A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Low Farm Prices Impacting Ag Economy– Will Executive Branch Trade Policy Help?

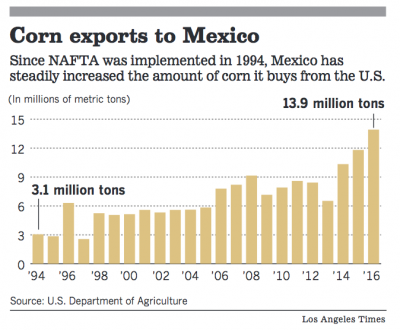

A recent article from the Federal Reserve Bank of Minneapolis discussed the downward economic trajectory that has impacted the U.S. farm economy in recent years. Secretary of Agriculture Sonny Perdue, in remarks this week to USDA employees, noted that trade is an area that could help provide relief for surplus stocks. News reports yesterday indicated that President Trump could sign an executive action withdrawing the United States from the North American Free Trade Agreement; since NAFTA’s implementation, U.S. agricultural trade has grown significantly. However, subsequent news developments explained that Trump had decided not to pull out of NAFTA. Many in the agricultural sector are already anxious about U.S. trade policy, yesterday’s executive branch actions on trade may not alleviate ongoing concerns.

Perspective on the U.S. Ag Economy- Federal Reserve Bank of Minneapolis

In an article this month from the Federal Reserve Bank of Minneapolis (“Trouble on the farm” (fedgazette)), Phil Davies indicated that, “For agricultural producers across the Ninth District, this has been the winter of their discontent. After reaping handsome profits earlier in the decade, producers are reeling from lower crop and livestock prices, the result of several years of high commodity production worldwide and a strong U.S. dollar that has limited farm exports.

“Many producers in the district are operating at a loss because revenues are not covering their costs.

‘I’m not sure I want to call it depression, but we’re getting into probably what is the third year of a downswing, and certainly there’s concern and anxiety,’ said Keith Olander, dean of agricultural studies at Central Lakes College, a community and technical college in north-central Minnesota.

In his article, Mr. Davies explained that, “Farmers are adapting to market conditions as best they can, trimming spending and exploring ways to boost income, including seeking out higher-paying customers, growing alternative crops and working off-farm jobs.

“The pain in farm country extends to agricultural suppliers and service firms such as farm implement dealers and manufacturers, which have retrenched and laid off workers.

“The downturn in the farm economy has raised the specter of the 1980 farm crisis, when low commodity prices triggered widespread foreclosures of debt-laden farms. But at this point, a reprise of the 1980s appears unlikely because market conditions are different and district farms are on average larger and better capitalized today.”

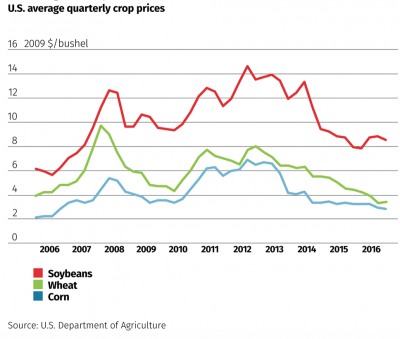

The Federal Reserve publication noted that, “But since 2012, crop prices have been on a downward slope because for most commodities, production has caught up with and surpassed demand.

“Last fall, U.S. farmers hauled in a bumper corn and soybean harvest, the fourth record or record-tying harvest in a row, according to the U.S. Department of Agriculture (USDA). Responding to higher prices, producers have put more acres into production, and favorable weather has boosted per-acre yields. Most of the world’s agricultural regions have also seen bountiful harvests in recent years, contributing to ample worldwide grain reserves.”

In the case of grains, stocks-to-use ratios are expected to reach multi-year highs- https://t.co/1eL2idjh53 @WorldBank pic.twitter.com/MDs73OTrn6

— Farm Policy (@FarmPolicy) April 26, 2017

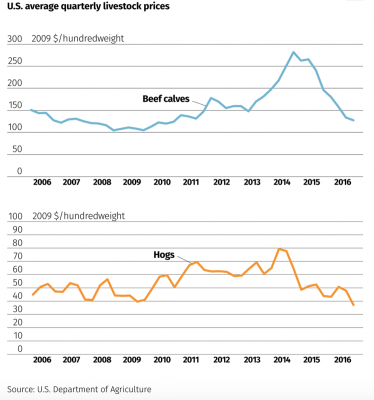

Mr. Davies also noted that, “Lower prices for soybeans and corn, chief ingredients in animal feed, have benefited livestock producers. But since 2014, when beef calf and hog prices peaked at the highest level in at least a decade, a meat glut has driven down livestock prices. Hog prices fell by more than half in real terms from the summer of 2014 to the end of 2016. Milk prices have also dropped sharply over the past two years, although prices recovered slightly late last year and are projected to rise somewhat in 2017.”

“The impact of these changes has rippled throughout the district’s ag sector, upending the balance sheets of producers and their suppliers and, in some instances, endangering livelihoods,” the fedgazette item said.

Watch "Trouble on the farm": #NinthDistrict ag producers reeling from low crop & livestock prices. https://t.co/vedXDsSr8k

— Minneapolis Fed (@MinneapolisFed) April 25, 2017

A related item this month by Phil Davies and Joseph Smith (“A call to action for community banks” (fedgazette)) stated that, “In rural areas of the [Minneapolis Federal Reserve] district, agricultural loans account for anywhere from 20 percent to 60 percent of the loan portfolio at community banks; commercial and consumer loans make up the remainder.”

Davies and Smith added that, “Even as farm revenues and profits faltered in 2014, production debt kept rising—possibly due to producers failing to fully pay off their annual operating loans. But since then, farm lending has slowed markedly; in the last quarter of 2016, production debt declined at district banks relative to the same period the previous year. Nationwide, farm lending by community banks has followed a similar downward slope.”

