Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

Prices Concern Farmers and Ag Lenders; Sec. Perdue Comments on NAFTA; Spring Weather Causes Havoc

Today’s update looks briefly at the U.S. agricultural economy from a variety of perspectives. A recent news report has shown that some Corn Belt producers may be losing money from farming this year, while a survey of agricultural lenders this month demonstrates that many are concerned about commodity prices, liquidity and farm income. Secretary of Agriculture Sonny Perdue has stated that U.S. farmers won’t be worse off if NAFTA is renegotiated, and adverse weather conditions continue to adversely impact farmers and ranchers in the Nation’s midsection.

Corn Belt Farmers- Breakeven Prices, NAFTA Issues

expects to lose money farming this year — and so will most U.S. farmers.

“Farmers across the Corn Belt have kicked off another growing season, investing billions of dollars in seed and fertilizer despite U.S. Department of Agriculture forecasts that net U.S. farm income will decline this year by nearly 9 percent, to $62.3 billion. That would be the lowest since 2002, adjusted for inflation, and would be the fourth year of declines after income figures hit a record high in 2013.

Ms. Soderlin added that, “Ag bankers have been refinancing old loans, raising interest rates and extending loan maturity periods because of farmers’ reduced capacity to pay back what they owe.”

And with respect to trade and farmer’s financial picture, Saturday’s article noted that, “In the face of low prices, Kelly Brunkhorst, executive director of the Nebraska Corn Growers Association and the Nebraska Corn Board, said the industry is working to expand markets for corn. An upcoming visit to Nebraska from a Mexican trade team underscores the importance of that market, even as President Donald Trump waffles about withdrawing from or renegotiating the North American Free Trade Agreement.”

More specifically with respect to NAFTA and agriculture, Jacob Bunge reported yesterday at The Wall Street Journal Online that, “U.S. farmers and ranchers won’t be worse off after the Trump administration renegotiates the North American Free Trade Agreement, Agriculture Secretary Sonny Perdue says.”

“‘I can assure you that neither this president, nor [Commerce Secretary Wilbur] Ross nor I, are going to negotiate or accept a worse deal than we have it now,’ Mr. Perdue said. ‘Our goal is to make it better for all producers.'”

Mr. Bunge also indicated that, “The farm sector has watched for signs that Mexico and Canada are preparing to reduce their reliance on U.S. farm products in case fresh negotiations significantly change the terms of trade.

“‘We know Mexican authorities have prepared for that,’ said Soren Schroder, chief executive of Bunge Ltd. , one of the largest grain-trading companies. ‘They can act tomorrow if something happened, and the loser for sure would be the U.S. farmer.’

“Ron Moore, an Illinois farmer and president of the American Soybean Association, said farmers were open to ‘modernizing’ Nafta. But if the U.S. withdrew completely, ‘I think it would be difficult to negotiate anything better than we currently have,’ he said.”

Perspective from Agricultural Lenders

FrtPg Business section today's @DMRegister "Lenders see declines in ag profitability" https://t.co/xcCvhzivbl by @DonnelleE #agriculture pic.twitter.com/w14ICzPBkr

— Farm Policy (@FarmPolicy) May 2, 2017

In an article in Tuesday’s Des Moines Register, Donnelle Eller reported that, “Nearly 90 percent of U.S. agricultural lenders have seen an overall decline in farm profitability in the last 12 months, according to a survey by the American Bankers Association and the Federal Agricultural Mortgage Corp., referred to as Farmer Mac.

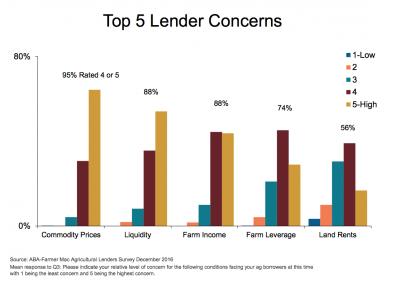

“The survey of about 350 farm lenders shows banks are most concerned about commodity prices, liquidity and ag income.”

The Register article stated that, “Ninety-five percent of lenders indicated commodity prices — particularly grains, beef cattle and dairy — are a top concern.

“Still, ag lenders reported 60 percent of their current agricultural borrowers were profitable in 2016, and they expect 54 percent to remain profitable in 2017.”

