As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Chinese Tariffs Take Toll on Soybean Markets

As the impacts of the ongoing U.S.-China trade dispute continue to unfold, a report last week from the U.S. Department of Agriculture provided some insight into how the Chinese tariffs are affecting soybean markets. Today’s update looks at news reports that discuss trade issues and the USDA report in greater detail.

Background- U.S. China Trade Row Persists

Wall Street Journal writer Bob Davis reported on Tuesday that, “The White House said it would assess 10% tariffs on a further $200 billion in Chinese goods, deepening the dispute with Beijing, while sending a message to other trading partners that the U.S. won’t back away from trade fights.”

And a separate Journal article form Wednesday pointed out that, “China doesn’t import enough from the U.S. to match Washington dollar for dollar as it has in previous rounds, so Beijing is reviewing plans to hit back in other ways, said Chinese officials familiar with the plans.”

Meanwhile, Don Lee and Jim Puzzanghera reported on the front page of Thursday’s Los Angeles Times that, “President Trump’s latest threat of tariffs against China, on imports totaling roughly $200 billion, substantially raises the stakes for Beijing and could push the two countries’ trade war beyond the tit-for-tat duties seen so far.”

The article noted that,”The Trump administration’s latest move drew opposition from business groups and some Republican lawmakers concerned the tariffs could be a blow to U.S. consumers and damage economy.”

Today the Senate overwhelmingly passed a measure that would help make certain Congress plays a role in the implementation of tariffs that relate to our national security. I went on @BloombergTV to discuss this important legislation and current trade issues. pic.twitter.com/eamHh0epW4

— Senator Jerry Moran (@JerryMoran) July 11, 2018

Thursday’s article added, “Trump already has imposed levies on Chinese solar panels, steel, aluminum and many machine and industrial parts. They are aimed at pressuring China to make significant changes that would sharply reduce its trade surplus with the U.S. Others in the administration want to press China to halt policies that compel American firms to turn over technologies in order to obtain access to the large Chinese market.

“Up to now, however, growing complaints about Trump’s broad tariffs from U.S. businesses, associations, lawmakers and even politically powerful constituents such as farmers have not dissuaded the president from following through on his threats.”

.@RodneyDavis says farmers in his district trust Trump on trade: "I’m concerned because I see this escalating into a trade war, but there’s a lot of faith in what’s happening with the administration and we just need to see results" @wics_abc20 #C2C pic.twitter.com/FEx1sDcHCY

— C2C Sinclair (@SBGC2C) July 11, 2018

With respect to any potential resolution to the trade conflict, Bloomberg writer Saleha Mohsin reported on Thursday that, “The U.S. and China signaled they were open to resuming negotiations over trade after days of exchanging retaliatory threats, though Treasury Secretary Steven Mnuchin said Beijing must commit to deeper economic reforms.”

Major #agriculture related #trade announcements and #tariff exchanges are seemingly related to uncertainty in commodity markets. A timeline of significant events corresponds with fluctuations in #soybean and #corn prices.#TradeNotTariffs #tradematters #tradewar @ILFarmBureau pic.twitter.com/xBthl6iBa4

— GardnerAgPolicyProgram (@GardnerAgPolicy) July 13, 2018

Agriculture Impacts- Soybeans

With this background in mind, Financial Times writer Gregory Meyer reported on Friday, “The first US government forecast incorporating the agricultural fallout from its trade war with China has come to a firm conclusion on soyabeans:

China will import less, American farmers will lose business and Brazil will be a beneficiary.

...things up, better than ever before, but it can’t go too quickly. I am fighting for a level playing field for our farmers, and will win!

— Donald J. Trump (@realDonaldTrump) July 11, 2018

Mr. Meyer explained, “As the top soyabean importer, accounting for more than 60 per cent of global trade, China’s move [to increase duties on U.S. soybeans] has rattled markets. Soyabean futures have slumped to levels at which many US farmers will lose money without federal assistance.

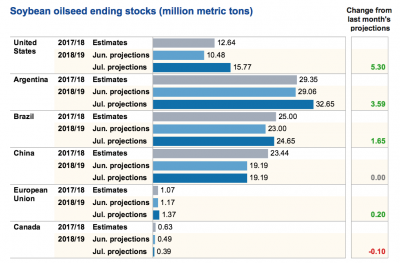

The US Department of Agriculture, in monthly supply and demand estimates published on Thursday, cut its forecast for China’s soyabean imports from 103m to 95m tonnes in the coming marketing year, reduced its outlook for US soyabean exports by nearly 11 per cent from 62.3m to 55.5m tonnes and raised its estimate of Brazilian exports from 73m to 75m tonnes, a record high.

