Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Recent FAO and USDA Updates Provide Additional Perspective on U.S. Agricultural Trade

The Food and Agriculture Organization of the United Nations (FAO) recently published its biannual Food Outlook report that provides short-term forecasts for commodity production, trade and prices. Also this week, the U.S. Department of Agriculture updated its monthly trade database which provided more insight into agricultural trade prospects for this fiscal year. Meanwhile, recent news articles continue to focus on U.S. soybeans and the potential impacts of Chinese tariffs on exports. Today’s update looks briefly at each of these three items.

FAO- Food Outlook Report

FAO’s July Food Outlook report stated that, “Regarding [wheat] exports, the biggest year-on-year increase is forecast for the EU in the wake of lesser competition from the Black Sea exporters. Wheat shipments from the EU are currently forecast at 27.5 million tonnes, representing a 31 percent rebound from the reduced sales in 2017/18. Exports from the United States are also projected to increase, by around 9 percent to 25 million tonnes, while sales by Canada are anticipated to rise by just under 2 percent to 22.2 million tonnes. By contrast, exports from the Russian Federation are likely to decrease by at least 5 percent from the 2017/18 record high level to 37 million tonnes, due to this year’s anticipated fall in domestic production. Despite this decline, the country remains the world’s largest wheat exporter for the second consecutive season.”

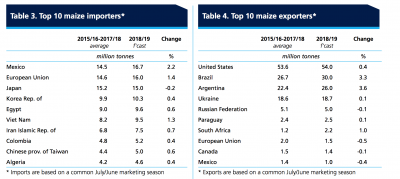

While addressing coarse grain economic variables, the FAO report noted that, “In Latin America and the Caribbean, total maize imports are forecast at nearly 36 million tonnes, 1.3 million tonnes more than in 2017/18, with the biggest increase foreseen in Mexico, followed by Colombia and Chile.

Maize imports by the region’s largest importer, Mexico, are set to reach a record 16.7 million tonnes, up 900 000 tonnes from 2017/18, driven by growing feed demand and this year’s decline in domestic production.

“By contrast, 2018/19 deliveries to Europe are forecast to decrease by nearly 1 million tonnes (5.4 percent) to 16.8 million tonnes, with all the predicted decline in the EU.”

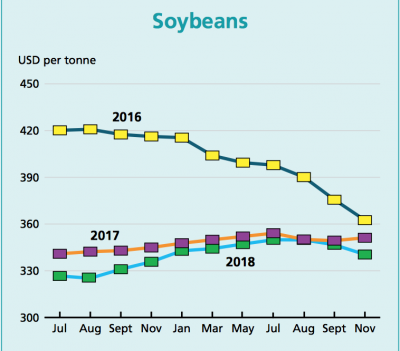

With respect to oilseeds, the Food Outlook report indicated that, “From March 2018 onwards, a dispute between the United States and China concerning their overall trade balance resulted in considerable market instability…in mid-June, China confirmed the tariff measure, the world’s key soybean spot and futures prices plunged, respectively, to 12-month and multi-year lows, with strong spillover effects across the oil crops complex.”

The FAO update added, “The lack of buying interest in the July 2018 soybean futures largely reflected China’s switch in demand from US to Brazil, where export premiums soared to record levels. The 2018 curves are markedly different from two years ago, when South American weather concerns for maize and soybeans elevated 2016/17 values over the successive crop year.”

USDA Monthly Trade Update

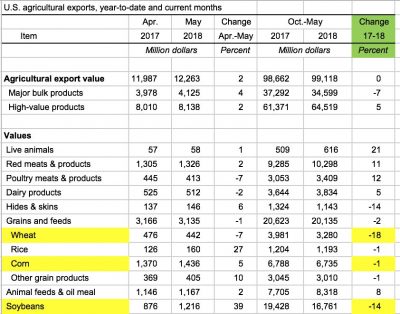

Recall that in June, USDA trade data showed that the total value of U.S. agricultural exports for this fiscal year (from October – April) was about two percent less than for the same seven month period in 2017.

