President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

Black Sea Grain Talks to Continue, Wheat Slides, as Dollar Value in Focus

Reuters News reported today that, “The Kremlin said on Wednesday that Russia would continue talks with the United Nations and other parties to the Black Sea grain deal, and that Moscow would not do anything to harm its own interests.

“On a call with reporters, Kremlin spokesman Dmitry Peskov said: ‘The Russian side will continue contacts with both U.N. and other representatives, in the hope that the terms of the deal will be fulfilled after all.’

“He added: ‘Of course, Russia will not do anything further that will be contrary to its interests.'”

Today’s article noted that, “Russia complains that its own food and fertiliser exports are still facing significant obstacles,” and added that: “Earlier, Russian Foreign Ministry spokeswoman Maria Zakharova said talks between Russia and the United Nations on the Black Sea deal will be held in Moscow on Friday, with the U.N. represented by top trade official Rebeca Grynspan.”

Meanwhile, Reuters writer Pavel Polityuk reported yesterday that, “Ukraine’s grain exports could fall to around 26 million tonnes in the 2023/24 season as the grain harvest has sunk, largely due to Russia’s invasion, a senior ministry official said on Tuesday.

“Ukraine harvested a record 86 million tonnes of grain in 2021 and 53 million tonnes in 2022, the first year of Russia’s invasion.”

The article indicated that, “After an almost six-month blockade caused by Russia’s invasion, three Ukrainian Black Sea ports were cleared at the end of July under a deal between Moscow and Kyiv brokered by the United Nations and Turkey.

“Actual grain exports from Ukraine depend on the continued operation of the corridor, which may end on May 18, as the parties have not yet agreed on its operation for a longer period.”

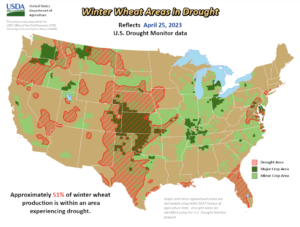

What an awful climate statistic: Only 0.72" fell at Wichita Eisenhower Airport since March 1st...the 2nd driest Mar-Apr on record, and the driest since 1936. Chanute saw only 1.56" since March 1st...the 3rd driest Mar-Apr on record, and also the driest since 1936. #kswx

— NWS Wichita (@NWSWichita) May 1, 2023

And Reuters writer Naveen Thukral reported today that, “Chicago wheat slid for a third consecutive session on Wednesday to its lowest in 25 months as the recent rain in U.S. winter wheat-growing areas and favourable weather in other northern hemisphere suppliers boosted expectations of abundant supplies.”

The article pointed out that, “Favourable weather conditions across top suppliers – the United States, Russia and Europe – are driving hopes of ample supplies in the second half of 2023.

“The U.S. winter wheat crop rating as of Sunday was up 2 points from the prior week at 28% ‘good to excellent,’ according to the U.S. Department of Agriculture (USDA).

“Soft wheat exports from the European Union in the 2022/23 season that started in July had reached 25.67 million tonnes by April 30, up 9% compared with 23.46 million a year earlier, data published by the European Commission showed on Tuesday.”

Dow Jones writer Kirk Maltais reported yesterday that, “A lot of attention has been given to Russia’s sizable wheat crop, and with good reason. Stocks of wheat in Russia are up 79% from the five-year average, says consultancy SovEcon. However, wheat grown in Australia is also expected to crowd the global export market. Dry conditions are expected to descend on farmland and limit wheat production in Russia, but the country is still expected to produce an above-average sized crop, said the USDA in an analysis released by its Foreign Agriculture Service last week. The above-average production is expected to keep export prices cheap.”

Maltais added that, “Flooding on the upper portion of the Mississippi River continues this week, but some areas of the river are expected to reopen by midweek, said American Commercial Barge Line in a note. The ACBL says that it expects most of the locks to reopen this week, with one lock’s reopening expected in two weeks.”

Elsewhere, Wall Street Journal writer Chelsey Dulaney reported yesterday that, “The U.S. economy no longer looks so exceptional. That is bad news for the dollar.

The greenback has fallen about 8.3% from a peak in September, as tracked by the WSJ Dollar Index, and is experiencing its worst start to the year since 2018.

“Investors are betting the U.S. currency has further to fall as the Federal Reserve nears the end of its most aggressive program of interest-rate increases since the 1980s. Also weighing on the dollar: concerns over the banking system, a potential U.S. debt default and expectations, shared by many economists, that the U.S. will slip into recession in the coming months.”

Yesterday’s article explained that, “A weaker dollar is typically good news for the global economy. It lowers the cost of servicing or repaying dollar debt for foreign companies and governments, boosts the value of overseas earnings by U.S. multinationals and can bolster global trade, because goods priced in dollars become more affordable to international buyers.”

And Laura Reiley reported in today’s Washington Post that, “Agriculture officials in the Biden administration are testing four vaccines in hopes of stanching the latest outbreak of a highly pathogenic avian influenza that has devastated U.S. poultry farms and driven up egg prices, with plans to launch a national vaccination campaign that would be the first-ever effort of its kind.

“Two of the vaccines being tested by the U.S. Department of Agriculture were developed by that agency. The others, from animal drugmaker Zoetis and Merck Animal Health, were developed during the last large-scale outbreak in 2015 and not used, a USDA spokesman said.

“Should the trials be successful, the next stage is identifying manufacturers, with many more steps before laying hens, domesticated turkeys and broilers are vaccinated. In a best-case scenario, the agency estimates an 18- to 24-month timeline before having a commercial quantity of vaccine available that matches the currently circulating virus strain, but the timeline could be expedited in an emergency.”