Republican U.S. lawmakers plan to create a task force to study potential year-round sales of higher-ethanol E15 gasoline blends in the U.S., after an attempt to pass such legislation in…

USDA Agricultural Projections to 2032- Focus on Corn, Soybeans

On Wednesday, the U.S. Department of Agriculture released its 10-year projections for the food and agricultural sector.

In part, the baseline update explained that, “The Agriculture Improvement Act of 2018 is assumed to remain in effect through the projection period. The projections are one representative scenario for the agricultural sector and reflect a composite of model results and judgment-based analyses. The projections in this report were prepared using data through the October 2022 World Agricultural Supply and Demand Estimates (WASDE) report, except where noted otherwise. Macroeconomic assumptions were concluded in August 2022.”

Corn

The report stated that, “The Baseline projects U.S. corn production to grow over the next decade as yield gains offset a slight decline in acreage. Planted area is projected to steadily decline after 2023/24’s strong response to increased global demand and tight supplies.”

“The stocks-to-use ratio is expected to rise somewhat rapidly, from 11.6 percent in 2023/24 to 16.0 percent in 2026/27. Later in the projection period, supply and use grow at similar rates, slowing growth in the stocks-to-use ratio,” the report said.

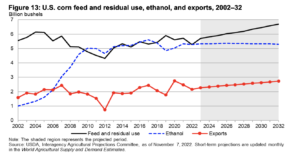

With respect to ethanol, the report noted that, “Corn used for ethanol production declines slightly over the projection period, from 5.325 billion bushels to 5.300 billion bushels by 2032/33. Expected declines in motor gasoline consumption constrains ethanol demand.”

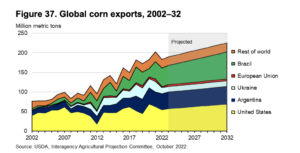

While addressing long-term corn exports, USDA explained that, “U.S. corn exports are expected to increase by 11.4 million tons to 69.2 million tons by 2032/33.”

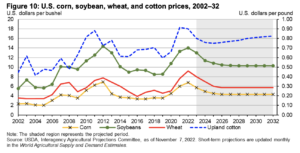

“Corn prices are expected to fall steadily from a near-record peak of $6.80 per bushel in 2022/23 to $5.70 per bushel in 2023/24 and continue a downward trend through 2026/27 before stabilizing at $4.30 through 2032/33,” the report said.

Soybeans

Wednesday’s report noted that, “U.S. soybean plantings rebounded sharply in 2021/22 and 2022/23 from the prior 2 years, and area is projected to remain steady over much of the coming decade before declining slightly near the end of the projections. Plantings remain near 87 million acres, supported by high prices and net returns relative to the 2014/14–2019/20 period.”

The update pointed out that, “Soybean oil use for production of biofuels increases from 11.8 billion pounds in 2022/23 to 12.15 billion pounds by 2032/33. The Federal and State policies in place as of October 2022 are assumed through 2032/33. Projections are largely driven by increasing renewable diesel for the California market and Federal mandates.”

“Soybean prices follow a similar trend as corn, falling to $13.00 per bushel in 2023/24; down $1.00 from the recent 2022/23 peak. Soybean prices continue their downward trend through 2028/29, before stabilizing at $10.30 per bushel through 2032/33,” the report said.

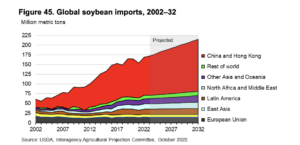

In more detailed demand analysis, the baseline report added that, “Demand from China will drive continued growth in soybean trade during the next 10 years, as world soybean imports climb 43.2 million tons (25 percent) to 215.2 million tons.”

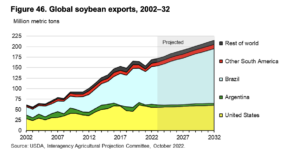

Turning to world soybean exports, USDA stated that, “The three leading soybean exporters—Brazil, the United States, and Argentina—are projected to account for 91 percent of world soybean trade by 2032/33.

The baseline report also noted that, “The U.S. share of global soybean exports is about 32.4 percent in 2023/24 and is projected to decrease to 28.0 percent by 2032/33. U.S. soybean exports are projected to increase from 55.8 million tons in 2023/24 to 60.3 million tons by 2032/33.”