Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

New U.S. Tariffs Ramp-Up Fear of Ag Trade Retaliation; Soybean Growers Especially Worried

On Thursday, President Trump implemented tariffs on steel and aluminum, an action that had been anticipated since last week. Today’s update explores recent news items that highlight the potential negative impact the executive branch action could have on the U.S. farm sector. Although Canada and Mexico were exempt from the new tariffs, if other countries, particularly China, take retaliatory trade measures based on U.S. trade policy, negative short-term and long-term impacts could be expected for U.S. farmers.

Background

Jacob M. Schlesinger and Rebecca Ballhaus reported late last week at The Wall Street Journal Online that, “President Donald Trump kicked his ‘America First’ trade policy into high gear Thursday, launching global tariffs on steel and aluminum, while signaling even more aggressive pressure on trading partners to come, especially against China.

With a single signature, Trump launched a global race to win relief from U.S. steel and aluminum tariffs https://t.co/ydWjq9ovUY via @tictoc pic.twitter.com/udNXo9MRRy

— Bloomberg (@business) March 9, 2018

“In announcing the measures, the president outlined his broader trade agenda, including rewriting existing U.S. pacts and a continuing sweeping investigation of Chinese trade practices, issuing a veiled threat that even bigger penalties are looming against Beijing.

‘We’re going to cut down the deficits [with China] one way or the other,’ he said.”

The Journal article pointed out that, “As Mr. Trump ratcheted up rhetorical pressure on China, the U.S.’s largest trading partner, he unveiled metal-industry protections that were considerably softer than opponents had feared a week ago when he first announced they were coming. The president and aides had originally said no countries would be exempt from the 25% steel tariff or 10% aluminum tariff, but on Thursday suggested that a large number of countries could ultimately be spared.

“‘We’re going to show great flexibility’ by considering exempting military allies, Mr. Trump said, and he started by excluding Canada and Mexico immediately.”

In response to Thursday’s action, Wayne Ma reported on Friday at The Wall Street Journal Online that, “China lashed out against the U.S. on Friday after the Trump administration launched global tariffs on steel and aluminum and signaled it would step up pressure on Chinese trade practices.

“China’s Commerce Ministry said in a statement it ‘strongly opposed‘ the move.”

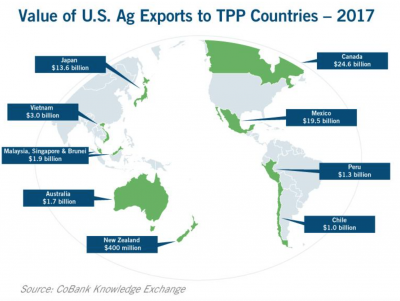

Interestingly, on the same day that President Trump slapped on the aluminum and steel tariffs, New York Times writers Ernesto Londono and Motoko Rich reported that, ” A group of 11 nations — including major United States allies like Japan, Canada and Australia — signed a broad trade deal on Thursday in Chile’s capital, Santiago, that challenges Mr. Trump’s view of trade as a zero-sum game filled with winners and losers…Mr. Trump withdrew the United States from an earlier version of the agreement, then known as the Trans-Pacific Partnership, a year ago as one of his first acts in office.”

The Wall Street Journal reported on Thursday that, “The agreement’s signing will spur the efforts of U.S. farm and business lobbyists to persuade Mr. Trump—or a future president—to rejoin the pact to address what they worry will be their competitive disadvantages in the region.”

Retaliation Concerns from U.S. Agriculture- Soybeans, China

On Thursday, DTN Ag Policy Editor Chris Clayton reported that, “Agricultural groups have expressed varying levels of fear over retaliation. The National Grain and Feed Association, along with the American Soybean Association, both pointed to worries about how other trading partners will react.

‘These tariffs are very likely to accelerate a tit-for-tat approach on trade, putting U.S. agricultural exports in the cross-hairs,’ said Brian Kuehl, executive director of Farmers for Free Trade, in a statement. ‘Already we have seen China discuss tariffs on sorghum. The EU and China have also indicated they will move forward with swift retaliation in the wake of these tariffs.’

Reuters writer P.J. Huffstutter reported on Friday that, “Farm groups have long feared that China, which imports more than third of all U.S. soybeans, could slow their purchases of agricultural products, heaping more pain on the struggling U.S. farm sector.”

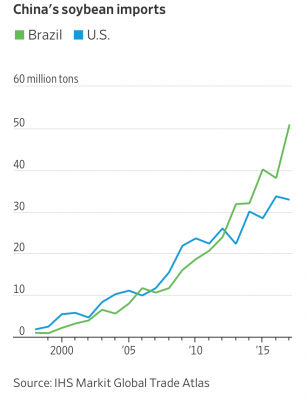

The article added, “‘We have heard directly from the Chinese that U.S. soybeans are prime targets for retaliation,’ the [American Soybean Association] said in a statement. ‘The idea that we’re the only game in town, and these partners have no choice but to purchase from the U.S. is flatly wrong.'”

And Wall Street Journal writers Benjamin Parkin and Jesse Newman reported last week that, “Farmers and grain traders worry that China might retaliate by slowing imports of U.S. beans or by erecting trade barriers to them.”

“The American Soybean Association, a trade group, said Chinese officials in Washington, D.C., told its leaders that soybeans also could face scrutiny. Retaliation ‘would be devastating to U.S. soy growers,’ said John Heisdorffer, the association’s president.”

