Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University's monthly…

Uncertainty Over Black Sea Grain Initiative Extension Continues to Impact Market- Wheat Price Volatility “Remains High”

Reuters writers Nigel Hunt and Jonathan Saul reported yesterday that, “Russia has proposed that a U.N.-backed initiative that has enabled grains to be exported from Ukraine’s Black Sea ports should be renewed for just 60 days.

“The deal to free up grain exports from Ukraine’s southern Black Sea ports, which expires later this month, has previously been renewed for 120 days and there are concerns a shorter extension could cause logistical issues.”

Hunt and Saul explained that, “The main potential change to the agreement is a shortening in the length of the renewal to 60 days from 120 days, a switch that is supported by Russia but opposed by Ukraine.

“A shorter period is significant as there is often a slowdown in shipments in the period leading up to the renewal date due to the potential risk that the deal may collapse.”

The article added that, “It is likely therefore that a shorter renewal period will effectively mean a lower volume of shipments of grains and oilseeds out of Ukraine through the corridor as companies consider whether their shipments may get stuck.

Shipping companies are already holding off from charters through the corridor until more is known over the outcome of the current talks, industry sources said.

Earlier this week, Turkish Defence Minister Hulusi Akar indicated support for a 120 extension of the Grain Initiative.

Grateful to Türkiye as the signatory of the #BlackSeaGrainInitiative and personally to Minister Hulusi Akar for unwavering adherence to the previously signed Agreement and support of the extension for 120 days. https://t.co/QVIIwPQRhU

— Oleksandr Kubrakov (@OlKubrakov) March 15, 2023

And yesterday, Reuters News reported that, “The German government on Wednesday called on Moscow to extend a deal allowing the export of grain from Ukrainian Black Sea ports beyond 60 days.”

Dow Jones writer Kirk Maltais reported yesterday that, “Wheat for May delivery rose 0.9% to $7.02 3/4 a bushel on the Chicago Board of Trade Wednesday due to uncertainty about discussions between Russia and Ukraine, and mounting pressure from an emerging banking crisis.”

Maltais pointed out that, “While it appears that the Black Sea Grains Initiative will move forward in some capacity, Russia and Ukraine disagree about how long the terms of the next deal extension should remain in place. Russia wants the deal to remain active for only 60 days, while Ukraine is holding to 120 days, the length of the current renewal. ‘Russia will allow the corridor to remain open during the negotiation period, but the trade would like to see some resolution,’ said Tomm Pfitzenmaier of Summit Commodity Brokerage in a note.”

Reuters writer Naveen Thukral reported today that, “Chicago corn futures rose for a third consecutive session on Thursday, supported by strong Chinese demand and uncertainty over a Black Sea grain export deal.”

“Wheat slid for the first time in five sessions.”

Thukral added, “Uncertainty over whether a deal to allow grain shipments from Ukraine’s Black Sea ports would be extended ahead of a deadline later this week continued to drive prices up, traders said, after Kyiv rejected a Russian push for a reduced 60-day renewal.”

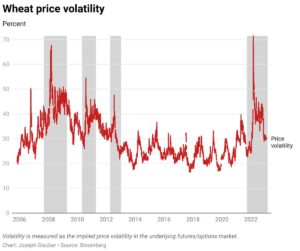

In more detail regarding wheat prices, Joseph Glauber, a Senior Research Fellow with the International Food Policy Research Institute, indicated in a blog update this week (“Assessing tight global wheat stocks and their role in price volatility“) that, “The Russia-Ukraine war has caused significant price volatility in agricultural markets over the past year—for wheat, in particular, price levels and price volatility reached the highest levels since the 2007/08 marketing year. Both have fallen back to pre-war levels over the past six months, but volatility remains high relative to historical levels, indicating that significant market uncertainty remains, creating ongoing vulnerability for global food security.”

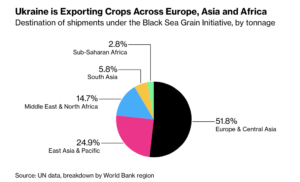

Meanwhile, Reuters writer Pavel Polityuk reported yesterday that, “Ukraine’s grain exports for the 2022/23 season stood at 34.7 million tonnes as of March 15, hit by a smaller harvest and logistical difficulties caused by Russia’s invasion, agriculture ministry data showed on Wednesday.”

And a separate Reuters article yesterday by Polityuk stated that, “Ukrainian winter grain crops have resumed growth is some regions and most are in good or excellent condition, state weather forecasters said on Wednesday.”