Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Despite Early Dryness, “Massive” Corn and Soybean Harvest Expected

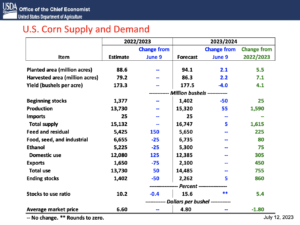

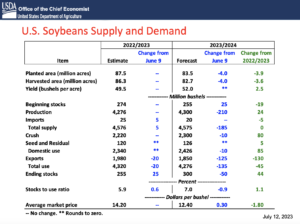

Reuters News reported yesterday that, “The government said on Wednesday that U.S. farmers will harvest massive crops of both corn and soybeans this year, boosting the supply base despite drought conditions stressing plants during early stages of development.

“The unexpectedly large forecasts immediately pushed down corn and soy futures, potentially easing inflation and making U.S. exports more competitive with South America in coming months.

#corn, #wheat, #soybeans - close pic.twitter.com/UGaw9yyq8Q

— FarmPolicy (@FarmPolicy) July 12, 2023

“The corn harvest was pegged at a record large 15.320 billion bushels and soybean harvest at 4.300 billion bushels, according to the U.S. Agriculture Department’s monthly World Agriculture Supply and Demand Estimates report.”

The Reuters article explained that, “USDA predicted record yields for both crops, with corn seen at an average of 177.5 bushels per acre and soybeans at 52.0 bushels per acre.”

Also yesterday, Dow Jones writer Kirk Maltais reported that, “Hot and dry weather in June pushed yield expectations for U.S. corn crops planted this spring lower, according to government data.

“In its latest world agricultural supply and demand estimates report Wednesday, the Department of Agriculture forecasts that corn yields will be an average of 177.5 bushels an acre, a drop from 181.5 bushels an acre projected last month.”

The Dow Jones article pointed out that, “Hot weather and growing drought conditions throughout the Corn Belt in June were seen as the primary factors behind the yield cut for corn, the USDA said.

“‘Harvested-area-weighted June precipitation data for the major Corn Belt states represented an extreme downward deviation from average,’ the agency said. ‘However, timely rainfall and cooler than normal temperatures for some of the driest parts of the Corn Belt during early July is expected to moderate the impact of June weather.'”

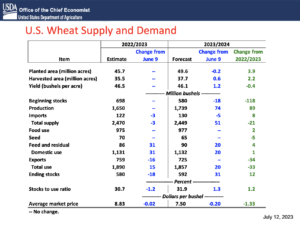

Maltais added that, “Meanwhile, estimates for wheat production were raised by the USDA, with 1.75 billion bushels now expected, up from 1.665 billion bushels forecast last month. Analysts were expecting an uptick of 12 million bushels, to 1.677 billion bushels.”

In a separate Dow Jones article yesterday, Maltais pointed out that, “Grain traders put most of their focus on the USDA’s yield adjustments, but demand figures were also adjusted in the WASDE, resulting in higher ending stocks for corn and wheat versus the previous month.

“Soybean ending stocks were lower than last month, but over 100 million bushels higher than projected by analysts surveyed by The Wall Street Journal.”

Reuters writer Naveen Thukral reported today that, “Chicago corn futures lost more ground on Thursday, with the market dropping to its lowest since early 2021 after a closely-watched U.S. government report estimated all-time high production.

“Wheat prices were also weighed down by a larger-than-expected U.S. production forecast from the U.S. Department of Agriculture (USDA), while soybeans rose.”

In other developments, Reuters writer Michelle Nichols reported yesterday that, “U.N. Secretary-General Antonio Guterres has proposed to Russian President Vladimir Putin that he extend a deal allowing the safe Black Sea export of grain from Ukraine in return for connecting a subsidiary of Russia’s agricultural bank to the SWIFT international payment system, sources told Reuters.”

Also yesterday, Bloomberg News writer Gerson Freitas Jr. reported that, “The world’s largest fertilizer company has agreed to distribute a new soybean variety that promises to soak up more carbon while yielding more of the vegetable oil and protein needed to meet demand for green diesel, chicken feed and veggie burgers.”

And today, Bloomberg writers Siddhartha Singh and Pratik Parija reported that, “India, the world’s biggest rice shipper, is considering banning exports of most varieties, a move that may send already lofty global prices higher as the disruptive El Niño weather pattern returns.”

Elsewhere, Paul Davidson, Medora Lee and Charisse Jones reported in today’s USA Today that, “A year after U.S. inflation hit a 40-year high of 9.1%, it has fallen by about two-thirds. But bringing down annual consumer price increases the rest of the way — to the more normal 2% level sought by federal policymakers — is expected to be a tougher slog.

“Inflation cooled for a 12th straight month in June as flat grocery prices partly offset a rebound in gasoline costs and still-hefty rent hikes. Core inflation, which the Federal Reserve watches more closely, eased more than expected.”

The article explained that, “Grocery prices were unchanged in June after either falling or rising modestly in the previous three months. That pushed down the yearly increase to 4.7% from 5.8%. The cost of commodities such as wheat and corn has fallen in recent months because of easing global demand.

“Last month, the price of eggs dropped by 7.3% following a 13.8% tumble in May. That’s the fourth straight monthly decline after a string of sharp bird flu-related increases, and costs are now down 7.9% over the past year. Bacon prices fell 1.7%; cookies dipped 0.7%; and fresh biscuits, rolls and muffins were slipped 0.1%.”