the panic-buying that stripped grocery store shelves at various moments of the pandemic, the current wave of protectionism will only compound the problems that governments are trying to mitigate, trade experts warn.”

The Times article pointed out that, “Export restrictions are making grains, oils, meat and fertilizer — already at record prices — more expensive and even harder to come by. That is placing an even greater burden on the world’s poor, who are paying an ever-larger share of their income for food, increasing the risk of social unrest in poorer countries struggling with food insecurity.

“Since the beginning of the year, countries have imposed a total of 47 export curbs on food and fertilizers — with 43 of those put in place since the invasion of Ukraine in late February, according to tracking by Simon Evenett, a professor of international trade and economic development at the University of St. Gallen.”

Meanwhile, Reuters writer Luiza Ilie reported yesterday that, “A cargo carrying over 71,000 tonnes of Ukrainian corn finished loading in the Romanian Black Sea port of Constanta on Thursday, the first since Russia invaded Ukraine on Feb. 24, the manager of port operator Comvex said.

“With Ukraine’s sea ports blocked since the war started more than two months ago, the world’s fourth-largest grain exporter has been forced to send shipments by train via its western border or through its small Danube river ports into Romania.”

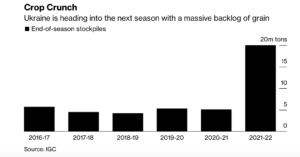

And Bloomberg writer Megan Durisin reported yesterday that, “Enough grain has made its way out of Ukraine to fill an export vessel in neighboring Romania, marking a small but important first step toward easing the backlog of crops the war has left piled up at home.

“The panamax vessel Unity N departed early Friday from Constanta port, loaded with 71,000 tons of Ukrainian corn, said Viorel Panait, general director of Comvex, which operates two terminals there. It is bound for Spain and further cargoes are planned for early and mid-May, he said by phone.”

Also yesterday, Reuters writer Pavel Polityuk reported that, “Ukraine’s grain exports have reached 45.709 million tonnes so far in the 2021/22 July-June season, the agriculture ministry said on Friday as it resumed publishing grain export data.

“The ministry said the volume included 763,000 tonnes exported in April but gave no comparative figures. Senior agriculture officials said this month that Ukraine exported up 300,000 tonnes of grain in March.

“Ukraine exported up to 6 million tones of grain a month before Russia invaded the country.”

In a separate Reuters article yesterday, Pavel Polityuk reported that, “Six regions in Ukraine have completed early spring grain sowing despite the Russian invasion, Ukraine’s agriculture ministry said on Friday.

“Ukraine has 24 regions, but there are no plans to sow grain in Luhansk in the east due to heavy fighting there.

The ministry said farmers had sown 175,800 hectares of spring wheat, 838,500 hectares of spring barley, 116,300 hectares of peas, 144,400 hectares of oats, 774,800 hectares of corn and some acreage of other commodities.

And today, Reuters writer Pavel Polityuk reported that, “Russian forces have stolen ‘several hundred thousand tonnes’ of grain in the areas of Ukraine they occupy, Ukraine’s deputy agriculture minister said on Saturday.

Russia is now actively "imports" food from the occupied territory of Ukraine. Here you see decision of Krasnoyarsk Kray (Siberia) to solve its shortage of food through "expropriation of excesses of two last harvests in Kherson region [occupied territory of Ukraine]" pic.twitter.com/IZgc1lT4aZ

— Kamil Galeev (@kamilkazani) April 29, 2022

“Speaking to Ukrainian national TV, Taras Vysotskiy expressed concern that most of what he said was 1.5 million tonnes of grain stored in occupied territory could also be stolen by Russian forces.”

In other news, Bloomberg writer Jen Skerritt reported yesterday that, “Farmers in Canada are struggling to plant crops in fields that are either too wet or too dry, testing an already tight grain market.

“One quarter of the cropland in Alberta, or 44 million acres, is in a significant drought, including major growing areas for spring wheat, barley and durum, said Trevor Hadwen, agroclimate specialist with Agriculture and Agri-Food Canada. In Manitoba, two-thirds of growing areas, another 21 million acres, are suffering from excess moisture after back-to-back storms, he said. That’s caused overland flooding, delaying the start of planting even as another storm threatens to dump more rain on the region this weekend.”

And Reuters writers Gus Trompiz and Forrest Crellin reported yesterday that, “The European Commission cut its forecast for the 2022/23 European Union wheat harvest on Friday, but maintained its projection for record EU exports as war disrupts supply from Ukraine.

“In monthly cereal supply and demand estimates, the Commission cut its outlook for usable production of common wheat, or soft wheat, in the July 2022 to June 2023 season to 130.1 million tonnes from 131.3 million tonnes previously.”

With respect to market prices, Reuters writer Naveen Thukral reported yesterday that, “Chicago wheat futures eased on Friday, although the market was poised for a third straight monthly gain as tightening global supplies after Russia’s invasion of Ukraine underpinned prices.

“Corn was set for a fifth monthly gain as support stemmed from forecasts of more showers, which will further delay planting in the rain-soaked U.S. Midwest.”