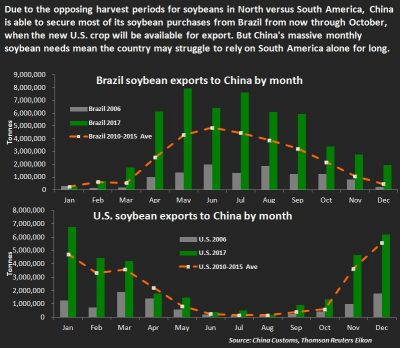

Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

In Ongoing Trade Dispute, China Targets U.S. Soybeans

Background- Prelude to Chinese Soybean Tariffs

Since withdrawing from the Trans-Pacific Partnership on his first working day in office, and formally opening the North American Free Trade Agreement to the renegotiation process, President Trump’s rhetoric on trade has perhaps caused more anxiety among agricultural producers than actual executive branch action. However, implementation of concrete trade policy from the Administration began to emerge in January of this year when the U.S. slapped tariffs on imports of solar panels and washing machines.

At the time, Bloomberg News reported, “China is the biggest maker of solar panels and expressed displeasure at the move.” Then, in February, China launched a probe into U.S. sorghum imports.

In early March, President Trump announced global tariffs on steel and aluminum, and The Wall Street Journal explained, “…the president outlined his broader trade agenda, including rewriting existing U.S. pacts and a continuing sweeping investigation of Chinese trade practices, issuing a veiled threat that even bigger penalties are looming against Beijing.”

On March 22nd, The Financial Times indicated that, “After 14 months in office Donald Trump is delivering on his campaign promise to crack down on what he has long labelled China’s unfair trade practices by rolling out plans for new tariffs on up to $60bn in Chinese imports and other sanctions against Beijing.” The FT article stated that, “The move is in response to what the administration says has been a co-ordinated strategy by Beijing to force US companies to hand over intellectual property to do business in China.”

The next day, The Wall Street Journal reported, “China fired a retaliatory shot against the U.S., announcing planned tariffs against American goods and saying it is readying more actions against the Trump administration’s proposed penalties on Chinese exports.” The Journal article noted that the measures being considered were items such as fruit and pork, but not soybeans or sorghum, and added that the potential penalties were in response to U.S. tariffs on steel and aluminum.

This week, on Monday, Financial Times writer Tom Hancock reported that, “China has unveiled retaliatory duties on US food imports including pork, fruit, nuts and wine of up to 25 percent as a response to the Trump administration’s new tariffs on steel and aluminium imports.” The FT article explained, “The list was consistent with measures proposed by Beijing last month when it said it was planning tariffs on $3bn of US imports. The response was seen as relatively measured because it left out key US exports to China such as soyabeans, of which the US exported about $14bn last year.”

On Tuesday, New York Times writer Ana Swanson reported that, “The Trump administration said Tuesday that it will place a 25 percent tariff on Chinese products like flat-screen televisions, medical devices, aircraft parts and batteries, outlining more than 1,300 imported goods that will soon face levies as part of a sweeping trade measure aimed at penalizing China for its trade practices.

“The move, which stems from a White House investigation into China’s use of pressure, intimidation and theft to obtain American technologies, is likely to inflame an already-simmering trade war between the countries.”

However, The Wall Street Journal noted on Tuesday, “None of the tariffs goes into effect immediately—and may never be imposed if the two sides eventually agree on a deal to open China further to U.S. imports. Instead, U.S. companies have until May 22 to raise objections; a public hearing on the issue is scheduled for May 15 in Washington.”

Soybeans Targeted

Lingling Wei and Yoko Kubota reported on Wednesday at The Wall Street Journal Online that, “China stepped up its trade fight with the U.S., retaliating against proposed tariffs on Chinese goods by targeting high-value American exports, from airplanes to soybeans, in a tactic Beijing officials say is meant to secure a truce.

“Hours after the Trump administration unveiled plans to impose tariffs of 25% on Chinese products worth $50 billion, China’s State Council announced Wednesday that it would levy penalties of the same rate on U.S. goods of a similar value.”

#Trade- #China-- U.S. #Soybeans: Percent each state contributed, on average, to national production-- Major and minor areas and state production percentages are derived from @usda_nass survey data from 2010 to 2014- @USDA's Office of the Chief Economist pic.twitter.com/EW7z4PWVCs

— Farm Policy (@FarmPolicy) April 4, 2018

The article also explained, “Neither the U.S. nor Chinese tariffs take effect immediately. [Chinese Vice Finance Minister Zhu Guangyao] said whether or when China will enforce its penalties would depend on ‘the outcome of negotiations between the two sides.’ Under the U.S. plan, companies have until May 22 to object to the proposed tariffs, and the U.S. government then has at least 180 days to decide whether to go ahead, providing ample time for negotiations.”

.@larry_kudlow on tariff announcements: "I doubt if there'd be any concrete action for several months... Nothing concrete has actually happened. These are proposals, but the message is clear." pic.twitter.com/FBFNbY2zBz

— FOX Business (@FoxBusiness) April 4, 2018

New York Times writers Keith Bradsher and Steven Lee Myers explained on Wednesday,

Moving with unusual speed, Chinese officials outlined plans to make it more costly to import 106 types of American goods into China. They are intended to hit the United States square in the farm belt — a major section of President Trump’s political support but also a major supplier of what China stocks in its supermarkets.

