The frustration in the room at Commodity Classic has been palpable following a year in 2025 where strong production was again unable to overcome swelling costs and expenses. Farmers here…

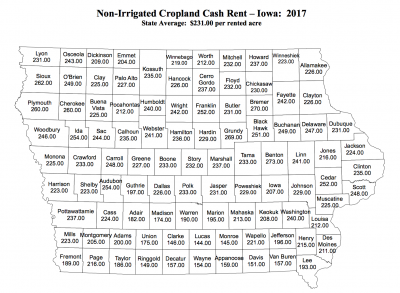

Farmland Values From 2017 Iowa Land Survey; NASS Cash Rent County Estimates

Iowa Farmland Values

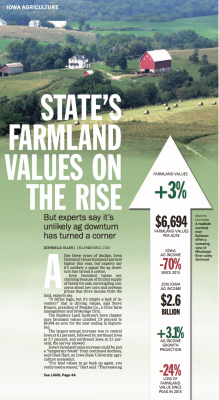

Donnelle Eller reported on the front page of Friday’s Des Moines Register that, “After three years of decline, Iowa farmland values bumped nearly 3 percent higher this year, but experts say it’s unlikely a signal the ag downturn has turned a corner.”

“Iowa farmland values are climbing because of limited supply of farms for sale, outweighing concerns about low corn and soybean prices that drive income from the land, experts say.

‘It defies logic, but it’s simply a lack of inventory’ that is driving values, said Steve Bruere, president of Peoples Co., a Clive farm management and brokerage firm.

Ms. Eller noted that, “The Realtors Land Institute’s Iowa chapter says [report available here] farmland values climbed 2.9 percent to $6,694 an acre for the year ending in September.

“The largest annual increase was in central Iowa at 6.1 percent, followed by northeast Iowa at 5.7 percent, and northwest Iowa at 5.1 percent, the survey showed.”

The Register article added that, “Iowa’s farmland value increase could be just a ‘temporary break’ from continued declines, said Chad Hart, an Iowa State University agriculture economist.

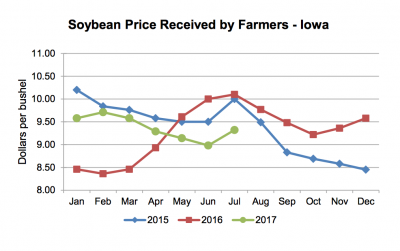

“‘For land values to go back up again, you really need a reason,’ Hart said. ‘The reason ag values typically move is the income you can derive from that land.’

“‘And right now, that income is still under stress,’ [Hart] said.”

Friday’s article added that, “Since 2013, Iowa ag income has fallen nearly 70 percent to $2.6 billion last year. Nationally, farm income has dropped 50 percent to $61.5 billion.

“But last month, the U.S. Department of Agriculture projected U.S. farm income would climb 3.1 percent this year, thanks primarily to an improved profit outlook for cattle, pigs, poultry and other livestock.

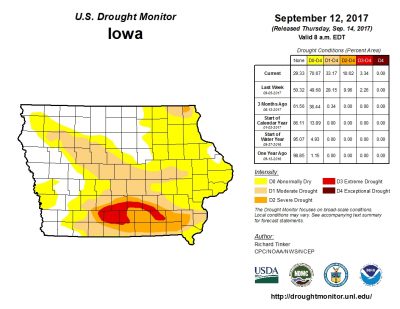

“Hart doubts Iowa will see that kind of farm income improvement, given drought conditions that hit most of the state this summer.”

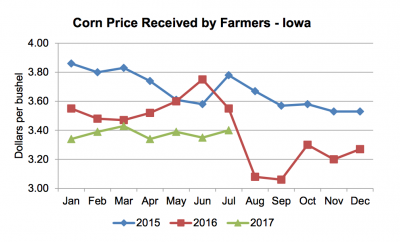

Meanwhile, on September 12th, USDA’s National Agricultural Statistics Service (NASS) indicated that, “Based on conditions as of September 1, [Iowa corn] yields are expected to average 187 bushels per acre, down 1 bushel per acre from the August 1 forecast, and down 16 bushels per acre from last year. If realized, this will be the third highest yield and production on record behind 2016 and 2015, respectively.”

Iowa, Corn forecasted production and yield are down in all 9 Iowa districts from 2016, @usda_nass pic.twitter.com/4vjrJ1U1O6

— Farm Policy (@FarmPolicy) September 12, 2017

2017 NASS Cash Rent County Estimates

Also with respect to farmland values and cash rental rates, a NASS news update from September 8th stated that, “Non-irrigated cropland cash rent averaged $231.00 per acre in Iowa during 2017, down $4.00 from 2016 according to the latest report released by USDA’s National Agricultural Statistics Service.”

“Benton County had the highest cash rent for non-irrigated cropland, at $273.00 per acre, followed by Bremer County, at $270.00 per acre. Grundy, Sioux, Cherokee and Plymouth also had non-irrigated cropland cash rental rates of $260.00 or higher. Lucas County, at $144.00 per acre, had the lowest average cash rent for non-irrigated cropland.”

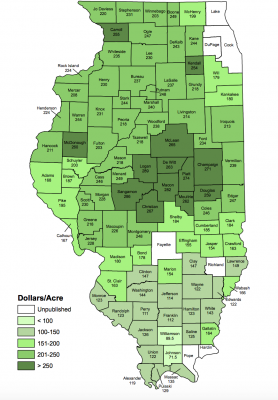

NASS also released Illinois 2017 cash rent county estimates on September 8th, which showed a state average cash rental rate for non-irrigated crop land at $218.00.

A corresponding Illinois county map was also released by NASS (see below).

Additional NASS cash rent county estimates for 2017 are also available for Wisconsin, Minnesota, Missouri, North Dakota, South Dakota, and Michigan.