The Financial Times article pointed out that, “Sonny Perdue, US secretary of agriculture, has said USDA economists were calculating the effects of trade disruptions as he weighs federal assistance to farmers hurt by lower prices.

[Robert Johansson, USDA chief economist] said his office had been conducting exercises to estimate the impact of the tariffs. He said he would have better information when more precise estimates of US summer crops are compiled next month.“‘That being said, we’re always hopeful that the tariffs are going to be resolved before harvest,’ he said.”

#Soybean exports (#WASDE) @USDA_ERS pic.twitter.com/fCGv3nGS13

— Farm Policy (@FarmPolicy) July 15, 2018

Note that in a Radio Update from USDA on Friday, farmdoc’s Carl Zulauf explained that it will be very difficult for USDA to determine how much financial damage to farmers is due to the tariffs.

And in referencing the potential assistance from USDA, The Wall Street Journal editorial board stated last week that, “Mr. Trump’s trade policy is creating a problem that didn’t exist and next he may create another one to ease the pain he has caused.”

Since the start of President Trump’s trade war, the value of soybeans has dropped 20%. This is hurting Illinois farmers and the rural economy. I asked @ILSoybean members to stay strong and we’ll weather this storm together.

— Senator Dick Durbin (@SenatorDurbin) July 11, 2018

In a related item, Brianne Pfannenstiel reported on Wednesday at The Des Moines Register Online that, “A day after President Donald Trump threatened to levy an additional $200 billion in tariffs on Chinese goods, Vice President Mike Pence was in Cedar Rapids promising Iowans that farmers will come out ahead in the end.

“‘When it comes to agriculture, I just want to assure all my friends here in Iowa and all across the region: Under President Trump’s leadership, we’re always going to stand with American farmers,’ Pence said.”

Last week’s World Agricultural Supply and Demand Estimates monthly update also stated that, “The U.S. season-average soybean price is forecast at $8.00 to $10.50 per bushel, down $0.75 at the midpoint.”

World Agricultural Outlook Board Chair Seth Meyer discussed the new soybean price forecast in greater detail on Friday in a brief update from USDA Radio News.

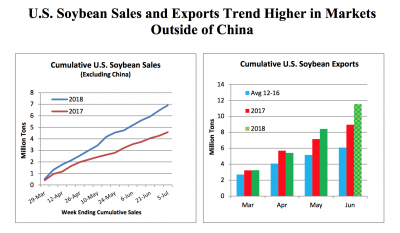

Additionally on the issue of trade variables and U.S. soybean exports, USDA’s Foreign Agricultural Service indicated in an update Thursday that, “U.S. soybean exports reached record territory in May and are expected to reach a record in June based on export inspections.

This strong pace of trade reflects the strong pace of net sales to markets outside of China.

“Since late March, cumulative sales to these markets have approached 7 million tons, roughly 50 percent ahead of last year’s pace. In contrast, cumulative net sales to China over the same period have turned negative in recent weeks as recent cancelations have exceeded sales since the end of March.

“The strong demand for soybeans in markets outside China is being driven by the hefty discounts for U.S. soybeans relative to Brazil, a direct response to the recent 25-percent duty levied on U.S. soybeans entering China beginning July 6. This has resulted in U.S. soybeans being considerably more competitive to Brazilian and Argentine product and at prices considerably below levels seen in April, a relative bargain for importers. This trend is expected to continue into the foreseeable future as both strong demand by China and the duties imposed on U.S. imports help maintain price premiums for South American soybeans well into 2019.”

Reuters writer Karl Plume reported on Thursday that, “Even Brazil, the world’s top soybean exporter, is prepping for major purchases of U.S. soybeans to feed its domestic processors as it diverts more of its own crops to China at premium prices, according to exporters association Anec. Brazil may import up to 1 million tonnes of U.S. soybeans, with purchases likely ramping up in October, said Anec representative Lucas Trindade.”

The Reuters article added that, “No. 3 exporter Argentina has also bought U.S. soy to supplement its own drought-stricken crop. U.S. soybean prices could fall further after the crops are harvested from September through November if Chinese buyers continue to avoid U.S. soybeans.”