Republican U.S. lawmakers plan to create a task force to study potential year-round sales of higher-ethanol E15 gasoline blends in the U.S., after an attempt to pass such legislation in…

Dry Weather Concerns Linger Over Parts of the Midwest, as Black Sea Grain Deal Issues Persist

Dow Jones writer Kirk Maltais reported yesterday that, “Corn for September delivery rose 3.5% to $5.00 1/2 a bushel, on the Chicago Board of Trade on Thursday, with rainfall over the next few days expected to give way to hot and dry weather that may stress crops.”

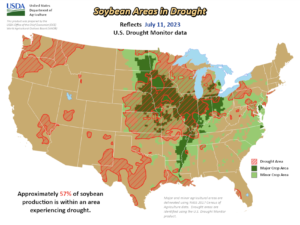

The Dow Jones article indicated that, “Drought conditions are becoming more dire in some areas of the Midwest, with parts of Wisconsin and Missouri experiencing growing severe drought conditions, according to the latest data from the U.S. Drought Monitor.

#Drought Monitor, Corn Belt, One-Week Change pic.twitter.com/OS4IBYvzW2

— FarmPolicy (@FarmPolicy) July 13, 2023

“Nebraska and Kansas still suffer from severe drought, but those patches are shrinking versus last week. The data appears to reflect recent rainfall missing some growing areas while landing in other areas – a trend that traders may see as continuing as rainfall persists in the coming days.”

30- Day Percent of Normal Precipitation pic.twitter.com/PY5yQ33IHX

— FarmPolicy (@FarmPolicy) July 13, 2023

Also yesterday, Reuters writer Julie Ingwersen reported that, “Corn and soybean futures rallied a day after a selling off when the U.S. Department of Agriculture projected massive harvests of both crops this year, despite drought conditions stressing plants during early stages of development.

“By Thursday, traders considered that crops in the United States, the world’s second-largest exporter of corn and soybeans, still faced weeks of weather risk.”

And today, Reuters writer Naveen Thukral reported that, “Portions of the northwestern Midwest are set to remain dry in the coming week and the key growth period for soybeans still lies ahead in August.”

The Reuters article added that, “China imported 10.27 million metric tons of soybeans in June, up 24.5% from a year earlier, customs data showed on Thursday, as large purchases of cheap Brazilian beans reached the market.”

#Drought Monitor, Corn Belt pic.twitter.com/P0qx3aHmcP

— FarmPolicy (@FarmPolicy) July 13, 2023

Elsewhere, DTN Meteorologist John Baranick indicated yesterday that, “The U.S. Drought Monitor (USDM) has been tracking expanding drought conditions in the Corn Belt for the last six weeks. Recent rainfall has been able to take a few bites out of the drought in some areas but has not been consistent enough to eliminate drought anywhere. And those areas that do not see the rain are seeing drought continuing to grow. It is a fair question to ask: How much rain will it take to end the drought?

“According to the National Drought Mitigation Center’s (NDMC) website, it is not a simple number. Drought is a ‘convergence of evidence’ of several different indicators that fall into one of these categories: precipitation, streamflow, reservoir levels, temperature and evaporative demand, soil moisture, vegetation health, impact reports from media outlets and private citizens, and the input of over 450 local experts throughout the country. In other words, you cannot objectively determine if you will get out of the drought categories by a simple look at the past week’s rainfall. There are more indicators that go into it.”

Baranick added that, “This also means a simple look at the map does not tell the whole story. The change over time is also important, especially for agriculture. Going from D4 — exceptional drought — to D2 — severe drought — will have a different meaning than going from no drought to D2. Momentum is important in agriculture because it is often an indicator of soil moisture availability for crops or pastures to use. Crops can be in good standing in drought conditions or could have limitations when drought is not indicated on the map.”

Meanwhile, Reuters writers Guy Faulconbridge and Vladimir Soldatkin reported yesterday that, “Russian Foreign Minister Sergei Lavrov said on Thursday that he had not heard of any new proposals on the Black Sea grain deal which expires next week but was working with Turkey on ways to ensure Russian grain exports regardless of any deal.

“U.N. Secretary-General Antonio Guterres has proposed to President Vladimir Putin that he extend the deal in return for connecting a subsidiary of Russia’s agricultural bank to the SWIFT international payment system, sources told Reuters.”

Also yesterday, Reuters writer Gareth Jones reported that, “President Vladimir Putin said on Thursday Russia was set to withdraw from a deal allowing the export of Ukrainian grain via the Black Sea unless its own demands are met, reaffirming Moscow’s tough stance ahead of the deal’s expiry next Monday.

“Putin, in comments to Russian state television, also said the United Nations had so far failed to come up with a satisfactory solution to the issue and he denied having received any letter containing proposals from the U.N. Secretary General.”

And Reuters writer Michelle Nichols reported yesterday that, “The European Commission is helping the United Nations and Turkey try to extend a deal allowing the Black Sea export of Ukraine grain and is open to ‘explore all solutions,‘ a European Union spokesperson said on Thursday, ahead of the deal’s possible expiration on Monday.”