Republican U.S. lawmakers plan to create a task force to study potential year-round sales of higher-ethanol E15 gasoline blends in the U.S., after an attempt to pass such legislation in…

Minneapolis Fed: Farm Incomes Down in Third Quarter, But Land Values Climb

In an article last week from the Federal Reserve Bank of Minneapolis, “Farm incomes fell going into harvest, but finances remained solid,” Joe Mahon pointed out that, “Farmers always have a lot riding on harvests. But heading into this year’s fall harvest, they were also contending with lower incomes, due to falling output prices and high production costs. That’s according to a third-quarter survey of agricultural bankers by the Federal Reserve Bank of Minneapolis.”

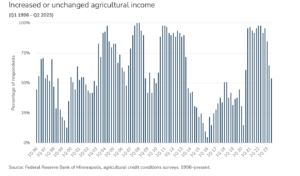

“Though incomes fell on balance, the decline was not uniform. Districtwide, 46 percent of agricultural lenders surveyed said incomes decreased in the third quarter from a year earlier, up from 35 percent the prior quarter.”

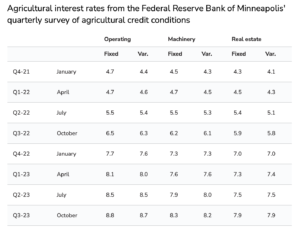

Mr. Mahon explained that, “Demand for loans hardly changed on balance from the low level prevailing over the past several years, according to lenders, as 52 percent reported no change to loan demand relative to a year ago. By contrast, 25 percent noted greater loan demand, and 23 percent said it was lower. Collateral requirements on loans were also unchanged according to 85 percent of lenders surveyed, though the remainder reported increases in collateral requirements. Interest rates continued to increase, climbing at least 20 basis points for all loan categories in the survey.”

Turning to land values, the Minneapolis Fed Survey indicated that, “Land values and cash rents continued to climb in the third quarter following a period of several years of strong growth.

Ninth District nonirrigated cropland values increased by 7.2 percent on average from the third quarter of 2022. Values for irrigated land increased by 12.8 percent, while ranchland and pastureland values increased almost 2.1 percent.

“Several respondents noted pressures behind rising farmland prices, such as out-of-state hunters looking for recreational land as well as domestic and international investors purchasing property. These pressures have ‘driven up the price of ag land making next to impossible for the next generation to purchase or even lease land to farm or raise livestock,’ said a Montana banker. ‘More & more is taken out of production as well.’

“Land rents followed suit, as the district average cash rent for nonirrigated land increased by 4.2 percent from a year ago. Rents for irrigated land grew by 8 percent, while ranchland rents jumped 10.9 percent.”

Mr. Mahon added that, “Bankers’ outlooks for agriculture over the remainder of 2023 are generally pessimistic.”

The Federal Reserve Banks of Chicago and Kansas City also released third-quarter agricultural credit survey results this month, a summary of those findings can be found here and here.