As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Farmland Values, Farm Income, and Ag Trade Issues with China

Today’s update summarizes recent news items relating to important components of the U.S. farm economy including farmland values, farm income and trade issues with China.

Farmland Values

Earlier this month, the Federal Reserve Bank of Dallas released its Agricultural Credit Survey for the first quarter of 2017.

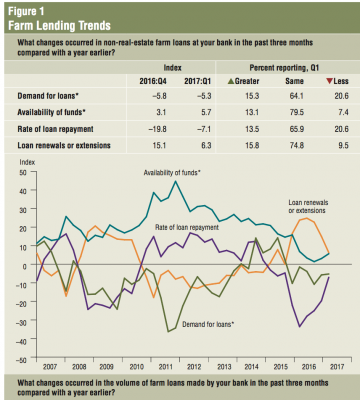

The Fed update noted that, “Demand for agricultural loans overall decreased for a sixth consecutive quarter. Loan renewals and extensions continued to increase, albeit at a slower pace, as loan repayment rates continued to decline. The volume of both non-real-estate and real estate farm loans was lower than a year ago. Operating loan volume, which had been increasing, was flat year over year this quarter; volumes fell in all other loan categories.”

The Ag Credit Survey also indicated that, “Real district ranchland and irrigated cropland values increased this quarter, while real dryland values decreased (Figure 2). According to bankers who responded in both this quarter and first quarter 2016, nominal district land values all rose year over year, with irrigated cropland showing the strongest increase.”

The Dallas Fed also pointed out that:

The anticipated trend in farmland values index remained negative for a seventh consecutive quarter, suggesting respondents expect farmland values to trend down in the coming months.

Comments from district bankers in the Fed update included:

- “General agricultural conditions are currently putting stress on farmers and ranchers in our area. Commodity prices must stabilize at higher levels for the overall agricultural environment to improve. Most farmers and ranchers in our area subsidize their agriculture operations with outside family income from other employment.”

-

“Grain prices need to increase as inputs are still high, especially seed and tech fees. Cattle prices need improvement as well. Two poor years in a row is not good.”

Farm Income

Tom Meersman reported in yesterday’s Minneapolis Star Tribune that, “[Mike Petefish], who farms 5,000 acres near Claremont in south-central Minnesota, is ready to plant.

“But mixed with excitement as a new growing season approaches is anxiety about whether he will end up in the red at the end of the year. Soybean prices have dropped by one-third since 2013 and corn prices are down by nearly half, well below the cost of production.

‘People can withstand a year or two of losses, but this could be the third year in a row for some farmers,” Petefish said. “I see this as the tipping year.’

The Star Tribune article explained that, “No one is saying that farmers are headed for a repeat of the 1980s, when high interest rates, inflation and huge debt forced thousands of producers out of business. But the tougher agriculture market and weakened farm economy of the past few years is steadily taking its toll, and cracks are beginning to show.”

Sunday’s article indicated that, “‘It’s clear that everybody that’s in farming is worried about this year and what’s going to happen,’ said U.S. Rep. Collin Peterson of western Minnesota, the ranking Democrat on the House Agriculture Committee. ‘If they have an average year and the prices keep trending down, that’s going to be a significant problem.'”

Mr. Meersman added that, “Not many farmers have been forced out of business yet, but increasing numbers of producers have needed to rebalance their debts and stretch out loan payments, said Mark Greenwood of AgStar Financial Services, which lends to growers across Minnesota and Wisconsin.”

Trade Issues

The Omaha World-Herald editorial board opined on Sunday that, “The Trump administration is aiming to take a tougher approach to international trade. But the administration would do well to pause and learn the lessons from its failure thus far on the health care issue.”

“The lessons: Don’t make unrealistic promises about what can be accomplished. Acknowledge the major complexities that have to be addressed. Craft policies likely to work in the real world.”

The World-Herald item stated that, “These lessons apply directly to trade issues. Business leaders and agricultural groups, including in the Midlands, are offering common-sense warnings about the harm inflicted if our country gets so aggressive that it ignites trade wars with our major trading partners.

