Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University's monthly…

USDA Trade Data Update: Focus on Soybeans and Grains

Today’s update provides a brief overview of updated USDA agricultural export data, with particular focus on soybeans and grains.

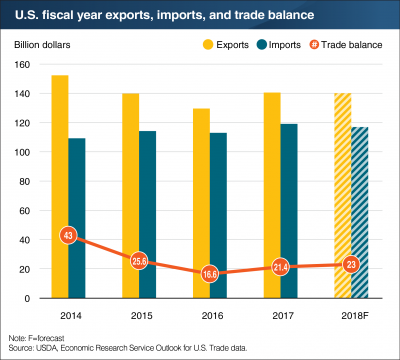

Earlier this month, USDA’s Economic Research Service updated its agricultural export data set, which included complete numbers for the first two months of Fiscal Year (FY) 2018. Gary Crawford, of USDA radio, explained in a segment last week that, October and November agricultural exports totaled $26.5 billion, about seven percent lower than the first two months of FY 2017.

U.S. #Agricultural Trade Data Update, https://t.co/1g1DRbcORP @USDA_ERS pic.twitter.com/NiiDFEyFAM

— Farm Policy (@FarmPolicy) January 5, 2018

The USDA is currently projecting FY 2018 agricultural exports at $140.0 billion, about the same as FY 2017, $140.5 billion.

However, from a calendar year perspective, from January 2017 through November 2017, the total value of agricultural exports were up by three percent compared to the same time in 2016, wheat exports were up by 15 percent, but corn exports were down eight percent and soybean exports were down two percent.

U.S. #agricultural exports, year-to-date and current months, https://t.co/D0QPgPoP8f, @USDA_ERS pic.twitter.com/eXx3SrIsrP

— Farm Policy (@FarmPolicy) January 8, 2018

In Friday’s World Agricultural Supply and Demand Estimates (WASDE) monthly update, the World Outlook Board (WOB) indicated that, “Soybean exports are reduced 65 million bushels to 2,160 million, reflecting lagging sales commitments through December and increased competition with higher soybean production and export forecasts for Brazil.”

Top 10 U.S. export markets for #soybeans by volume https://t.co/dcJNz7tbit, @USDA_ERS pic.twitter.com/OGdl6z6WAF

— Farm Policy (@FarmPolicy) January 8, 2018

The WOB also stated on Friday that, “All wheat exports are unchanged at 975 million bushels.” The January WASDE update did not include any changes to corn exports.

Top 10 U.S. export markets for #corn by volume https://t.co/D0QPgPoP8f , @USDA_ERS pic.twitter.com/y4rkaSRR7s

— Farm Policy (@FarmPolicy) January 8, 2018

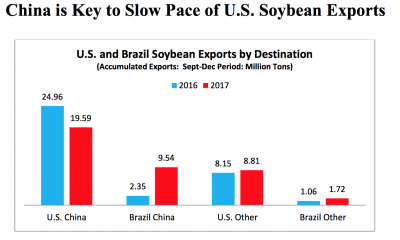

With respect to additional information on soybeans, USDA’s Foreign Agricultural Service (FAS) indicated on Friday (“Oilseeds: World Markets and Trade“) that, “The pace of U.S. soybean exports continues to lag behind last year. Accumulated soybean exports through late December, as reported in the January 5 U.S. Export Sales report, show a 14 percent decline in trade since September 1. This is nearly 5 million tons below the mark reached in 2016 when 33 million tons of exports were reported.

This slower pace squarely resides with China where U.S. trade is more than 20 percent below last year. In contrast, shipments to other markets, while roughly a third of the volume to China, are up 8 percent.

Friday’s FAS report explained that, “The slowdown in U.S. exports is primarily a result of last season’s record crop in Brazil, which boosted total supply by nearly 18 million tons. With record supplies available for export on September 1, Brazil exported over 11 million tons in the final 4 months of 2017, more than a three-fold increase over the same period in 2016. Much of this increase was business to China, which more than offsets the trade from the United States.”

