A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Trade Policy Uncertainty: Lingering Concern for Farmers

Recent news items suggest that anxiety in the agricultural community over Trump administration trade policy is not going away. After promising to renegotiate the North American Free Trade Agreement (NAFTA), floating the the idea of a 20% border tax adjustment or a tariff on Mexican imports, and pulling out of the Trans-PacifcPartnership (TPP), farmers are on edge about disruptions in export markets. In the past couple of days, from California specialty crops, to the U.S. livestock sector, to row crop growers in Nebraska and Illinois, agricultural reporters have scrutinized the potential impact of obstacles in agricultural trade flows. Other articles have shown that the future outcomes of trade policy remain uncertain.

Trade Impacts: California Specialty Crops

Geoffrey Mohan reported in yesterday’s Los Angeles Times that:

It took Donald Trump 71 days to settle on an Agriculture secretary after winning the presidency. It took him 72 hours after that to unsettle much of the agriculture industry.

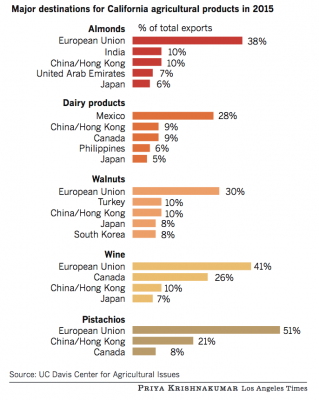

After reminding readers of some of the early trade policy actions by the Trump administration, the LA Times article explained that, “But no state has more at stake than California. It leads the country in agricultural revenue, and its farmers and ranchers are twice as dependent on foreign trade as the country as a whole. Last year, growers in the state earned $21 billion from trade — about 44% of their total revenue, according to the California Department of Food and Agriculture.

“Without California, the U.S. would not have exported a single tree nut, table grape, raisin, olive oil drum, garlic clove, artichoke, fig, date, kiwi or dried plum.

“The Golden State last year also exported more than 90% of the wine, processing tomatoes, avocados, carrots, broccoli and celery in the U.S. California’s berries, peaches, nectarines, apricots, melons, oranges, lemons, tangerines, mandarins, spinach, lettuce, seasonal vegetables and rice constituted more than half the U.S. exports of those commodities.”

Mr. Mohan noted that, “The last time the U.S.-Mexico relationship got rocky, it cost U.S. growers close to $1 billion in lost sales from 2009 to 2011, according to USDA economist Steven Zahniser. That’s when Mexico launched retaliatory tariffs against dozens of U.S. agricultural products, over U.S. reluctance to comply with NAFTA provisions to allow Mexican trucks into the States. [Click here for more details].

“Resolving a tiff in one economic sector by using food as a pawn is not an unusual tactic.

Food frequently bears a steeper penalty in trade wars because it carries a lot of political clout.

“It doesn’t last as long as politicians can argue, for one. And few people riot over the price of a smartphone, laptop or car, but they’ve been known to overthrow governments over a spike in the price of food or shortages of staples.”

Trade Impacts: U.S. Beef Sector

Beyond California and specialty crops, Bloomberg writers Lydia Mulvany and Megan Durisin reported on Thursday that, “A shakeup of Nafta now would come as U.S. beef output is forecast to rise to a six-year high. More supplies mean the industry must continue to export or face a chronic oversupply.”

The article pointed out that, “U.S. beef exports rose 78 percent by volume since 1993, the year before Nafta was enacted, according to U.S. Department of Agriculture data. As of 2015, Mexico was the largest foreign buyer of American beef and Canada was No. 4, according to figures compiled by the U.S. Meat Export Federation.”

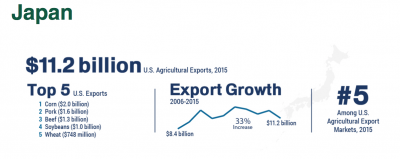

Mulvany and Durisin added that, “The [National Cattlemen’s Beef Association] NCBA, which represents more than 175,000 cattle producers and feeders, also bemoaned the U.S. withdrawal from the Trans-Pacific Partnership, the proposed 12-nation trade pact that includes Japan, Singapore, Australia, Canada and Chile. The U.S. beef industry is losing $400,000 a day due to lower tariffs for Australian meat that goes to Japan, according to Colin Woodall, the NCBA’s vice president of government affairs.”

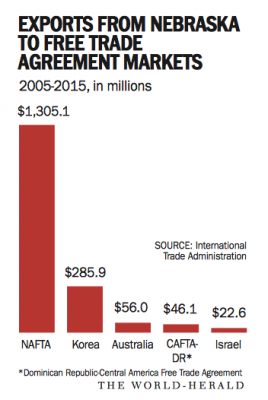

Trade Impacts: Nebraska

And Barbara Soderlin reported in Saturday’s Omaha World-Herald that, “Like a lot of Midlands farmers, Randy Uhrmacher gets a little nervous when he hears in the news about President Donald Trump looking to shake up free trade agreements.

“Trump’s push to renegotiate the North American Free Trade Agreement — even withdraw from the 23-year-old U.S. trade deal with Mexico and Canada — makes Uhrmacher wonder: What would that do to the market for the corn and soybeans he raises near Hastings, especially with prices already at their lowest in about seven years?

