A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Federal Reserve Ag Credit Surveys- 2018 Second Quarter Farm Economy Conditions in the Midwest

On Thursday, the Federal Reserve Banks of Chicago, St. Louis and Kansas City released updates regarding farm income, farmland values and agricultural credit conditions from the second quarter of 2018. Recall that the Federal Reserve Bank of Dallas issued a similar update last month. Today’s update highlights core findings from Thursday’s reports.

Federal Reserve Bank of Chicago

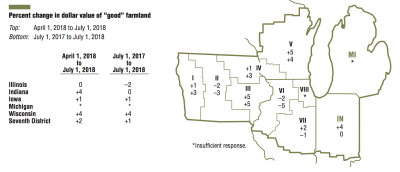

David Oppedahl, a Senior Business Economist at the Chicago Fed, explained in The AgLetter that, “Farmland values for the Seventh Federal Reserve District edged up 1 percent in the second quarter of 2018 from a year earlier. Moreover, values for ‘good’ agricultural land in the District increased 2 percent from the first quarter to the second quarter of 2018, according to a survey of 177 agricultural bankers. Overall, District farmland values were steady in the first half of 2018 even amid ongoing trade disputes.”

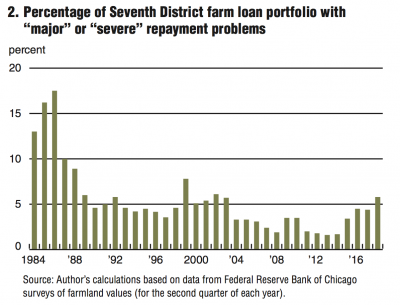

The Ag Letter noted, “In the second quarter of 2018, agricultural credit conditions for the District slid again. Repayment rates for non-real-estate farm loans were lower in the second quarter of 2018 than a year earlier.

The proportion of the District’s agricultural loan portfolio reported as having repayment problems increased some from a year ago, reaching mid- year levels not seen since 2002.

“Higher rates than a year ago for renewals and extensions of non-real-estate farm loans were reported by the bankers once more.”

Thursday’s update stated, “[T]he expected profitability of corn and soybean farms took a hit in the second quarter of 2018. Moreover, livestock producers had to deal with prices lower than those of a year earlier.”

The Chicago Fed update added, “Comments from District bankers emphasized their concerns (and farmers’ concerns) about the negative impacts to the agricultural sector from recent changes in trade policy. Additionally, an Indiana banker commented: ‘Commodity prices are becoming a greater concern. If they persist at present levels, it will cause some farmers to make major changes or exit their operations.'”

Federal Reserve Bank of St. Louis

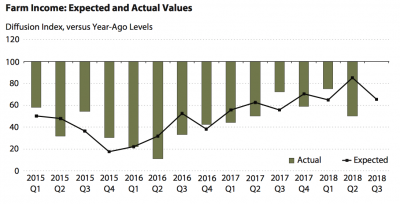

The Agricultural Finance Monitor stated on Thursday, “For the eighteenth consecutive quarter bankers who responded to the survey on net reported a decline in farm income when compared with the same period a year ago.”

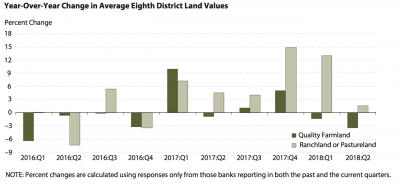

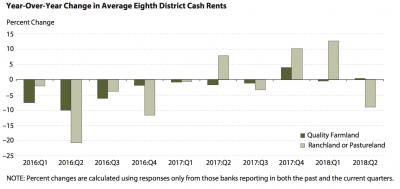

With respect to land values and cash rental rates, The Monitor noted that,

Quality farmland values decreased by 3.5 percent compared with a year ago, while cash rents increased by 0.4 percent relative to a year ago.

While addressing interest rate levels, the St. Louis Fed indicated that, “Interest rates were higher in the second quarter for all categories. Fixed-rate real estate loans demonstrated the highest increase of 29 basis points while fixed-rate operating loans increased the least of the categories with an increase of only 7 basis points.”

