Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

China Ag Trade Issues Continue to Percolate- Closer Look at Sorghum, Soybeans

China recently announced anti-dumping measures on U.S. sorghum. Meanwhile, potential action by China on U.S. soybeans continues to concern farm state lawmakers and agricultural producers alike. Today’s update looks at recent news articles that explore these issues, and their potential implications, in greater detail.

Sorghum

Emily Rauhala reported on Tuesday at The Washington Post Online that, “China announced temporary anti-dumping measures on U.S. sorghum, potentially hitting U.S. growers and exacerbating the brewing trade war between Beijing and Washington.

“China’s Ministry of Commerce said that starting Wednesday, Chinese importers of U.S. sorghum, used by the Chinese for animal feed and brewing alcohol, will be required to put down a 178.6 percent deposit in anticipation of anti-dumping tariffs. The deposits could discourage imports of U.S. sorghum, hurting American producers.”

‘We didn’t ask for this fight, but now we’re on the front lines of it,’ said Tim Lust, the chief executive of the National Sorghum Producers, an industry group. ‘Farmers are really stuck in the middle of . . . this much larger fight [with China].’

The article also noted that, “The top five sorghum-producing states are Kansas, Texas, Colorado, Oklahoma and South Dakota. All but Colorado went for Trump in the 2016 presidential election.”

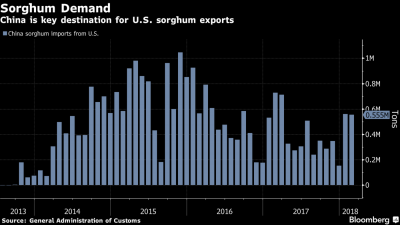

Also on Tuesday, Bloomberg News reminded readers that, “China began a probe into sorghum imports from the U.S. in early February, just weeks after U.S. President Donald Trump slapped tariffs on imported solar panels and washing machines. Tensions between the countries have since escalated after Trump ordered levies on steel and aluminum, with plans for more on products from China. The Asian nation, the largest buyer of American sorghum, has responded with tariffs of its own and potentially more to come.”

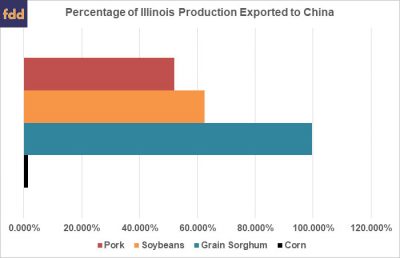

And, a recent farmdoc daily update pointed out that, “Despite not being one of the top 10 producing states, Illinois sorghum has seen a five-year average of $74 million or 93% of total Illinois sorghum exports going to China, with $133 million or 99.7% of total Illinois exports just in the last year.”

Reuters writers Dominique Patton and Tom Polansek noted on Tuesday that, “White House Deputy Press Secretary Lindsay Walters added that Trump ‘has made it clear that any further illegal trade actions by China are not acceptable, including the unfair targeting of U.S. sorghum producers.'”

On Wednesday, Secretary of Agriculture Sonny Perdue indicated that, “Our sorghum producers are the most competitive in the world and we do not believe there is any basis in fact for these actions.”

Meanwhile, Bloomberg writers Megan Durisin and Mario Parker reported on Friday that, “At least two ships loaded with sorghum have changed course while sailing across the Indian Ocean after China imposed a hefty tariff on U.S. supplies this week.”

U.S. sorghum armada U-turns at sea after China tariffs https://t.co/6cRB7I35Ni pic.twitter.com/aXiw08xOvC

— Reuters Top News (@Reuters) April 20, 2018

Also, the Associated Press reported last week that, “It won’t be easy replacing the Chinese market. Last year, Chinese buyers purchased more than 90 percent of the 245 million bushels of sorghum America exported.

‘Basically, this will shut off grain sorghum exports to China for the United States,’ said Mark Welch, an agricultural economist at Texas A&M University.

Soybeans

Politico’s Morning Agriculture reported on Friday that, “U.S. soybean exports to China could fall by as much as 65 percent if the tit-for-tat trade battle between the world’s two largest economies prompts Beijing to slap retaliatory tariffs, according to a soon-to-be published report from Purdue University. The study comes after China announced earlier this month that U.S. soybeans could be hit with a 25-percent tariff if President Donald Trump pulls the trigger on planned tariffs to punish Beijing for its forced technology transfers, Pro’s Blake Paterson writes.

“If a U.S.-China trade war comes to fruition, China is expected to rely even more on Brazil for soybeans. Brazil is the largest soybean exporter to China, a title it snatched from American farmers seven years ago.

