As 2026 ushers in a fresh start, agricultural economists say the U.S. farm economy has stopped sliding, but it’s far from fully healed.The December Ag Economists’ Monthly Monitor shows month-to-month…

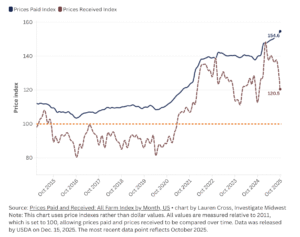

Gap Between Farm Costs and Prices Received Hits 10-Year High

Investigate Midwest’s Lauren Cross reported that “U.S. farmers are facing one of the widest gaps in a decade between what they pay to produce food and what they earn from selling it.”

“New USDA data released on Dec. 15 show that by October 2025, the prices paid index had climbed to 154.6, while the prices received index had fallen to 120.5. The agency measures the indexes against 2011 levels, which are set to 100, making it easier to see how prices have changed over time,” Cross reported. “In practical terms, that means production costs were more than 50% higher than in 2011, while prices farmers received were only about 21% higher. That gap reached 34.1 index points in October, the widest spread in the data going back at least a decade, according to the data.”

“The prices paid index tracks a wide range of expenses, from fertilizer and fuel to feed and labor. Meanwhile, prices for crops and livestock have slipped from their recent highs,” Cross reported. “This hasn’t always been the case. In parts of 2021 and 2022, rising commodity prices helped close the gap. Since then, prices received have dropped faster than costs have come down, reopening the spread. These indexes don’t measure profits directly, but they offer a clear signal of rising financial pressure on farm operations heading into the next season.”

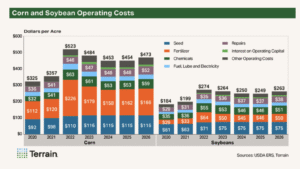

Input Costs Likely to Remain High in 2026

Terrain Ag’s Marc Rosenbohm reported that “given the current outlook for fertilizer and other input prices, Terrain projects slightly higher operating costs for the 2026 corn and soybean crops. A mix of potential tariff impacts as well as global factors could push overall crop production costs higher in 2026 than they were in 2025. Tariffs could impact some production-cost line items such as chemicals and repairs, while global factors have contributed to higher fertilizer costs.”

“Overall, I project operating costs to be 4% higher for corn and 6% higher for soybeans in 2026 versus 2025,” Rosenbohm reported. “These are above the USDA’s estimates in June, by 2.2% for corn and 4.4% for soybeans.”

Farmers National Company’s Terry Longtin reported at the end of November that “crop input costs for 2026 are projected to show a slight increase compared to 2025. The primary drivers are higher fertilizer prices—especially nitrogen—along with modest increases in chemicals, financing costs, equipment, and labor. Seed, fuel and land costs are expected to remain flat with little to no change.”

“Fertilizer prices range from 10-15% higher than in 2025 and will be quite different in different regions of the US. This is driven by world demand, production and tariffs,” Longtin reported. “Chemicals are expected to see a slight increase for 2026. Equipment and labor costs are expected to increase slightly, driven by increased machinery repair expenses and higher living costs impacting labor.”

Grain Futures Down Over Last Few Years

Progressive Farmer’s Joel Karlin reported that “another year of generally good growing conditions was noted in the U.S., resulting in projected record yields for corn and soybeans, and close to those for wheat. This, along with decent weather in other feed-producing regions of the globe, pressed grain futures lower, though beans and their co-products eked out some gains for the year.”

“The spot contract has corn down 3.9% versus the prior year’s 2.8% tumble, the third price decline in a row. The two-year decline for the spot corn contract is 6.6%,” Karlin reported. “Spot soybeans were up 3.3% following the prior year’s 22.9% decline, the largest annual percentage drop for soybeans since 2008. The two-year decline is 20.3%.”

“Spot Chicago wheat was down 4.3%, following a 20.3% decline in 2024. Therefore, the two-year decline is 19.3%,” Karlin reported. “Kansas City wheat was off 8.0% for 2025, its third straight yearly decline. Minneapolis wheat was down 3.7% this past season, its fourth straight annual loss.”