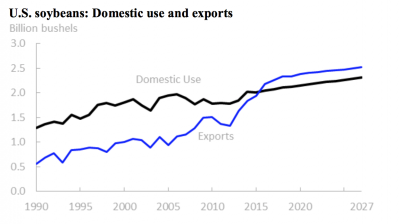

The Journal article explained that, “U.S. farmers aiming to tap [the Chinese] market are growing more soybeans than ever. Many planted soybeans in fields long used for corn and wheat after prices for those grains dropped in recent years. Soybean acreage is on track to match corn this year for the first time in 35 years.

“But China is buying fewer U.S. soybeans, thanks to bumper harvests of cheaper beans in South America.

“Brazil exported more soybeans than ever last year after a bumper harvest, almost 80% of them to China.”

Bloomberg’s Alan Bjerga pointed out last week that, “‘Action by China to restrict imported U.S. soybeans would be the beginning of a long tail,’ Ryan Findlay, chief executive officer for the American Soybean Association, a St. Louis-based trade group, said in an email. ‘If China doesn’t buy from the U.S., they buy from one of our competitors. If they establish a good relationship with our competitor they may be more apt to buy from them in the future reducing our exports more not only short-term but long term. From a historical perspective, U.S. farmers don’t win in these scenarios.'”

New York Times writers Monica Davey and Patricia Cohen reported on Saturday that, “‘The world’s already awash in grain,’ [Illinois farmer Eldon Gould] said, ‘and then if you lose a key customer — it’s big. They’re going to go somewhere else to buy it.’

“That’s a tangible threat throughout the Midwest, which accounts for roughly half the nation’s agricultural output, a prime target in any tit-for-tat response to the tariffs announced by President Trump. Unlike the rest of the economy, farms deliver a trade surplus for the United States, and a trade war could put barriers around lucrative markets.”

Global #soybean #imports are projected to grow 30 percent by 2027 with China leading the way. Learn more: https://t.co/F278qfDTS6 pic.twitter.com/U5vqsA2nTX

— USDA_ERS (@USDA_ERS) March 9, 2018

The Times article noted that, “Three out of every five rows of soybeans planted in the United States find their way out of the country; half of those, valued at $14 billion in 2016, go to China alone. Mr. Gould estimates that 90 percent of his soybeans are exported, and 70 percent of his corn, so what he calls Mr. Trump’s ‘trade antics’ — particularly his criticisms of Nafta — nag at him.”

Kevin Hardy and Donnelle Eller reported last week at The Des Moines Register Online that, “At a legislative breakfast over the weekend, Republican Congressman Steve King told northwest Iowa residents that he opposed Trump’s steel and aluminum tariffs because of what they could do the agricultural market.

“‘It will be the ’80s all over again,’ he said, referencing the 1980s farm crisis that put 10,000 Iowa farms out of operation.”

The Register writers stated that, “The entire Iowa congressional delegation wrote to the president Wednesday urging him not to impose the steel and aluminum tariffs. The letter said ‘tariffs are a tax on families and hardworking Iowans cannot afford a trade war.'”

Legislative Branch Response

Bloomberg writers Anna Edgerton, Bob Van Voris, and Laura Litvan reported on Friday that, “Republican lawmakers opposing President Donald Trump’s imposition of steel and aluminum tariffs said the White House may face lawsuits to block the duties, even as legal experts cast doubt that the cases would succeed.

“There will almost certainly be broad legal challenges of the Trump administration claim that protecting U.S. steel and aluminum producers is necessary for national security, John Cornyn of Texas, the second-ranking Republican senator, said Friday.”

The article noted that, “In Congress, some Republicans are trying to claw back authority to implement or at least review tariffs. But it may be difficult to get a veto-proof majority with some Democrats supporting Trump’s action.”

I support the need to modernize our trade agreements, but I am concerned about the impact the new #tariffs on steel and aluminum will have on Nebraska agriculture.

— Senator Deb Fischer (@SenatorFischer) March 9, 2018

The Bloomberg writes added that, “Both Senate Finance Committee Chairman Orrin Hatch of Utah and Senate Homeland Security and Governmental Affairs Committee Chairman Ron Johnson of Wisconsin are planning hearings in coming weeks about the decision. Both said they are continuing to lobby the president to change course.”

Despite widespread condemnation from House Republicans, none have introduced measures to counter Trump’s action.

Perspective from Secretary of Agriculture Sonny Perdue

Jenny Schlecht reported on Friday at AgWeek Online that, “Agriculture Secretary Sonny Perdue said he talked to President Donald Trump on March 8 about the importance of trade to rural America.

“Perdue on March 9 told the Forum Editorial Board he was talking to the president about the loss of income over the past four years in agriculture, and turned it into an opportunity to point out the same part of the country that voted for the president in large numbers and has seen their income drop have anxieties over the North American Free Trade Agreement and other trade considerations.”

The article noted that, “Perdue also was open about the ‘anxiety’ over trade, including Trump’s announcement of aluminum and steel tariffs earlier this week, continued negotiations over NAFTA and negotiations with other countries. But [Sen. John Hoeven (R., N.D.)] said Perdue has been proactive on not only advocating for agriculture but also making plans for possible effects of trade issues.”

Associated Press writer Dave Kolpack reported on Friday that, “Agriculture Secretary Sonny Perdue says that while he’s as anxious as farmers are about how President Donald Trump’s tariff increases will affect agricultural exports, the move doesn’t look as bad as he originally thought…Perdue says the final version looked much better because Canada and Mexico were excluded, which he believes could boost discussions on improving the North American Free Trade Agreement.”