The possibility of reduced access to foreign markets is ‘probably the biggest risk we have in the farm economy right now,’ Steve Nelson, president of the Nebraska Farm Bureau Federation, told The World-Herald last week.

“About a third of U.S. farm income comes from overseas sales.”

And, Reuters writer Mark Weinraub connected the importance of trade to farm income in an article last week where he reported that, “Struggling U.S. farmers are pressing their luck with soybeans this spring, sowing record acreage even though the world is awash with the oilseed, as demand from China offers a potential lifeline.”

Mr. Weinraub explained that, “But fierce competition to supply China threatens the bottom line for U.S. growers, and 2017 prices, while seen as up slightly from 2016, are still projected to be 50 cents per bushel lower than three years ago.

“Diplomatic concerns also weigh heavily as the market eyes tense relations between the two countries. U.S. President Donald Trump and China’s leader Xi Jinping meet this week in Florida. Trump has said he wants U.S. companies to stop investing in China and instead create jobs at home. He has also accused China of manipulating its currency to boost exports.”

The Reuters article pointed out that, “China’s soybean imports have grown for 13 years in a row and the USDA expects them to hit 87 million tonnes in the year ending Sept. 1. That would soak up one-fourth of the world crop and represent a 130 percent surge in demand in the last decade.”

China demands 30% of U.S. #soybeans, hope #trade on the agenda w/ #Trump #PresidentXi https://t.co/7fN2hzC7Uh #FarmBureau @FBMarketIntel pic.twitter.com/Qg1Qu0shMQ

— New10 (@New10_AgEcon) April 7, 2017

“The next-biggest importer is the European Union – set to bring in just 13.80 million tonnes in the 2016/17 crop year,” the Reuters article said.

EU-28 Imports of #soybeans, https://t.co/9aPadXwQAv @USDAForeignAg pic.twitter.com/FaIWKMocEb

— Farm Policy (@FarmPolicy) April 6, 2017

The Reuters article also pointed out that, “Additionally, massive crops in Brazil and Argentina provide China with purchasing options, and the competition is likely to persist as South American farmers also have the export market at the forefront of planting decisions.”

In other trade developments regarding the U.S., China and agriculture, Tom Mitchell and Shawn Donnan reported on Sunday at The Financial Times Online that, “China will offer the Trump administration better market access for financial sector investments and US beef exports to help avert a trade war, according to Chinese and US officials involved in talks between the two governments.

“US President Donald Trump and Xi Jinping, his Chinese counterpart, decided at their first meeting in Florida last week that they needed rushed trade negotiations to produce results within 100 days. The two concessions on finance and beef are relatively easy for Beijing to make.”

The FT article indicated that, “China is also willing to end a ban on US beef imports that has been in place since 2003, officials said, and buy more grains and other agricultural products as it seeks to reduce tensions stemming from the $347bn annual trade surplus in goods that it enjoys with its biggest trading partner.”

Bloomberg’s Alan Bjerga discussed the Chinese beef import issue in more detail last week.

China's beef with US cows may be on Trump-Xi agenda at Mar-a-Lago this weekend https://t.co/uSTZRB23Xs with @AlanBjerga pic.twitter.com/Kr1ezXjQOY

— SFBJ Newsroom (@SFBJNews) April 7, 2017

In their FT article, Mitchell and Donnan added that, “Mr Trump’s campaign threats last year to slap tariffs on Chinese goods and declare Beijing a currency manipulator have raised fears of a destructive trade war between the world’s two largest economies. But since taking office the former reality television star has moderated his rhetoric and cabinet officials have signalled they plan to take a more pragmatic approach.

“If concluded, the mooted deal would be welcomed by US financial services companies, which have grown increasingly frustrated in recent years about what they say are rising barriers to doing business in the country. Beef exporters have also complained about the lingering Chinese ban on US imports, which was introduced after a BSE scare in the US herd.”