As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Federal Reserve Ag Credit Surveys- 2017 Third Quarter Farm Economy Conditions in the Midwest

On Thursday, the Federal Reserve Banks of Chicago, St. Louis and Kansas City each released updates regarding farm income, farmland values and agricultural credit conditions from the third quarter of this year.

Federal Reserve Bank of Chicago

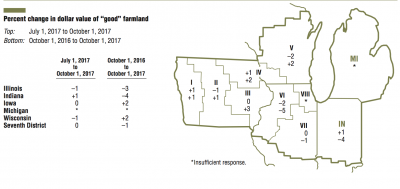

David Oppedahl, a Senior Business Economist at the Chicago Fed, explained on Thursday in The AgLetter that, “In the third quarter of 2017, agricultural land values for the Seventh Federal Reserve District were down 1 percent from a year ago. Moreover, on a year-over-year basis, ‘good’ farmland values were little changed for the fourth quarter in a row.”

Mr. Oppedahl noted that, “The District did not experience a year-over-year decrease or increase in its agricultural land values greater than 1 percent in the past four quarters.

Such relative stability in farmland values had not occurred in the District since 1970.

“Illinois and Indiana farmland values were down on a year-over-year basis (3 percent and 4 percent, respectively), while Iowa and Wisconsin farmland values were both up 2 percent (see map and table below). The District’s agricultural land values were unchanged from the second quarter of 2017.”

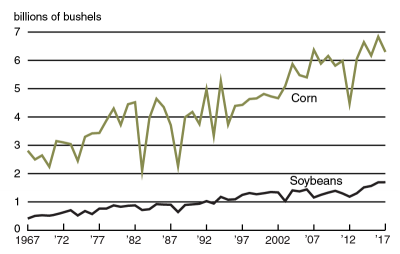

More broadly, the Chicago Fed explained that, “Difficult weather conditions during planting season, a trying drought, and heavy rains during harvest all threatened to batter District crops this crop year. In the end, according to U.S. Department of Agriculture (USDA) forecasts, the five District states’ harvest of corn for grain in 2017 would fall by 7.8 percent from 2016, whereas soybean production would just break the record, set last year (see chart 1).”

Note that Wall Street Journal writers Benjamin Parkin and Jesse Newman reported on Thursday that, “U.S. farmers will harvest more grain than expected this year, exacerbating a glut of grain supplies that has kept prices low.”

With respect to credit conditions in the Seventh Federal Reserve District, the AgLetter update stated that, “District agricultural credit conditions deteriorated in the third quarter of 2017. For the third quarter, the availability of funds for lending by agricultural banks was down relative to a year ago—the first such occurrence in 11 years. However, for the third quarter, the demand for non-real-estate loans was up relative to a year ago. The result was a surge in the average loan-to-deposit ratio for the District to 77.4 percent—its highest level in nine years. Furthermore, repayment rates for non-real-estate farm loans were lower in the third quarter of 2017 relative to the same quarter last year, and loan renewals and extensions were higher.”

AgLetter in Perspective Third Quarter 2017 https://t.co/IFGPaMlOQp via @ChicagoFed

— Farm Policy (@FarmPolicy) November 9, 2017

Federal Reserve Bank of St. Louis

The Agricultural Finance Monitor, released yesterday by the St. Louis Fed, state that, “Consistent with the past several surveys, proportionately more bankers continue to report year-over-year declines in farm income.”

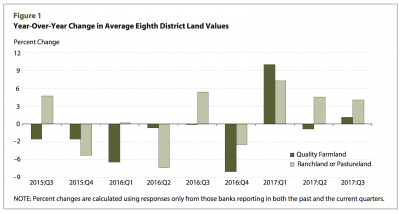

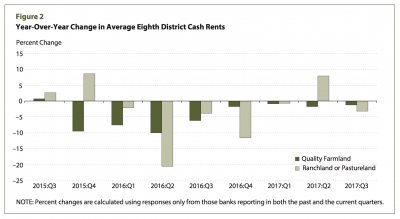

The report indicated that, “Measured from a year earlier, quality farmland values rose 1.1 percent in the third quarter, while ranchland and pastureland values increased slightly more, 4 percent [Figure 1]. By contrast, cash rents fell in the third quarter from a year earlier. Cash rents for quality farmland fell by 1.2 percent, and rents for ranchland and pastureland fell by 3.2 percent [Figure 2].”

Federal Reserve Bank of Kansas City

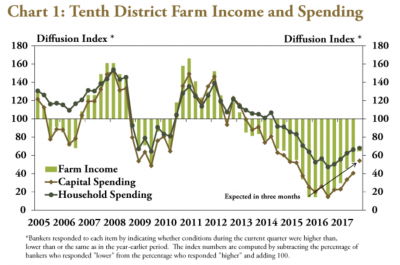

Nathan Kauffman and Matt Clark writing in Thursday’s Ag Credit Survey from the Kansas City Fed, noted that, “Farm income in the Federal Reserve’s Tenth District decreased in the third quarter, but at a slower rate. For the 13th consecutive quarter, a majority of bankers reported that farm income was lower than a year ago, but that the pace of the decline was less significant than recent quarters (Chart 1).”

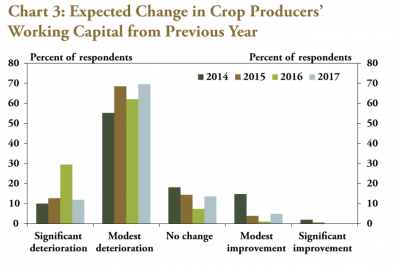

The report also pointed out that, “Although the pace of decline in farm income has moderated, the prolonged downturn in the District’s farm economy has continued to cut into the working capital of farm borrowers. Nearly 82 percent of bankers reported a year-over-year decline in crop producers’ working capital (Chart 3).”

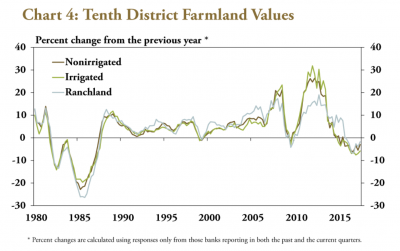

Kauffman and Clark added that, “Prolonged declines in farm income also continued to push farmland values lower, but at a modest pace. For example, the value of nonirrigated and irrigated cropland declined 3 percent and 6 percent, respectively, from the previous year (Chart 4).

Although the magnitudes of recent declines have yet to approach the magnitudes of the 1980s, the duration of the recent downturn in cropland values has approached that of the 1980s.

“The value of ranchland also continued to soften in the third quarter at a modest pace.”

In conclusion, Thursday’s Kansas City Fed report noted that, “A prolonged downturn in the Tenth District farm economy that began several years ago persisted in the third quarter of the year. Farm income, repayment rates and farmland values declined from the previous year and were expected to decline further in the coming months. However, a larger share of bankers reported some improvement in the region’s agricultural economy. Going forward, agricultural economic conditions are still expected to remain subdued and financial stress in the farm sector may intensify further, but the sharp transition of recent years appears to be lessening.”