More broadly, Bloomberg writers Alfred Cang and Phoebe Sedgman reported on Wednesday that, “China has taken aim at America’s rural heartland as the top buyer of U.S. soybeans said it would restrict imports.

“China’s Ministry of Commerce on Wednesday said it plans to impose 25 percent duties on the commodity in addition to other U.S. agricultural produce including wheat, corn, cotton, sorghum, tobacco and beef. They’re among 106 products ranging from aircraft to chemicals targeted by Beijing in retaliation for proposed American duties on its high-tech goods.”

Nebraska’s ag economy is the backbone of our state and China is the single largest export market for ag commodities produced in Nebraska. I am extremely concerned about the proposed Chinese tariffs on U.S. soybeans, beef, and corn. Read my full statement below: pic.twitter.com/pcsSyBqQj3

— Rep. Don Bacon (@RepDonBacon) April 4, 2018

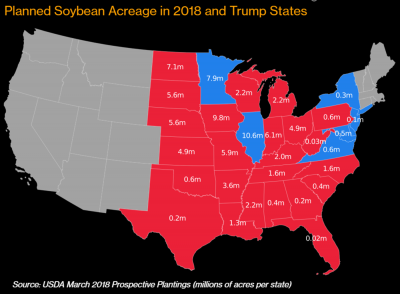

Alan Bjerga noted on Wednesday at Bloomberg that, “Trump won eight of the 10 states that are the biggest producers of soybeans, and three of them — Missouri, Indiana and North Dakota — are home to three Senate Democrats targeted by Republicans trying to hold or expand their Senate majority. Four other of the states have close races for governor. The economic ripples may extend out to U.S. House races at the same time Democrats are threatening Republican control of the chamber.”

Adam Samson reported on Wednesday at The Financial Times Online that, “Trade groups representing American soyabean farmers, processors and exporters have warned that the escalating trade battle between the US and China will deal a blow to a wide range of industries in both countries.”

The FT article stated, “China’s planned retaliatory tariffs, which were unveiled in response to measures by the Trump administration, ‘will have a devastating effect on every soyabean farmer in America,’ said John Heisdorffer, president of the American Soybean Association, which represents more than 300,000 soyabean producers.

“Mr Heisdorffer hit out directly at the White House, saying, ‘we regret that the administration has been unable to counter China’s policies on intellectual property and information technology in a way that does not require the use of tariffs.'”

Tariffs on pork and soybeans in China will hurt IL farmers. I support fair trade and fighting for American manufacturing, but I expect this Admin. to fight as hard to protect markets for our farmers. Yet again, the heartland is feeling the consequences of a reckless president.

— Rep. Cheri Bustos (@RepCheri) April 4, 2018

Jacob Bunge and Jesse Newman reported on Wednesday at The Wall Street Journal Online that, “Chinese officials didn’t say when the country’s proposed 25% tariffs on soybeans, corn, wheat, beef, and other products would take effect. But in central Illinois, Aaron Wernz is already considering how to react. On Wednesday he said the sharp drop in soybean prices and the possibility of diminished sales to China could prompt him to sow more corn, and less soybeans, on his 2,000 acres when he fires up his planter in a few weeks. He said he would also take a harder look at future seed and fertilizer purchases if crop prices remain depressed.

“As soybean and corn prices traded lower Wednesday, Mr. Wernz figured the day’s decline alone cut $50,000 off the value of his crops this year. ‘That’s my first house,’ the 39-year-old said, adding that switching 200 acres back to corn could cost him nearly $40,000 more thanks to corn’s higher per-acre cost.”

The Journal article added, “Ronald Moore, who raises soybeans near Roseville, Ill., and chairs the American Soybean Association, said a trade war with China would hurt rural investment in rural areas. He also sits on the board of a local bank that is financing a new hog facility in the area, a project he says China’s new pork tariffs on pork have thrown into question.”

The proposed retaliation from China will have a negative impact on the state of Nebraska. @POTUS must negotiate with the Chinese in a constructive way to get good trade results for our farmers and ranchers.

— Senator Deb Fischer (@SenatorFischer) April 4, 2018

And, Reuters writers Mark Weinraub and Michael Hirtzer reported on Wednesday that, “China’s swift retaliation rattled U.S. farmers, their options shrunk by the wide variety of agriculture products that have been or could be targeted by China. Doug Keesling of Kansas struggled to imagine what crops he might plant instead of soy.

“Keesling said his most logical next option would typically be sorghum, but not with Chinese tariffs on top of the anti-dumping investigation, which was widely viewed as retaliation for Trump’s move to put tariffs on U.S. imports of Chinese solar panels and washing machines.”

“‘The bigger story for me is not what am I going to plant,’ he said. ‘It is how long can I sustain that as a farmer and continuing producing food, not just for China but for the United States.'”

"Officials Mulling Possible Help for #Farmers as U.S./#China Trade Tensions Rise," https://t.co/KzjbAHJjfE (MP3- 1 minute). @USDA Radio. pic.twitter.com/3K0xwtmuGZ

— Farm Policy (@FarmPolicy) April 4, 2018

Meanwhile, Tamar Hallerman reported earlier this week at the Atlanta Journal Constitution Online that, “Agriculture Secretary Sonny Perdue said Tuesday he feels confident that President Donald Trump will not allow farmers ‘to bear the brunt’ of a possible trade war with China.

“The former Georgia governor also suggested the Trump administration might consider economic ‘mitigation efforts’ to aid U.S. farmers should relations with China continue to harden. He did not specify what form those efforts might take and said the White House plans to wait and see before making any moves.”