The U.S. ag economy enters 2026 in a clear crop-sector recession, but the deeper crisis is one of confidence. High input costs, weak prices, policy uncertainty and eroding trust in…

Quick Take: Farmland Values “Could Level Off”

Daniel Grant reported recently at FarmWeekNow.com that, “The meteoric rise of farmland values in 2021-22 could level off this year.

“But that doesn’t mean it will turn into a buyer’s market any time soon.

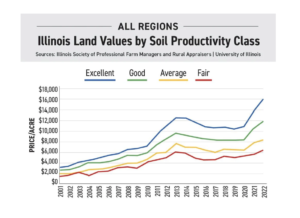

“Land prices are expected to remain near historic highs in 2023, based on the Illinois Society of Professional Farm Managers and Rural Appraisers (ISPFMRA) 28th annual farmland values report and member survey.”

Last week’s article noted that, “‘Every classification of land saw significant increases (in 2022),’ Luke Worrell of Worrell Land Services in Jacksonville and chair of the ISPFMRA report, said at the group’s Illinois Land Values Conference in Bloomington. ‘If you factor in 2021 results, Class A land across Illinois is up 42% the past two years. It’s just tremendous growth.'”

The FarmWeekNow.com article stated that, “‘We just experienced a two-year bull run in farmland values we’ve never seen before,’ said Bruce Sherrick, director of the TIAA Center for Farmland Research at the University of Illinois. ‘The total value of assets in the ag sector topped $4 trillion in the U.S.’

Sherrick believes the jaw-dropping jump in land values was justified by returns and did not represent a bubble.

“Farm returns reached historic levels the past two years and investor interest in farmland surged when interest rates were low through the first half of 2022.”

The article stated that, “‘Where do we go from here? Last year we already knew 2022 was off to the races (by March based on the amount of sales and prices),’ Worrell said. ‘I can’t say the same for this year.

“‘We still have a really strong market, but we all can kind of tell the market has a different feel,’ he continued. ‘A leveling off or pause is probably expected. The number of transactions so far in 2023 pales in comparison to what we saw last year on the state level, although we certainly have pockets of activity.'”

“‘Interest rates have literally more than doubled since last year,’ Worrell said. ‘That is bound to have an effect. We could also be looking at lower (farm) returns, inflation is an issue and we have geopolitical issues.'”

For additional perspective, see, “Kansas City Fed: ‘Signs of Softening’ in Farmland Values, as Interest Rates Climb.”

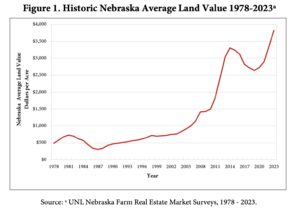

Meanwhile, an update earlier this month from the University of Nebraska noted that, “The market value of agricultural land in Nebraska increased by 14% over the prior year to an average of $3,835 per acre, according to the 2023 Nebraska Farm Real Estate Market Survey. This marks the second-largest increase in the market value of agricultural land in Nebraska since 2014 and the highest non-inflation- adjusted state-wide land value in the 45-year history of the survey.”

And the Federal Reserve Bank of Dallas stated in its quarterly Agricultural Survey report last week that, “Bankers responding to the first-quarter survey reported overall weaker conditions across most regions of the Eleventh District. They noted that dry conditions are straining agricultural production and that inflationary pressures remain an impediment.”

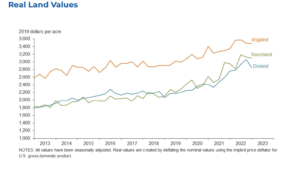

The Dallas Fed stated that, “Ranchland, irrigated cropland and dryland values fell this quarter.

“But according to bankers who responded in both this quarter and first quarter 2022, ranchland, irrigated cropland and dryland values rose at least 8 percent year over year in Texas, with some segments seeing much higher increases.

“The anticipated trend in farmland values index bounced back into positive territory, suggesting respondents expect farmland values to increase.”