However, USDA agricultural economist Bryce Cooke explained in a recent USDA Radio update that the most recent trade data from May shows U.S. agricultural exports are now $500 million ahead of last fiscal year.

Mr. Cooke noted that the $12.3 billion worth of U.S. agricultural exports in May was “the strongest May export value on record.”

Latest U.S. #Agricultural #Trade Data, https://t.co/BdkHhLkSvz @USDA_ERS pic.twitter.com/W5k3azx2Vc

— Farm Policy (@FarmPolicy) July 6, 2018

Despite the overall robust May trade figures, export values for U.S. soybeans (down 14%), wheat (down 18%), and corn (down 1%) were all lower than a year before.

Monday’s radio update reminded listeners that the May trade figures are “pre-tariff,” as is the current USDA export forecast, which projects total U.S. agricultural exports this year to exceed the 2017 level.

With respect to the recently imposed trade tariffs, Mr. Cooke noted that, “It’s harder to figure out how that will affect markets moving forward.”

Top 10 U.S. export markets for #corn by volume https://t.co/TvKg7YfK5Y @USDA_ERS pic.twitter.com/kNJoX5gaDK

— Farm Policy (@FarmPolicy) July 9, 2018

Meanwhile, the Department of Agriculture will update its quarterly trade forecast at the end of next month.

A separate USDA Radio update from Friday, which included remarks from World Outlook Board Chairman Seth Meyer, indicated that the World Agricultural Supply and Demand Estimates for July will include the Board’s “first shot” at considering the long-term impacts of the newly imposed Chinese and Mexican tariffs on U.S. agricultural products.

In a closer look at livestock exports, USDA’s Agricultural Marketing Service (AMS) stated in The Economic Landscape for July that, “Cumulative beef exports were higher in volume by 10 percent relative to 2017, and value was 21 percent higher. Japan, South Korea and Hong Kong were our largest export markets in May.”

A Chinese food company is saddled with a stack of unaffordable American steaks as a result of the U.S.-China trade war https://t.co/Jx2kIg7K2O #tictocnews pic.twitter.com/ReBY9LpdHr

— TicToc by Bloomberg (@tictoc) July 9, 2018

The AMS update added that, “For 2018 so far, pork exports are up from 2017 by 3 percent in volume and 5 percent in value. The largest overseas markets for U.S. pork were Japan, Mexico and South Korea.”

Also with respect to pork, a farmdoc daily update from Monday pointed out that, “Demand will likely be weakened by reduced exports with tariffs in place on U.S. pork exports to China and Mexico.”

Focus on Soybeans

Lev Borodovsky reported on Tuesday at The Wall Street Journal Online that, “A sharp increase in soybean exports ahead of China’s retaliatory tariffs significantly boosted the second quarter GDP growth. This distortion, however, will be reversed in the third quarter. Here is a note from Capital Economics:

“The rush by US exporters to beat the imposition of retaliatory tariffs on soybeans by China will provide an artificial boost to second-quarter GDP growth, but will become a potentially significant drag in the third quarter.

“US soybean exports jumped to $4.1bn in May, from $2.2bn the month before. China is the biggest global buyer of soybeans, which are used to feed pigs, while the US, along with Brazil, is one of the key global producers. Corn exports, also subject to the tariffs China introduced at the end of last week, increased to $1.5bn in May, from less than $1.0bn a few months ago. Although overall exports increased by 1.9% m/m in May, half of that gain was due to the rush to ship soybeans and corn before the tariffs hit.”

Nonetheless, Raymond Zhong reported on the front page of the Business section in Tuesday’s New York Times that, “For all its economic might, China hasn’t been able to solve a crucial problem.

Soybeans. It just can’t grow enough of them. That could blunt the impact of one of the biggest weapons the country wields in a trade fight with the United States.

The article noted that, “Still, soy-producing states like Iowa and Illinois might not feel the tariffs’ impact right away.”

“China is pressing its own farmers to grow more. But the math is daunting, and the obstacles are formidable,” the Times article said, adding that, “Farm goods could be a big weakness for China should the trade conflict with the United States turn into an all-out brawl.”