Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

Low Mississippi River Levels “Likely to Persist,” Black Sea Grain Deal in Focus, While Turkey Prices Rise

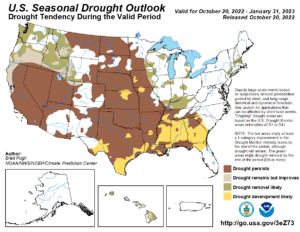

Reuters writer Karl Plume reported yesterday that, “Low water levels on the Mississippi River are likely to persist this winter as drier-than-normal weather is expected across the southern United States and Gulf Coast, U.S. government forecasters said on Thursday.

“Drought, which currently spans 59% of the country, is expected to continue or worsen in the middle and lower Mississippi River valley as well as in much of the West and the Great Plains, the National Oceanic and Atmospheric Administration’s (NOAA) Climate Prediction Center said in its winter (December-February) outlook.

“Above-average precipitation, however, expected in the Midwest and the Ohio River valley may provide some relief to the drought-parched waterway later in the winter, NOAA said, citing the effects of a third consecutive winter of La Nina, a climate phenomenon that alters weather patterns.”

The Mud Island Marina home of the #Memphis Yacht Club which is surrounded by the Mississippi River has all the boats sitting in mud now. Record low levels on the #MississippiRiver are causing many different problems. pic.twitter.com/kXWIt378QE

— Charles Peek (@CharlesPeekWX) October 19, 2022

The Reuters article noted that, “‘Across the lower Mississippi Valley, we are favoring continuation of below-normal precipitation,’ said Jon Gottschalck, chief of the Operational Prediction Branch of NOAA’s Climate Prediction Center.

“‘That would certainly, if the prediction is realized, lead to continued low water levels and exacerbate drought conditions there.'”

The Mississippi River Is Drying Up, Disrupting a Vital Supply Lane https://t.co/w7zJ7CuqHL

— FarmPolicy (@FarmPolicy) October 21, 2022

Wall Street Journal writer Talal Ansari reported yesterday that, “In recent weeks, parts of the Mississippi River have been approaching low water levels not seen in more than three decades because of a lack of rain in the Ohio River Valley and the Upper Mississippi. This has the potential to disrupt a vital supply lane for a variety of goods including agriculture, oil and building materials.”

Drought conditions continue to worsen across portions of the LMRFC forecast area. Larger areas of D1 and D2 drought conditions are present this week compared to last week. #drought pic.twitter.com/HuDMXi9V0l

— NWS LMRFC (@NWSLMRFC) October 20, 2022

Also yesterday, Dow Jones writer Kirk Maltais reported that, “The cost to send grains via barge down the Mississippi River has dropped back, but remains much higher than it was at this time last year, says the USDA. In its latest Grain Transportation Report, the agency says that for the week of October 18, the St. Louis barge spot rate fell to $72.58 per ton – off from a peak of $105.85 per ton established the previous week. Even so, the cost remains 130% higher than this time last year, and 260% higher than the three-year average. ‘Amid uncertainty about when barge traffic will normalize, some grain shippers have delayed deliveries until later in the year, which has softened demand for barges,’ said the USDA.”

And on the subject of the Black Sea Grain Deal, Maltais indicated that, “The Black Sea export corridor deal signed in July has been instrumental in lowering food prices, but needs to continue in order to bring the flow of grains from Ukraine back to normal levels, says the UN Conference on Trade and Development. Unctad says that almost 8 million metric tons of grain have been shipped in the course of the deal, primarily corn and wheat. Developing countries are the primary recipients of grain, the agency said.”

Meanwhile, Wall Street Journal writer Alistair MacDonald reported earlier this week that, “Ukraine said its exports of agricultural products have recovered to around prewar levels, a revival that has helped ease pressure on global food prices and offers a bright spot in Kyiv’s fight against Russia.

“However, analysts say the rise in exports, which were hit hard by the war, hides continued hurdles for Ukraine’s globally important agricultural industry. The country relies on shipping grain out of the Black Sea, a route dependent on cooperation with Russia. Farmers, meanwhile, have planted fewer crops this year, and Russia still controls a large slice of Ukrainian farmland.

“Nevertheless, data from Ukraine’s Ministry of Agrarian Policy and Food shows the country shipped 6.9 million metric tons of grain, vegetables and edible oils last month, almost matching the 7.1 million tons exported in September last year.”

Reuters News reported yesterday that, “Russia’s foreign ministry said on Thursday that Moscow was ready to boost exports of food and fertilizers to help avert a global food crisis, but was being blocked from doing so by the United States.

“Foreign Ministry spokeswoman Maria Zakharova said Washington was ‘blackmailing’ and ‘persecuting’ those that try to trade with Russia and was therefore compromising global food security.”

Also yesterday, Reuters writer Mark Weinraub reported that, “Wheat markets have been pressured by hopes of progress towards extending Ukraine’s United Nations-backed shipping corridor beyond November.

“But talks on extending a July deal that resumed Ukraine Black Sea grain and fertilizer exports are not making much progress because Russian concerns are not being taken into proper account, Russia’s U.N. ambassador in Geneva said on Thursday.

“‘At the moment it is difficult to get a clear idea about the outcome of the negotiations, as the Russia-Ukraine war has just intensified,’ a Singapore-based trader said.”

And today, Reuters writer Ece Toksabay reported that, “Turkish President Tayyip Erdogan was quoted on Friday as saying that he sees no obstacles to extending a U.N.-brokered deal allowing Ukrainian Black Sea grain exports, after discussions with his Russian and Ukrainian counterparts.

“‘There is no obstacle to extending the export deal. I saw this in the talks I held with (Ukrainian President Volodymyr) Zelenskiy last night and also in the talks I held with (Russian President Vladimir) Putin,’ NTV cited Erdogan as telling reporters on his plane returning from a trip to Azerbaijan.”

In other news, New York Times writer Kim Severson reported today that, “Thanksgiving 2022 is shaping up to be a tough one for turkey. The star of the holiday meal will be both hard to find and more expensive than ever.

“Turkey supplies have been tight for a long time. Producers began to cut back on raising the birds back in 2019 after turkey prices crashed. Then the pandemic hit, further curtailing production.

“Inflation has also pushed up the price of whole turkeys. Farmers and processors are paying a lot more for feed, fuel and labor, which can be scarce. They face supply shortages and drought.”

Severson pointed out that, “All of it means that home cooks this year could be paying more than twice as much for a turkey as they did last year, some in the poultry industry predict.

“And then there’s the avian flu. A particularly persistent and contagious strain carried by migrating birds has killed at least 3.6 percent of the nation’s turkeys, or about 7.3 million birds, so far this year, according to figures from the Department of Agriculture and Watt Global Media, which monitors the poultry business.”

The Times article explained that, “Most producers, retailers and market analysts don’t think meat cases will be empty. Contracts for most frozen turkeys were signed in the first quarter, some of them before the nation’s first case of avian influenza in a commercial flock was detected at an Indiana turkey farm on Feb. 8. And much of the nation’s supply of frozen birds has been ready to go for months.

“But still, shoppers shouldn’t expect the options they’ve enjoyed in the past.”