CNBC's Ruxandra Iordache reported that "China’s finance ministry on Friday said it will impose a 34% tariff on all goods imported from the U.S. starting on April 10, following duties…

USDA Trade Data Update, and China Trade Dispute Weighs on Exports

Late last week, the U.S. Department of Agriculture released updated agricultural trade data for the first half of this fiscal year (October – March). Meanwhile, President Trump sent members of his senior economic team to China for trade negotiations, but those talks ended Friday, “with no deal and no date set for further talks.” Since April, China has canceled and curtailed purchases of key Corn Belt commodities. Today’s update highlights recent news items that explore these developments in greater detail.

USDA Trade Data Through March

Gary Crawford reported on Friday at USDA radio, “We now have the complete ag trade figures for the first half of this fiscal year, taking us from October through March,” before much of the current trade row between the U.S. and China unfolded.

The data showed that the U.S. exported $12.9 billion worth of ag products during March.

Bryce Cooke, a trade analyst at USDA, explained that this was, “the best March export total since 2014.”

However, Mr. Cooke noted in the radio segment that, compared to fiscal year 2017, exports were down three percent for the first half of fiscal year 2018.

The radio report pointed out that USDA will issue its latest trade outlook on May 31st.

A separate USDA radio report on Friday explained that bulk ag commodities sales were down 14 percent in the first half of the fiscal year, while high value ag exports were up four percent.

Compared to last year, the value of corn exports were down 20 percent, the value of soybean exports declined 19 percent, and wheat sales were down 12 percent.

Although U.S. sorghum farmers are expected to be hit by China’s 179 percent import duty last month, USDA’s Bryce Cook pointed out on Friday, “Before China started importing a lot of sorghum from the U.S. a couple of years ago, we did have Mexico as a major market.” He added, “There are other markets that are interested in the product, maybe not for the value amount that China has shown in the past couple of years– but still, there are other players.”

Meeting today with @SorghumGrowers, who are facing duties of almost 179% from China. Chinese claim of "dumping" of sorghum is not credible in the international grain market, which is about the freest market there is. U.S. producers are the most competitive in the world. pic.twitter.com/nkG9Vj2KJn

— Sec. Sonny Perdue (@SecretarySonny) May 3, 2018

U.S. – China Trade Issues: Implications Since March, and Negotiations

Jacob Bunge and Jesse Newman reported in Saturday’s Wall Street Journal,

The U.S.-China trade spat is cutting into the flow of soybeans, pork and other commodities from U.S. farms to one of the world’s biggest markets.

“Since early April, when China announced tariffs on some U.S. agricultural goods and threatened to target others, Chinese importers have canceled purchases of corn and cut orders for pork while dramatically reducing new soybean purchases, according to U.S. Department of Agriculture data. Chinese importers’ new orders of sorghum, a grain used in animal feed, have dwindled while cancellations increased.

“The chill in agricultural trade is sending jitters through the U.S. Farm Belt, which for years has dispatched farmers on trade missions to cultivate the Chinese market.”

Bunge and Newman added, “In soybeans, China-based importers are holding off on new orders from the U.S., including advance purchases of this fall’s crops. The risk that a shipment will face a steep tariff by the time it is delivered has directed Chinese buyers to book more beans from South American suppliers, according to [Soren Schroder, chief executive of Bunge Ltd.].”

.@ChuckGrassley: China is the largest consumer of U.S. soybeans, buying up nearly 60 percent of our soybean exports. If that market closes, it could be devastating for local communities across the Midwest. https://t.co/wv9AhX5OTR

— Sen. Grassley Press (@GrassleyPress) May 4, 2018

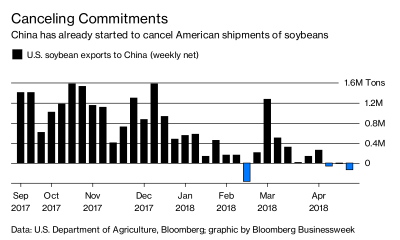

On Friday, Bloomberg writers Alfred Cang, Megan Durisin, and Mario Parker reported that, “China has yet to implement tariffs on imports of U.S. soybeans, but the country’s traders are already canceling American shipments, according to the latest trade data. Weekly numbers released Thursday by the U.S. Department of Agriculture show China canceled import commitments in the week ending April 26, making it the third straight week they have fallen. The data reinforce comments from the chief executive officer of grain-trading giant Bunge Ltd., who said Wednesday that China has essentially stopped buying U.S. supplies.”

Meanwhile, Reuters News reported on Thursday that, “China is taking extra efforts to increase its soybean output this year amid an ongoing trade spat with the United States that threatens to curb imports from its second supplier.”

The article noted that,

The threat of the tariffs alone have already cut off U.S. soybean imports, and pushed up prices from other suppliers such as Brazil, supporting the price of soymeal, a widely used animal feed ingredient.

The article pointed out that, “Authorities in the north-eastern Heilongjiang and Jilin provinces met last weekend to discuss actions to boost planting of soybeans, reports posted on city government websites said.”

“China is expected to import 96 million tonnes of soybeans in the 2017/18 year, according to official numbers, versus domestic production of 14.6 million tonnes.

“But the official efforts to increase domestic production underline Beijing’s concerns about the impact of the tariffs,” the article noted.

Delegation heading to China to begin talks on the Massive Trade Deficit that has been created with our Country. Very much like North Korea, this should have been fixed years ago, not now. Same with other countries and NAFTA...but it will all get done. Great Potential for USA!

— Donald J. Trump (@realDonaldTrump) May 1, 2018

Meanwhile, Lingling Wei reported on the front page of Saturday’s Wall Street Journal that, “The U.S. and China asked one another to make sweeping concessions in trade talks, failing to bridge sharp divisions and raising the chances that each government will slap tariffs on tens of billions of dollars of the other country’s exports.

“Top economic officials on both sides sat down for two days of talks this week after exchanging lists that contained sizeable demands. The U.S. asked China to cut its trade surplus by $200 billion, for example, while the Chinese officials sought to get Washington to ease national-security reviews of Chinese investments. Instead of reaching common ground, the talks ended inconclusively Friday.”

2 days of U.S.-China trade talks ended with an agreement to keep on talking, and little else https://t.co/1nHgiBJuD9 #tictocnews pic.twitter.com/sRU3IzxKO6

— TicToc by Bloomberg (@tictoc) May 4, 2018

An update on Saturday at The Economist Online stated, “Start with the good news from the trade negotiations between China and America. After weeks of threatening tariffs and counter-tariffs, representatives from the world’s two biggest economies are at last talking. Over two days of meetings in Beijing, which ended on May 4th, Chinese and American officials laid out their grievances and their demands. That, unfortunately, is where the good news ends. The positions that both sides took were so extreme and contradictory that compromise appears a remote prospect. What, until now, has largely been a war of words could easily careen into a full-fledged trade war.”

And Reuters writer Tom Polansek reported on Friday, “U.S. soybean futures fell on Friday on disappointment that trade talks did not move Washington and Beijing closer to a deal to resolve the mounting dispute that has crimped U.S. crop sales to China.”

“U.S. soybean sales to China over the last four weeks are down 10 percent from a year ago, according to U.S. trade figures. This is a blow to farm country, which helped boost President Donald Trump into office in the 2016 election,” the article said.