“‘If we lost that market, that would be devastating for the farmers in the United States,’ Uhrmacher said.”

The World-Herald article indicated that, “Agriculture exports account for about a third of U.S. farm income, [Steve Nelson of Nebraska Farm Bureau] said.”

Saturday’s article also noted that:

But the president’s continued esteem in the eyes of some rural voters could hinge on how he handles trade.

Trade Impacts: Illinois

Meanwhile, Ben Zigterman, writing in Sunday’s News Gazette (Champaign, Il.) stated that, “Area farmers primarily grow corn and soybeans, and according to University of Illinois agriculture and consumer economics professor Katherine Baylis, almost 50 percent of U.S. soybeans are exported and less than 20 percent of U.S. corn is exported.”

The News Gazette article also quoted Dr. Baylis as saying, “if we get into a trade fight with Mexico, Mexico is probably going to be doing more trading with the European Union.”

Mr. Zigterman pointed out that, “‘Agriculture is one area that’s truly benefited from NAFTA,’ Illinois Farm Bureau senior director of commodities Tamara Nelsen said. ‘NAFTA was huge for our state.'”

More broadly, Gregory Meyer reported today at The Financial Times Online that, “Corn is the biggest of the US’s $17.7bn in agricultural exports to Mexico, a value that has risen fivefold since the countries signed the North American Free Trade Agreement. Mexico’s exports to the US have grown even faster to $21bn, led by fruits and vegetables such as lemons and avocados.”

The FT article noted that, “‘The attitude has changed in the last three or four weeks,’ says Rajiv Singh, chief executive of Rabobank’s North America wholesale banking business. ‘Right after the election, people were starting to talk about whether there would be an impact on trade with Mexico, but they were not worried about it.'”

Mr. Meyer explained that, “But US farm groups fear being targeted by Mexico in retaliation. ‘The soft spot for Trump would be hitting back at America’s heartland,’ says Richard Feltes of commodities broker RJ O’Brien in Chicago. Most states in the US corn belt voted for the president.”

Today’s FT article added that:

For farmers north of the border, the prospect of worsening trade relations with top export markets could not come at a worse time. Their silos are bulging with surpluses, land values are softening and grain prices are weak.

Looking Ahead, An Uncertain Future

William Mauldin reported late last week at The Wall Street Journal Online that, “President Donald Trump met with key lawmakers Thursday in an effort to win crucial support from a divided Congress on plans to overhaul North America’s economic ties and reshape U.S. trade policy.

“Mr. Trump said he wanted to move quickly on retooling the 23-year-old North American Free Trade Agreement, or Nafta. The meeting came a day after the Mexican government said it was beginning a 90-day period to consult with the country’s private sector and prepare a negotiating position on Nafta.

“The Trump administration hasn’t given its own necessary 90-day notice to Congress that the U.S. intends to seek a revamped accord, and Canadian Foreign Minister Chrystia Freeland said a formal renegotiation of Nafta hasn’t begun.”

Mr. Mauldin added that, “Even if Mr. Trump clinches deals with Mexico and Canada, lawmakers could be his hardest sell. Any final agreement would need majority approval by both the Senate and House, where lawmakers are likely to assert themselves on economic priorities and procedural safeguards.

“Lawmakers have long been divided on trade issues, but the fault lines have shifted in recent years as rank-and-file Republicans have grown more skeptical of free trade.”

John Paul Rathbone and Jude Webber reported on Sunday at The Financial Times Online that, “The White House is expected soon to give Congress a required 90-day notice that it will begin negotiations with Canada and Mexico, which wants to see the start of Nafta talks in May. ‘You cannot properly react until you see the policies [that will be proposed],’ [Ildefonso Guajardo, Mexico’s economy minister] said.

“Meanwhile, Mexico is drafting bilateral deals with Brazil, Argentina, Australia and New Zealand, and the government says Singapore and Malaysia are priorities. Mexico already has free-trade agreements with 45 countries, the most in the world.”

And with respect to Japan, a TPP participant and key destination for agricultural exports, Financial Times writers Shawn Donnan and Robin Harding reported on Thursday that, “The Trump administration is putting a bilateral trade deal with Japan high on its economic agenda with a visit to the US next week by Shinzo Abe, the Japanese prime minister, set to include discussions about how best to pursue such a pact.”

The FT article explained that, “The new administration has told business leaders that striking a deal with Japan is high on its list of priorities and has made clear it is aware of the domestic political capital that Mr Abe invested in the TPP;” but, “But any deal is likely to have to face significant hurdles.”

“Wendy Cutler, who oversaw the US negotiations with Japan during the TPP, said the idea of bilateral deal ‘really puts Japan in a bind,’ particularly as it would mean revisiting sensitive issues such as currency, agriculture and cars that were the subject of painful negotiations in the TPP,” the FT article said.

Donnan and Harding pointed out that, “During a call last weekend the two leaders agreed to pursue deeper trade ties. But Mr Abe, who is due to visit Washington on February 10, has so far offered only lukewarm support for the idea of a bilateral deal, insisting that he wanted to continue making the case for the TPP.”

Until specific trade policy parameters are defined, which may take some measure of time, it appears likely that apprehension over agricultural trade issues may continue.