“U.S. soybean farmers could find some substitutes for its loss in business by expanding in other markets that now take in Brazilian beans.”

Brazil has held the title of world’s No. 1 soybean shipper for the past five seasons. This year, the nation is expected to win by the widest margin yet. More on @TheTerminal via @megandurisin pic.twitter.com/bGzpm0HzPi

— Stuart Wallace (@StuartLWallace) April 20, 2018

Late last week, Pat Westhoff, the director of the Food and Agricultural Policy Research Institute at the University of Missouri, explained that, “The proposed 25 percent tariff on U.S. soybeans would almost certainly have the effect of pushing down U.S. soybean prices, while pushing up prices in China.

“These price changes would have many implications. China would import fewer soybeans from the United States and more from Brazil, Argentina and other countries. It would also slightly reduce its domestic consumption of soybeans and soybean products, and boost its domestic soybean production.”

Dr. Westhoff added, “South American countries would increase their soybean exports to China, but would lose market share to the United States in other soybean markets. They might even import soybeans from the U.S.”

Beyond Brazil and the Untied States, a recent Reuters article also pointed out that Paraguay is also selling soybeans to China, although the soybeans are labeled as Uruguayan exports.

Reactions- Implications

Reacting to some of these recent trade developments, on Friday, Rep Sanford D. Bishop, Jr. (D., Ga.), Ranking Member of the U.S. House Appropriations Subcommittee on Agriculture, “authored a letter to U.S. Trade Representative Robert E. Lighthizer urging him to take action to address China’s recently announced agricultural tariffs.”

And earlier this month, a letter signed by 46 Members of Congress that was sent to President Trump, urged him to “work diligently in its negotiations with China to address China’s trade practices in a manner that will avoid retaliation.”

An update on Friday at The Economist Online stated that, “‘Everyone in pork production is more anxious than they have been for 20 years,’ says Jimmy Tosh, a pig farmer from north-western Tennessee. As for the grain farmers, he reckons things are worse than at any time since the 1980s. The farmers’ latest worry is the five-yearly Farm Bill, which was submitted to Congress on April 18th. But Donald Trump, whom they overwhelmingly supported for the presidency, has provided them with plenty of other reasons to grouse.”

The article noted that,

But trade is the farmers’ biggest worry.

New York Times writer Jonathan Martin reported last week that, “After a year in which Mr. Trump only mused about pulling out of Nafta and was stymied by Congress in his attempt to slash the Agriculture Department’s budget, there is now a sense in the farm belt that Mr. Trump’s yearning to punish China could inflict real economic and political damage on his own political base.”

Seung Min Kim reported on Thursday at The Washington Post Online that, “But trade has been the most significant dividing line between congressional Republicans who generally favor free trade and a president who has embraced protectionist positions.”

The Post article noted, “‘Farmers need certainty. It’s planting time,’ said Sen. Jerry Moran (R-Kan.), another farm-state Republican who has criticized Trump’s tariffs and attended last week’s meeting. ‘The uncertainty of what markets are going to be available to American agriculture diminishes that certainty. I wish it was different than it is.’

“He added: ‘One never knows with this president what’s negotiating tactics and what’s not.‘”

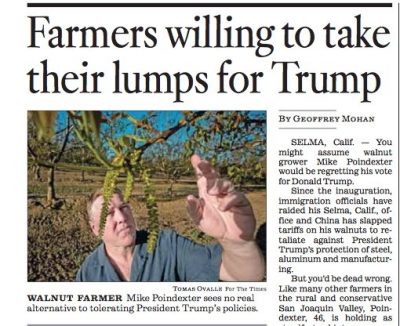

Nonetheless, an article by Geoffrey Mohan on the front page of Saturday’s Los Angeles Times quoted San Joaquin Valley farmer Mike Poindexter as saying, “I don’t think you’ll have farmers go out and vote for Democrats over tariffs.”

The article indicated that, “Poindexter’s stoicism echoes across the farms of the San Joaquin Valley, where rural and suburban voters strongly supported Trump and where they regularly send Republicans to the House of Representatives. House Majority Leader Kevin McCarthy of Bakersfield is in his sixth term, and fellow Republican Devin Nunes, farther north in Tulare, is in his seventh.

“‘If I’ve gotta take a few bullets getting caught up in the cross-fire, but after four years or eight years — however long he spends in office — we’re on a better trajectory as a country, then it’s all parred up,’ said Matt Fisher, a fourth-generation citrus grower in Arvin, near Bakersfield. ‘I did my part, so to speak.'”