A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

FAPRI Baseline: Farmers Still Caught in Economic Squeeze

A news release last week from the Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri indicated that, “The latest analysis of national and global agricultural trends from the University of Missouri indicates little change in net farm income this year and a slight increase in 2019. However, even with modest projected increases in commodity prices in 2019, net farm income is expected to remain far below the record level set in 2013. Good news in the report includes strong demand for meat, which offset downward pressure on prices from increased production last year.”

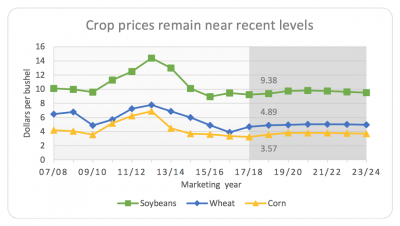

The release noted that, “FAPRI’s analysis shows that a fifth straight year of global grain and oilseed production above the long‐term trend hampered recovery of crop prices last year. Projections contained in the 2018 Briefing Book include slight price increases for 2018‐19 and 2019‐20 crops. These include projected average 2018‐19 prices of $3.57 per bushel for corn, $9.38 for soybeans and $4.89 for wheat. In contrast to other crops, upland cotton and rice prices are projected to fall in 2018‐19, due to carryover of cotton stocks from 2017 and expected planting acreages for both rice and cotton.”

Pat Westhoff @WesthoffPat and Peter Zimmel @MidMoFarmBoy are in Washington, DC today meeting with congressional staff ahead of today's baseline release. pic.twitter.com/Vd9emQekqe

— FAPRI-MU (@FAPRI_MU) March 8, 2018

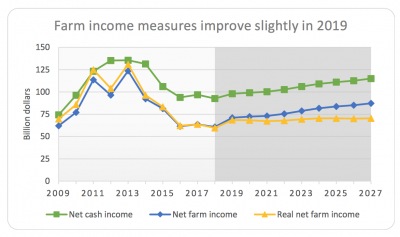

The release added that, “Overall, net farm income is projected to grow slightly in 2018. However, real net farm income remains flat, and below 2015 levels from 2019 through 2027. This is not encouraging for producers, who have watched their income‐to‐debt ratio dwindle in recent years.

Net farm income averaged nearly 32 percent of outstanding debt from 1995 through 2014, but it fell to less than 17 percent in 2016 and 2017. This year’s projections suggest continued pressure on farm finances in the years ahead.

Before getting into additional details of the FAPRI report, recall that earlier this year USDA released its 2018 Farm Income forecast, as well as it’s 10-year projections; and USDA Chief Economist Robert C. Johansson provided a broad outlook for U.S. agriculture in late February. Also in February, the Federal Reserve Banks of Chicago, St. Louis and Kansas City each released updates regarding farmland values and agricultural credit conditions from the fourth quarter of last year.

@WesthoffPat is currently presenting the 2018 Baseline Outlook to the US Senate Ag Committee. Check out the new baseline outlook at https://t.co/pcbiquoSlW pic.twitter.com/iyKMyLUnO4

— FAPRI-MU (@FAPRI_MU) March 8, 2018

The FAPRI baseline report stated that, “Projected average prices for most grains and oilseeds increase only slightly from prices received in recent years.

Average corn prices re- main below $4 per bushel, soybean prices stay below $10 per bushel and wheat prices average around $5 per bushel.

“In any given year, weather and other factors are likely to result in prices that deviate sub- stantially from the stochastic baseline averages reported here.”

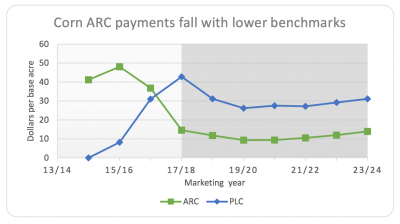

With respect to farm program outlays, the baseline report stated that, “The baseline generally assumes an extension of farm programs in place in January 2018. Under current program rules, Agriculture Risk Coverage (ARC) payment rates for corn are projected to decline. The program uses a benchmark tied to a moving average of past prices, which has declined sharply since 2015. Projected average Price Loss Coverage (PLC) payment rates exceed those under ARC, not just for corn, but for all major program crops.”

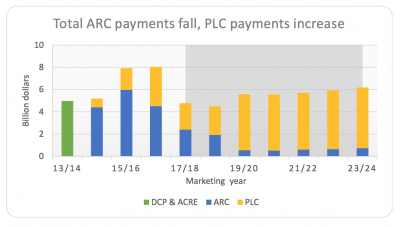

“Total ARC payments peaked in 2015/16, at levels exceeding Direct and Countercyclical Program (DCP) and Average Crop Revenue Election (ACRE) payments under previous legislation. ARC payments under the current farm bill decline. In the baseline, it is assumed that producers can make a new ARC-PLC election in 2019, and that more will choose PLC because of the expected difference in payment rates. Total PLC payments average about $5 billion per year between 2019/20 and 2023/24.”

“Crop insurance outlays were relatively small in fiscal years (FY) 2016 and 2017, as high yields reduced program costs.”

More specifically on farm income, the FAPRI baseline noted that, “Different measures of net income for the farm sector all show sharp declines from recent peaks. Net farm income remains around $60 billion for the third straight year in 2018. Farm income measures improve slightly in 2019, in part because of a modest recovery in prices for corn and other crops. After 2019, real net farm income (correcting for inflation) remains relatively constant.”

The baseline update added that,

The recent decline in net farm income makes it more difficult for producers to service debts.

Last week’s update also pointed out that, “The spike in recent soybean returns led to a record number of soybean planted acres in 2017. Soybean acres are expected to exceed corn acres in 2018 for the first time. However, as profits wane, soybean acreage falls in subsequent years. Even so, average soybean area remains at least 87 million acres which had never occurred before 2017.”

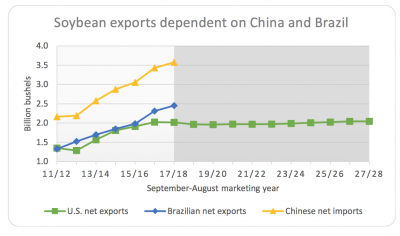

And with respect to soybean exports, the baseline stated that,

The growing demand for soybeans in China has largely been met by a corresponding increase in Brazilian exports.

“China accounted for 61 percent of U.S. soybean exports in 2016/17. This was 31 percent of U.S. production that year. Although the baseline has moderately increasing exports, this assumption is reliant on stable trade relationships and average weather conditions around the world.”