A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

The Outlook for U.S. Agriculture From USDA’s Chief Economist

Speaking yesterday at USDA’s Agricultural Outlook Forum in Arlington, Virginia, USDA Chief Economist Robert C. Johansson provided a broad outlook for U.S. agriculture. Today’s update provides an overview of key aspects of Dr. Johansson’s presentation.

Farm Economics

In his speech yesterday (transcript/ slides), Dr. Johansson noted that, “Farm income has fallen dramatically since 2013, falling almost 30 percent in real terms. That is the largest 4-year drop in farm income in 40 years, when real farm income fell more than 45 percent between 1973 and 1977. We have seen record production in major commodities over the past few years, and as a result prices are down significantly. Baseline projections show flat farm income throughout the 10-year forecast period.”

This is a headline maker from USDA Ag Outlook Forum today. But this lacks context. Look at the real income gains in the previous decade pic.twitter.com/5JpyGRtm6Z

— Scott Irwin (@ScottIrwinUI) February 23, 2017

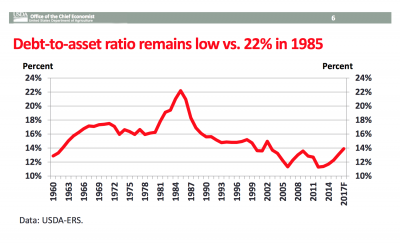

With respect to farmland values, Dr. Johansson explained that, “While the farm income forecast is down by almost 50 percent in nominal terms since the peak in 2013, farmland values remain relatively strong. While they have come down off their highs from two years ago, those values continue to underlie a relatively strong debt- to-asset ratio, which is now expected to be 13.9 percent in 2017, up from the low point in 2012 of 11.3 percent, but well below the peak of more than 22.2 percent in 1985.

To reach that point today would still take a dramatic increase in debt payments or a loss in farmland value of more than 50 percent.

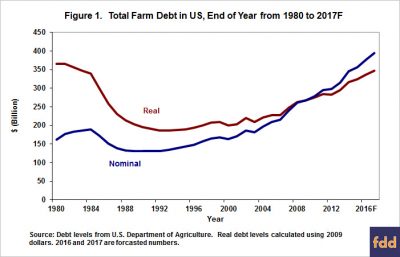

And Dr. Johansson explained that, “While loan volume may be down, current levels of real debt are approaching the record levels from the early 1980s or more than $350 billion, with real estate debt in 2017 projected to exceed a record $210 billion.”

More specifically on debt issues, Brandy Krapf, Dwight Raab and Bradley Zwilling recently indicated at the farmdoc daily blog that, “The importance a farmer puts on monitoring their debt level is becoming increasingly important in this period of lower farm returns. With lower crop prices and higher inputs, we will continue to see the increase in debt per acre. With interest rates moving higher, this mean a rising interest expense as well.”

Dr. Johansson also noted at yesterday’s Forum that, “Another place we might expect to see the tightening financial situation reflected is in land values and rental rates for farmland as farming profitability erodes.”

Acreage Allocation

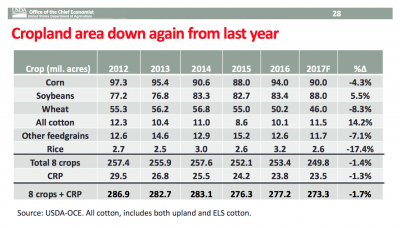

DTN Ag Policy Editor Chris Clayton reported yesterday that, “USDA projects soybean acres will grow to 88 million acres planted this spring, up 4.6 million acres from last year, while corn planting will be 90 million acres, down 4 million from last year.”

The DTN article noted that, “Corn acreage will decline by 4 million acres even though corn prices will increase slightly to an average of $3.50 per bushel, up about 3% from the 2016-17 marketing year.

“Soybeans will see an average price of $9.60 per bushel for the 2017-18 marketing year, up roughly 1.1% from the current marketing year. Still, soybean acres will gain on corn because the price ratio for soybeans is projected at 2.6 times that of corn, based on the February futures prices. If the numbers hold through the rest of the month, they will be the most favorable price spread between soybeans and corn since 1997, [USDA Chief Economist Johansson] said.”

On Tuesday, Bloomberg writer Jeff Wilson reported that, “While corn is still king — it’s the largest U.S. crop by value and volume — farmers from North Dakota to Texas are preparing to use more of their land on soybeans instead. That’s because cash prices have jumped 9.2 percent since the 2016 harvest, creating the widest premium over corn in 29 years, and the oilseed is cheaper to grow.”

The Bloomberg article added that, “Soybean profits beat corn by an average of $47 an acre this year, based on budgets from the University of Illinois and Purdue University. It will cost farmers between $292 to $315 an acre to grow soybeans, compared with $521 to $531 for corn, according to Gary Schnitkey at the University of Illinois.”

Trade

After detailing other aspects of the U.S. agricultural economy yesterday, Dr. Johannson turned to trade issues and pointed out that, “Overall, U.S. agricultural exports are forecast at $136 billion for FY 2017, with a rebound in Chinese demand and strong export sales in the beginning of this year.

In FY2017, U.S. exports to China are projected at $22.3 billion, up more than $3 billion from 2016 and making it the top export market for U.S. agriculture.

“Exports to Canada and Mexico are also projected to increase. Together those three countries purchase 45 percent of total U.S. agricultural exports.”

Global soybean trade projected to increase by 25% over next 10 yrs, China’s soybean imports forecast to account for 85% of that increase- pic.twitter.com/Le2SHcHEFU

— Farm Policy (@FarmPolicy) February 23, 2017

In its more detailed report yesterday, “Outlook for U.S. Agricultural Trade,” USDA indicated that, “While shipments of sorghum and DDGS have declined, China continues to have a strong appetite for soybeans, cotton, pork and pork variety meats, and dairy (especially whey products). Exports to Japan are forecast up $200 million to $11.2 billion on the strength of beef and pork demand.”

The Trade Outlook added that, “The North American forecast is unchanged at $39.6 billion. Canada and Mexico remain the second and third largest U.S. agricultural markets, with exports forecast at $21.3 billion and $18.3 billion, respectively.”

Meanwhile, in additional reporting on China agricultural trade issues, Bloomberg writer Alan Bjerga reported yesterday that, “President Donald Trump’s pick to be the U.S. ambassador to China emphasized friendship between the countries as he prepared to meet with China’s ambassador during a trip this week to Washington.

“Cordial ties are ‘going to be an important thing’ between the two nations, Iowa Governor and Trump Nominee Terry Branstad said Thursday in an interview after speaking at a U.S. Department of Agriculture conference in Arlington, Virginia.”

The Bloomberg article added that, “Trump rode to his election victory partly on strong support from voters in rural areas clamoring for an economic turnaround. Farm incomes, which reached a record high in 2013, are expected to fall for a fourth successive year, while debt levels have climbed. Trump and Vice President Mike Pence ‘better understand the needs of rural America,’ and the ‘importance of a level playing field on trade‘ than the previous administration, Branstad said.”

And Jesse Newman and Jacob Bunge reported yesterday at The Wall Street Journal Online that, “Mr. Brandstad said he was confident the Trump administration would pursue export growth and work to eliminate barriers that countries like China have imposed against U.S. agricultural products.

“In particular, Mr. Branstad said he hoped to see the removal of Chinese restrictions on U.S. beef as well as tariffs on imports of U.S. dried distillers’ grains, an ethanol co-product used in animal feed. Earlier this month, an ethanol industry group said U.S. exports of the feed ingredient fell 10% last year amid a sharp drop-off in purchases by China.”