President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

U.S. Soybeans Facing Increased Export Competition as Brazilian Soybeans to China Jump

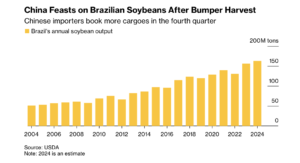

Bloomberg writer Tarso Veloso Ribeiro reported last week that, “A sevenfold jump in Brazilian soybean shipments to China for next month highlights how the US is losing influence over one of the world’s most important agricultural markets.

“China, the biggest soybean importer globally, booked at least 95 cargoes of the crop from Brazil for now until the end of November. For next month, there are 52 vessels already scheduled, compared with seven for the same week last year, according to shipping agency Alphamar Agencia Maritima.

“In contrast, export sales of US soybeans for this season are down 40% from a year earlier. It’s a striking drop, considering the ideal timeframe for American shipments usually starts in October to coincide with the harvest and continues for months. This year, that key window has narrowed to weeks. US soybean sales to other countries totaled $34 billion last year, making it the top agricultural export commodity.”

The Bloomberg article also pointed out that, “Drought and the hottest summer ever have shriveled the Mississippi River, which funnels barges of soybeans from the Midwest to Gulf Coast ports.

Freight costs have soared, making US exports less competitive at a time when the harvest would typically make them cheaper relative to supplies from other countries.

“Brazil, meanwhile, still has stocks available from its record crop earlier this year, with shipments poised to beat estimates.”

Reuters writer Naveen Thukral reported on Monday that, “For soybeans, China’s imports of the oilseed from Brazil rose in September by 23% from a year earlier, data showed on Friday, after a huge crop produced by the South American nation this year continued to reach the world’s top buyer.”

Nonetheless, Bloomberg writer Beatriz Amat reported on Friday that, “There is no relief in sight for a historic drought in Brazil’s Amazon that has been disrupting river transport, causing forest fires and killing wildlife, according to a prominent climate scientist.”

“The water level at the Rio Negro river, the main tributary to the Amazon, is at the lowest since 1902, according to the Geologic Survey of Brazil. It will take up to two months of rain for Amazonian rivers to rise enough for navigation to normalize, Artaxo said. About 30 million Brazilians live in the Amazon and they rely on rivers to transport essentials including food, medicine and drinking water. The drought has forced some soy and corn shipments to be rerouted to other ports in Brazil’s south,” the Bloomberg article said.

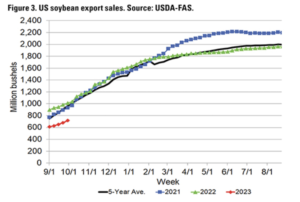

Elsewhere, in the latest AgDecisionMaker, Iowa State University extension economist Chard Hart noted that, “For soybeans, the general story on exports is similar, and again the early data is not encouraging. USDA’s current export projection sits at 1.755 billion bushels. That is down 70 million bushels from a couple of months ago, is down 237 million from last year, and is down 511 million from 2020. So, the soybean market is staring at a roughly 22% pullback in exports over 3 years.

“And given the relatively dependence of soybeans on exports, it’s a significant cut. US soybeans are facing increased competition with record global supplies and a strong US dollar.”

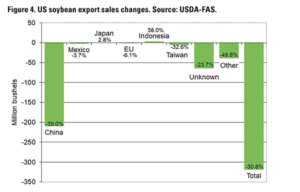

Hart added that, “Digging down into the country level data, most of the changes are relatively small, with the exception of China. Compared to this time last year, Chinese soybean purchases are down by 200 million bushels. That is two-thirds of overall drop in soybean exports.”

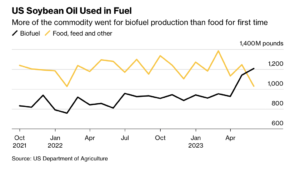

Looking at other soybean use variables, Bloomberg News writer Sophie Caronello reported on Sunday that, “Soybean processing margins are an important indicator of potential returns for producers. Profits from crushing the oilseed into animal feed and cooking oil have rebounded since June as a poor harvest in Argentina boosted demand for American crops, even as the prices for soybean futures and soybean oil have weakened.

“At the same time, increased demand from the renewable-diesel industry and a bumper crop in Brazil have helped lift margins.”

Amid prospects for a reduced #outturn and record domestic #processing, #US #soybean export availabilities are set to tighten in 2023/24 (Sep/Aug), as shipments fall for the third consecutive year. #GMR pic.twitter.com/kp78IT5ALN

— International Grains Council (@IGCgrains) October 23, 2023

And Bloomberg writers Michael Hirtzer, Tarso Veloso Ribeiro, and Archie Hunter reported on Friday that, “Louis Dreyfus Co., one of the world’s biggest agricultural traders, said it’s building a soybean processing plant in Ohio to boost production of the vegetable oil that’s been increasingly in demand both for cooking and fuel.

“Construction of the plant in Upper Sandusky is set to begin next year, with an annual processing capacity of 1.5 million metric tons of soybeans, according to a Friday statement from the company.”