FAS added that, “With the start of the 2018 Brazilian harvest just weeks away, the prospects of a near-term brisk uptick in the pace of U.S. sales to China are limited. However, the current forecast for a slightly smaller Brazilan harvest in 2018 should alleviate some of the competitive pressure U.S. exporters faced in 2017.”

Also on the issue of Chinese soybean imports, Reuters news reported late last week that, “Chinese imports of soybeans jumped to the second-highest volume on record in December, according to customs data, boosted by strong demand in the run-up to next month’s Lunar New Year holiday and healthy crushing margins.

“December imports by the world’s top soy buyer came in at 9.55 million tonnes, up 10 percent from the month before and up 6 percent from December 2016, according data released on Friday by General Administration of Customs. SB-CN-IMP.”

The Reuters article added that,

China’s imports of the oilseed for all of 2017 hit an annual record of 95.54 million tonnes, up 13.9 percent from last year’s 83.91 million tonnes, the customs data showed.

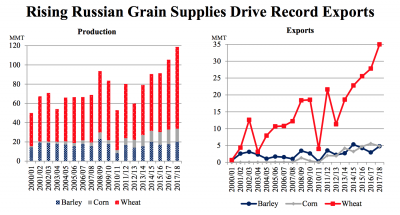

In a closer look at trade issues relating to grains, a separate FAS update on Friday (“Grain: World Markets and Trade“) stated that, “With bumper supplies, Russian grain exports overall are forecast to reach record levels in 2017/18. The expansion is primarily driven by record wheat exports, set to exceed both the United States and the European Union. Corn and barley exports are forecast to be the second-highest on record.”

The FAS report pointed out that, “Recent investments have been made in Russian port capacity, and the country has the flexibility to use smaller vessels to accommodate infrastructure constraints in nearby countries. Ports on the Black and Caspian Seas give it easy access to the Middle East and North Africa where feed demand has grown in burgeoning poultry industries. Russia’s wheat sales are booming to Egypt, the top importer… plentiful supplies have enabled it to expand exports to reach markets farther afield in Africa, Asia, and even to Mexico, demonstrating Russia’s growing influence in the global grain market.”

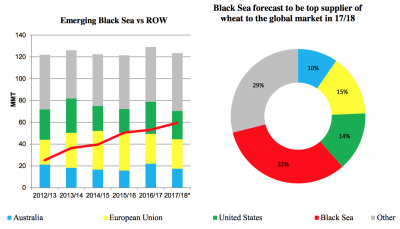

And, Friday’s update stated that, “The traditional major wheat exporters are Australia, Canada, the European Union (EU), and the United States, but in recent years the Black Sea region–Kazakhstan, Russia, and Ukraine – has emerged as a strong player in the global wheat market. Wheat from Australia, the EU, and the United States is marketed on its high quality, while the Black Sea has been successful at competing on lower price and location. This dynamic has increased competition rapidly and has affected all major suppliers in the global market. The Black Sea region will continue to challenge its competitors, with this year’s record crop in Russia dampening prospects for the traditional exporters.”

Meanwhile, Wall Street Journal writers Benjamin Parkin and Jesse Newman reported on Friday that, “U.S. wheat farmers planted the least acres of winter wheat in over a century, as enormous stockpiles of the grain remain in storage.”

Winter #Wheat Acres United States, @usda_nass pic.twitter.com/dK7ymM4XG7

— Farm Policy (@FarmPolicy) January 12, 2018

The Journal writers noted that, “Bumper harvests in Russia, meanwhile, have allowed exporters there to supply major importers in North Africa and the Middle East at a better price than U.S. farmers can offer. The USDA on Friday raised its Russian export forecast to a record.”

Friday’s Journal article also stated that, “It’s not just Russia squeezing American farmers. U.S. soybean exporters are expected to lose ground to Brazil, which produced a bumper harvest last season and is on track for another. The USDA raised its forecast for Brazilian soybean shipments and trimmed its U.S. export forecast by 65 million bushels to 2.16 billion.”