The fedgazette article noted that:

Many community banks have also declined to lend to new ag customers with anything less than a rock-solid balance sheet. ‘We look for new-customer financials to be very strong as a qualification to begin a banking relationship,’ said [Lynn Schneider] of American Bank & Trust.

Meanwhile, Associated Press writer Roxana Hegeman reported this week that, “With commodity prices still low — and crops still piled up on the ground outside bulging grain elevators across Kansas — [ Kansas corn grower Tom Giessel] worries that a more normal-sized harvest this season won’t bring in enough money to cover his costs.”

The AP article indicated that, “But the latest farm loan delinquency numbers from the U.S. Agriculture Department’s Farm Service Agency, which administers farm commodity loan programs, show that thanks to those past record yields Kansas farmers have fared better than many people had feared.

“The agency’s direct loan delinquencies in Kansas as of March 31 fell slightly to 6 percent, compared to 6.5 percent at the same time a year ago.”

“But [Robert White, the agency’s farm loan chief in Kansas] said the lower delinquency rate is not an indication that farmers have received significant relief from the financial challenges,” the article said.

Trade Developments

Secretary of Agriculture Sonny Perdue addressed USDA staff on Tuesday, after he was sworn into office.

During his remarks, Sec. Perdue noted that, “One of the challenges that I heard as I visited with over 75 Senators was- we need to have a good trade policy, because our producers out there have been so productive, we have got a lot of stuff we need to sell. And, we are going to sell it world-wide: Trade is going to be at the top of our agenda, as well as other things, but we have got to be good traders. We are in a Nation that has been blessed with abundance.” (40 second audio clip available below).

AUDIO: @SecretarySonny on trade, remarks this morning to @usda staff, https://t.co/AwuEbvKQE4 (MP3- 40 seconds) #agriculture #trade pic.twitter.com/xXeY4LYF91

— Farm Policy (@FarmPolicy) April 25, 2017

And note that Wall Street Journal writer Jacob Bunge reported this week that, “The agricultural sector, which heavily relies on exports, has also watched warily as President Trump’s administration has moved ahead with an overhaul of U.S. trade policy, including withdrawing from the Trans-Pacific Partnership, which farm groups generally had backed.”

Joined @POTUS for White House Farmers Roundtable to talk #agriculture trade policy, tax reform, regulation, labor issues & infrastructure. pic.twitter.com/1YEgnIquZ5

— Sec. Sonny Perdue (@SecretarySonny) April 25, 2017

Although President Trump held a “Farmers Roundtable” and signed an Executive Order establishing an Interagency Task Force on Agriculture and Rural Prosperity, New York Times writer Mark Landler reported yesterday that, “President Trump is likely to sign an executive action formally withdrawing the United States from the North American Free Trade Agreement, according to a senior administration official, a move that would set the stage for renegotiating the deal with Canada and Mexico and fulfill one of Mr. Trump’s major campaign promises.”

The Times article added that, “It was not clear what the language of the order would be, or what steps would come next. But such a move could start a required six-month notification period for withdrawal, during which time talks on renegotiation could be pursued.”

Recall that a FarmPolicyNews update from earlier this month discussed the importance of NAFTA to U.S. agricultural producers, and a statement yesterday from National Corn Growers President Wesley Spurlock noted in part that, “Mr. President, America’s corn farmers helped elect you…Withdrawing from NAFTA would be disastrous for American agriculture. We cannot disrupt trade with two of our top trade partners and allies. This decision will cost America’s farmers and ranchers markets that we will never recover. NAFTA has been a huge win for American agriculture.”

Rep. Adrian Smith (R., Neb.) noted yesterday that, “I strongly oppose withdrawing from NAFTA. Canada and Mexico are two of our largest trading partners, both representing billion-dollar export markets for Nebraska’s farmers and ranchers.”

Later yesterday, Mark Sandler and Binyamin Appelbaum reported at The New York Times Online that, “President Trump told the leaders of Mexico and Canada on Wednesday that he would not immediately move to terminate the North American Free Trade Agreement, only hours after an administration official said he was likely to sign an order that would begin the process of pulling the United States out of the deal.”

The Times article explained that, “The announcement appeared to be an example of Mr. Trump’s deal-making in real time. It followed a day in which officials signaled that he was laying the groundwork to pull out of Nafta — a move intended to increase pressure on Congress to authorize new negotiations, and on Canada and Mexico to accede to American demands.”

“It was not clear whether the president would still sign an executive action to authorize renegotiation of Nafta, which he once called the worst trade deal ever signed by the United States. Washington must give Canada and Mexico six months’ notice before exiting the trade agreement, which came into force in 1994. Any action to that effect would start the clock,” the Times article said.

Shawn Donnan, Demetri Sevastopulo, Jonathan Wheatley and Jude Webber reported yesterday at The Financial Times Online that, “Many economists and companies see Mr Trump’s hard line on Nafta as playing with economic fire. China, with which the US had a trade deficit worth more than $300bn, was the US’s top trading partner last year. But Canada and Mexico were close behind and together accounted for more than $1tn in products traded with the US, or almost twice as much as China.

“Mr Trump’s manoeuvres appeared to have been intended to raise the heat on Canada and Mexico to do a deal, analysts said.”

The FT article added that, “Others saw the talk of a withdrawal from Nafta as aimed at raising pressure on Congress to confirm [Robert Lighthizer for US trade representative], who needs to be in place for the administration to formally notify the legislature that it is embarking on new negotiations.”

As planting season and production prospects continue to unfold this year, many in the agricultural sector are already anxious about U.S. trade policy, yesterday’s executive branch actions may not alleviate ongoing concerns.