Federal Reserve Bank of Kansas City

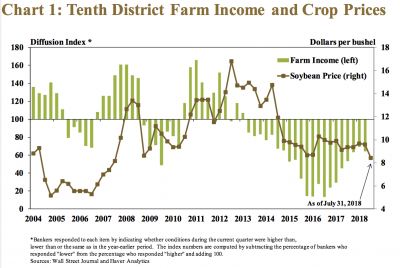

Nathan Kauffman and Ty Kreitman, writing in Thursday’s Ag Credit Survey from the Kansas City Fed, noted that, “A decline in farm income accelerated slightly in the second quarter as crop prices plummeted in June. In contrast to earlier signs of income stabilization, more District bankers reported a decrease in farm income. The sharp decline in crop prices likely contributed to reduced income.

In June alone, prices for U.S. soybeans dropped 17 percent. In addition, from the beginning of May to mid-July, corn prices also dropped 17 percent.

“Despite the steep declines in crop prices, however, the effect on farm income was somewhat limited with several months remaining before harvest begins.”

The Survey pointed out that, “While the sharp declines in commodity prices may have had a limited effect on trends in farm income leading into the second quarter, the conditions likely had a greater influence on future prospects for farm income…In the corn and soybean heavy states of Nebraska and Missouri, more than 50 percent of respondents expected farm income to decrease in the next three months. In comparison, less than 35 percent of respondents in Oklahoma and the Mountain States expected income to be lower.”

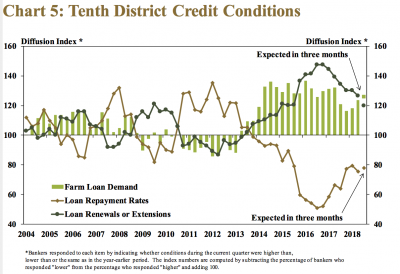

The Fed update explained that, “Despite some signs of stabilization in earlier quarters, agricultural credit conditions in the second quarter also weakened at a slightly faster pace. Following a trend similar to farm income, rates of loan repayment deteriorated slightly after showing signs of improvement in late 2017.”

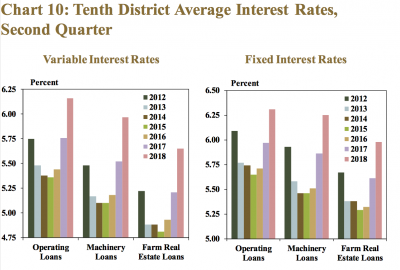

While addressing interest rates, Kauffman and Kreitman stated, “Interest rates on farm loans continued to rise in the second quarter, building on those of a year ago. The increase in the second quarter was largest for variables rate loans, growing about 6 basis points more than fixed rates for the same type of loan.

While increased interest expenses are unlikely to have a significant impact on farm income in the short term, higher rates are likely to influence decisions in making longer-term capital and real estate purchases.

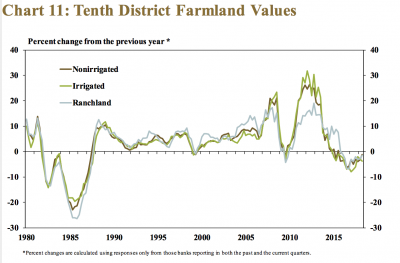

More broadly, the KC Fed also pointed out that, “Recent increases in interest rates could continue to put pressure on the market for farm real estate, but farmland values generally remained steady. The annual rate of decline in the value of farmland in the second quarter was relatively small for all land types across the District.”

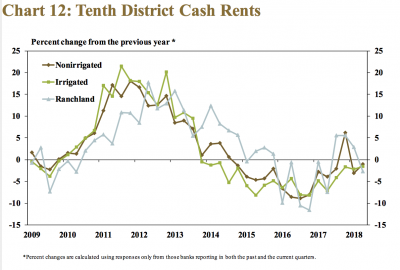

And with respect to cash rents, Thursday’s report noted, “Slight declines in cash rents for farmland reduced farm expenses slightly, but the overall cost of production relative to commodity prices has continued to weigh on farm income.”

In conclusion, the Fed update explained, “If crop prices remain low through harvest, many farm borrowers likely will face additional increases in financial stress and the future path of agricultural credit conditions may hinge on the strength of farmland markets.”