The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

Reports Discuss Soybean Export Variables

Today’s update looks briefly at recent reports that discuss variables associated with U.S. soybean exports. In addition, news items that highlight concerns about crop storage issues, and the trade policy outlook, are also noted.

Soybean Export Variables- Recent Reports

The October edition of the Agricultural Market Information System (AMIS) Market Monitor stated that, “For fifteen years, US farmers have responded to China’s inexorable demand for soybeans by nearly doubling their output of the oilseed, even as other countries eagerly joined the soybean production race. While the flow of US soybean sales to China reached about 36 million tonnes in 2016/17, today it has nearly halted.

U.S. Soybean Orders From China: (A VERY important note, a negative number means canceled orders) pic.twitter.com/MP5CjCKXAK

— Michael McDonough (@M_McDonough) October 5, 2018

“In a retaliatory measure to US tariffs on a host of Chinese products, China imposed an additional 25 percent tariff on soybeans coming from the US in July 2018. Previously unthinkable distortions to trade flows and prices have emerged as a result. Compounded by a bumper soybean crop in the US, owing to favourable weather and near record soybean acreage, US producers now face a triple price disadvantage:

- the soybean futures price plummeted to a ten-year low;

- the cash basis quotes in multiple growing areas dropped to historically low levels;

- and the carrying charge from this November to next has reached a record wide number.

In other words, US producers selling soybeans during this fall period are certain to make distressed sales.

The Market Monitor pointed out that, “[C]hina cannot secure its projected imports of over 90 million tonnes and will have to find new suppliers and indeed has recently agreed to import soy products from India for the first time. Alternatively, it can buy larger quantities from the Americas – excluding the US – as Canada, Mexico and Argentina are taking increased quantities of US soybeans. These countries, in turn, can take advantage of the abnormally wide arbitrage between US and non-US prices to satisfy domestic needs and boost exports.”

The AMIS update added: “With no resolution in sight, the economic tolls on the two countries engaging in a trade spat have reached historic levels, likely not projected in worst case scenarios, while other countries have gained the upper hand.”

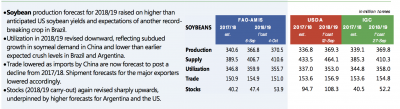

Meanwhile, a recent update (“Brazil: Oilseeds and Products Update“) from the USDA’s Foreign Agricultural Service (FAS) stated that, “Soybean exports for MY 2018/19 (February 2019 to January 2020) are forecast to reach a new record of 75.5 mmt…assuming China continues to apply import duties to U.S. soybeans, demand for Brazilian soybeans will remain elevated.”

The FAS update noted that, “Total soybean exports in MY 2017/18 (February 2018 to January 2019) are forecast to set a new record of 75 mmt on the back of robust demand from China…as the below chart shows, while the traditional peak for Brazilian soybeans is March through July, exports have continued at a stronger than usual pace in August.”

FAS added, “Despite some indications in the press that Brazil may import a large volume of soybeans from the United States, Post does not anticipate this. According to Post conversations with traders, the infrastructure in Brazilian ports is not adept for the import of grains.”

And Bloomberg writer Andrew Mayeda reported Friday that, “The U.S. trade deficit widened in August to the biggest in six months as soybean exports plunged and a measure of the gap with China hit a record, showing how the Trump administration’s trade war is dragging on economic growth.”

“Soybean exports dropped $1 billion, or 28 percent, to $2.58 billion, reversing a run-up earlier this year ahead of retaliatory levies from China,” the article said.

Storage Concerns

David Fickling indicated last week at Bloomberg News that, “Across the U.S. Midwest, farmers are taking in their annual harvests of corn, soybeans and sorghum. This year, they have a special problem: Where to put it all?

“Grain storage levels already have been extraordinarily tight. For the past two years, about 73 percent of capacity was used up in the December peak season, when the three crops are newly harvested. Thanks to Chinese tariffs, lackluster prices and near-perfect growing conditions, there’s likely to be even less space this time around.”

And a news release on Tuesday from Rep. Ralph Abraham (R., La.) stated that, “[Rep. Abraham] today wrote to U.S. Department of Agriculture Sec. Sonny Perdue requesting that the USDA provide assistance to soybean farmers in finding places to store the current soybean harvest until it can be brought to market.”

Trade Outlook

Wall Street Journal writer Vivian Salama reported Friday that, “With a month to go until the midterm elections, President Trump will hit the road next week to sell his new North American trade deal in the U.S. heartland, while trying to ease concerns over lingering trade disputes.”

The article noted that, “At a rally in Minnesota on Thursday night, Mr. Trump argued that his ‘America First’ policies are paying off for farmers and workers.

‘We have removed unfair trade barriers for our proud Minnesota farmers and our dairy producers like has never, ever been done before in our country,’ he said.

.@SecretarySonny: "Let's see if China wants to come along." pic.twitter.com/JaVvj3k1S6

— FOX Business (@FoxBusiness) October 3, 2018

Ms. Salama added: “The Trump administration has sought to ease the blow by compensating U.S. farmers for the hit from the retaliatory tariffs, including by extending $3.2 billion in compensatory cash payments to soy producers.”