The joint survey also pointed out that:

Forty-seven percent of respondents report lower land values in 2016, and 56 percent of lenders expect further declines in the first half of 2017.

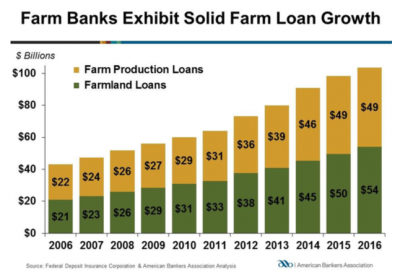

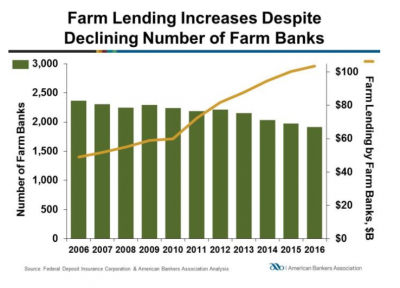

And a news release yesterday from the American Bankers Association indicated that, “Farm banks increased agricultural lending by 5.3 percent in 2016 and held $103.4 billion in farm loans at the end of the year, according to the American Bankers Association’s annual Farm Bank Performance Report.”

The update also stated that, “Asset quality remained healthy at the nation’s 1,912 farm banks as non-performing loans have fallen to a pre-recession level of 0.54 percent of total loans. ABA defines farm banks as banks whose ratio of domestic farm loans to total domestic loans is greater than or equal to the industry average.”

Spring Weather Concerns

Total precipitation, April 23 - 29, via @USDA Weekly Weather and Crop Bulletin pic.twitter.com/4ju1dbHGus

— Farm Policy (@FarmPolicy) May 3, 2017

Stephen Steed reported in Tuesday’s Arkansas Democrat Gazette that, “This year’s growing season is already too much like last year’s and, for farmer Jerry Morgan Jr. and many other farmers, that’s not a good thing.

“Heavy rains over the weekend, coupled with rainwater that will flow from southern Missouri into the Black, Spring, Eleven Point and Strawberry rivers of northeast Arkansas over the coming days, likely will wipe out much of Morgan’s rice crop for the second year in a row, he said Monday.”

Aerial footage shows flooding in Arkansas after torrential rains overflowed rivers and local towns. pic.twitter.com/USISrgUNQw

— Fox News (@FoxNews) May 3, 2017

Gregory Meyer reported on Monday at The Financial Times Online that, “Perhaps more than any other field crop, the market for wheat has been depressed by a worldwide surplus brought on by favourable weather and large harvests. Last month the July-delivered hard red wheat contract fell to the lowest in the contract’s history.

“But the weekend brought 10 to 20 inches of snow in western Kansas, southeastern Colorado and western Oklahoma that toppled plants, said Commodity Weather Group. Farmers posted photos and videos of lush wheat stalks wreathed in white.”

Snow Depth on May 1st--- via @USDA Weekly Weather and Crop Bulletin pic.twitter.com/fmM91oz7SW

— Farm Policy (@FarmPolicy) May 3, 2017

Reuters writer Mark Weinraub reported yesterday that, “U.S. wheat futures were close to unchanged on Wednesday, with the markets waiting for a good assessment of the crop damage caused by a snowstorm in Kansas during the weekend, traders said.

“Corn and soybeans were slightly higher, supported by concerns that heavy rains in the Midwest and southern growing areas will force some farmers to re-plant recently seeded crops.”

Ken Anderson reported on Tuesday at Brownfield that, “It’s estimated as much as 75 percent of the nation’s cattle on feed were impacted by the weekend snow storm in the High Plains.

“Garden City, Kansas cattle feeder Lee Reeve says the conditions on Sunday were ‘as bad as I’ve ever seen.'”

The Brownfield article noted that, “Reeve says the longer-term impact will be weight loss.

“‘Just in talking around, kind of the consensus is we’ve probably lost about 35 pounds per head, on all the cattle that are ready for slaughter—and that will tail off through time as the cattle have more time to recover and it will be a smaller impact.’

“Reeve says rain also fell before and after the storm. Feedlots are very muddy, which will also hamper cattle performance.”