As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Kansas City Fed: Ag Credit Conditions Strong, “Alongside Some Moderation in the Farm Economy”

In an update last week from the Federal Reserve Bank of Kansas City (“Credit Conditions and Farmland Values on Solid Footing as Farm Economy Moderates“), Nate Kauffman and Ty Kreitman indicated that, “Agricultural credit conditions remained strong in the first quarter, but improvement slowed alongside some moderation in the farm economy. The pace of increase in farm loan repayment rates and farm income was slower than previous quarters in all participating Districts. Interest rates on agricultural loans moved higher alongside further increases in benchmark rates and collateral requirements also increased at a slightly larger share of banks. Despite higher interest rates and more measured farm incomes, agricultural real estate values continued to rise at a firm pace.

Farm finances have been bolstered by historically strong incomes in recent years, but higher production expenses and some retraction in commodity prices have tempered the outlook for profits.

Kauffman and Kreitman explained that, “Current prices for most major commodities have preserved modest profit margins for many producers, but lenders continued to highlight production costs, higher interest rates and weather conditions as key risks in the months ahead.”

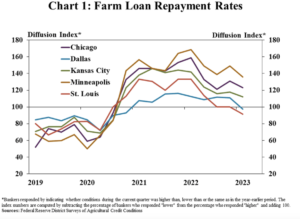

“The pace of increase in farm loan repayment rates slowed in the first quarter according to Federal Reserve Surveys of Agricultural Credit Conditions,” the report said.

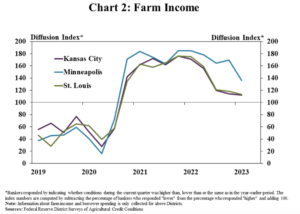

Regarding farm income, the Kansas City Fed noted that, “Loan repayment rates have steadied alongside a moderation in farm income. Similar to credit conditions, the pace of improvement in farm income slowed in all participating Districts.”

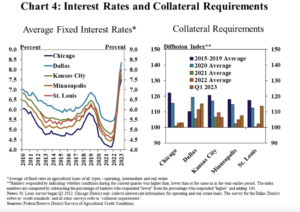

More narrowly on interest rate levels, last week’s update pointed out that, “On average, farm loan interest rates were 40 basis points and 300 basis points higher than last quarter and a year ago, respectively.”

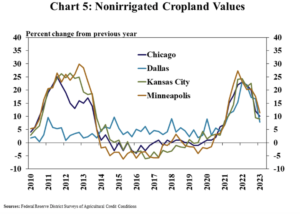

Turning to farmland values, Kauffman and Kreitman stated that, “Farm real estate values continued to increase at a solid pace despite downward pressure from higher interest rates and some moderation in farm profits.

“The value of nonirrigated farmland was about 10% higher than a year ago across all reporting regions. The pace of growth in agricultural real estate values has slowed from rapid increases in 2021 and 2022, but remained resilient.”