The U.S. Courts report that 315 farm bankruptcies were filed in calendar year 2025, up 46% from 2024. While still down from recent highs, this is the second year in…

Kansas City Fed: Ag Lending and Interest Expenses Increase for Farmers

An update on Friday from the Federal Reserve Bank of Kansas City (“Agricultural Lending Increases, As Do Interest Expenses for Farmers,” by Cortney Cowley John McCoy) stated that, “Lending at agricultural banks increased sharply in the fourth quarter, after appearing to stabilize in previous quarters. Large loans drove the increase in farm lending, which may heighten concerns about cash flow in 2018 as interest rates have continued to rise steadily.”

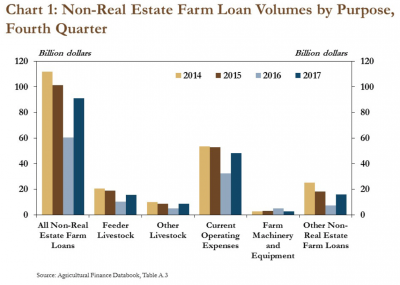

Cowley and McCoy explained that, “Farm lending at commercial banks increased in the fourth quarter. Demand for all types of loans except farm machinery and equipment increased significantly from a year ago (Chart 1). Current operating expenses continued to comprise the majority of loan originations, and loans for livestock made up 27 percent of all new non-real estate farm loans.

The total value of operating loans and livestock loans increased almost 50 percent from the fourth quarter of 2016, but was still below 2014 and 2015 levels.

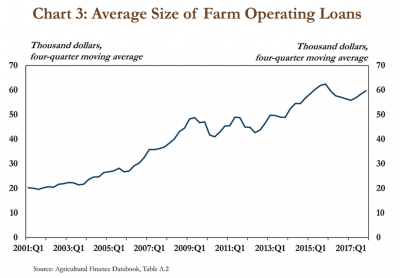

Friday’s update noted that, “Large loans continued to account for the majority of farm loan volumes at commercial banks. With production costs remaining relatively high, loans of $100,000 or more accounted for more than 70 percent of total loan volumes.” The update added that, “Alongside an increase in the share of large loans, the average size of farm operating loans continued to grow. After declining in 2016, the average size of farm operating loans grew in every quarter of 2017. ”

The Fed update also pointed out that interest rates have increased. Specifically, the update stated that, “Rates on loans used to finance current operating expenses increased nearly a full percent, from 3.7 percent in 2016 to 4.5 percent in the fourth quarter of 2017. In addition, for the first time since 2014, more loans were issued with interest rates greater than 6 percent than loans with rates of 3 percent or less.”

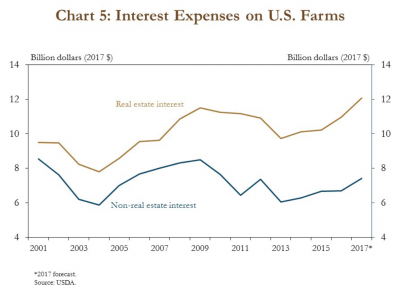

The combination of larger loans and higher interest rates has, in general, increased farmers’ loan payments.

“In fact, in 2017 real estate interest expenses were expected to be the highest since 1989, and non-real estate interest expenses were 23 percent higher than in 2013,” the Fed update said.

More broadly, Cowley and McCoy pointed out that, “Similar to survey data of commercial banks, regional Federal Reserve surveys of agricultural credit conditions showed stronger demand for farm loans. Demand for non-real estate farm loans increased in the third quarter from a year ago in most Federal Reserve Districts, with the strongest increases in the Kansas City and Minneapolis Districts…Demand for farm loan renewals and extensions also rose in every District.”

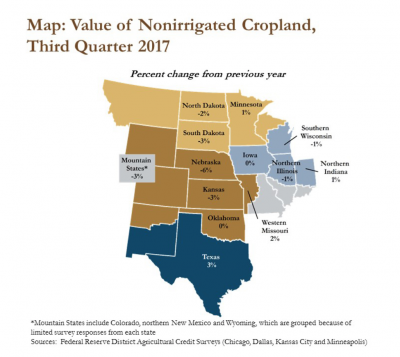

While addressing farmland values, Friday’s Kansas City Fed update stated that, “Despite continued moderation in credit conditions, farmland values generally have remained stable.

In the Corn Belt and Southern Plains states, farmland values increased slightly or remained steady compared with a year ago.

“In the mid- to upper-Plains states, farmland values declined slightly, most notably in Nebraska, where farmland values fell 6 percent from the third quarter of 2016.”

In a related article, Farm and ranchland valuations dropped last year after a decade of double-digit increases, according to a new state report.

“The Nebraska Department of Revenue report, issued [Jan. 26th], shows that agricultural land valuations fell to $99.27 billion in 2017, down 0.18 percent from $99.45 billion the year before.”

#Iowa #Land Values Update: This dataset includes tillable #farms that sold via the public auction method and have 85% tillable acres or greater. Our team calculated the average dollar per CSR2 point ($/CSR2) based on tillable acres, https://t.co/jSMn2wu3EN @PeoplesCompany pic.twitter.com/P3rsQc9Jls

— Farm Policy (@FarmPolicy) February 3, 2018

The World-Herald article explained that, “State Sen. Curt Friesen, who farms near Henderson, said the decline in ag land valuations reflects falling land prices in recent years. He said he expects the valuations to continue falling for a few more years.

“Ag land valuations change more slowly than prices because the valuations are based on three years’ worth of sales.”