A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Steady Farmland Values Help Insulate a Struggling Agricultural Sector

Suzanne Jenkins, a senior policy analyst at the Federal Reserve Bank of St. Louis, and Nathan Kauffman, vice president at the Federal Reserve Bank of Kansas City, indicated in a recent update (“A Tale of Two Economies: Farmers Struggle despite Strong U.S. Economy“) at the Regional Economist that, “At a time when the overall U.S. economy continues to boom, the U.S. agricultural sector has continued to struggle amid falling farm income and deteriorating agricultural credit conditions.

“Over the past five years, U.S. economic growth has continued to strengthen. The growth in U.S. real gross domestic product (GDP) has averaged 2.4 percent per quarter since 2013.

Down on the farm, though, conditions have been far from robust. From 2013 to 2017, net farm income—considered to be a broad measure of farm profitability—fell 39 percent, from $123.8 billion to $75.5 billion.

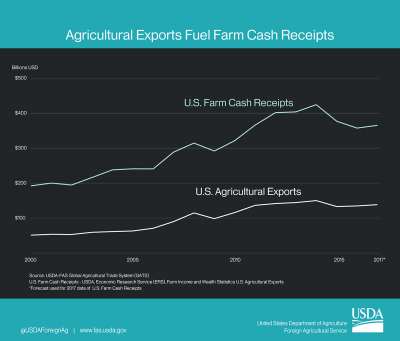

The authors noted that, “While domestic demand remains strong, the decline in its rate of growth has increased the importance of export markets as a source of long-term growth. Indeed, concerns have increased that farm income will fall even lower in 2018 amid trade disputes with China and other countries.”

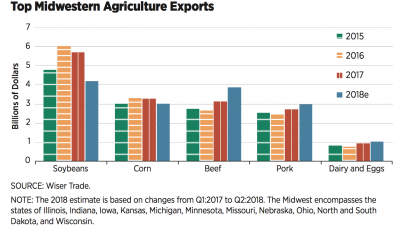

Jenkins and Kauffman explained that, “About 80 percent of all U.S. commodities are consumed domestically, with 20 percent exported. In 2017, soybeans were the most valuable export from the Midwest, followed by corn, beef, pork, and dairy and eggs.”

The Federal Reserve Bank writers noted, “While large harvests improve the cash flow of agricultural producers in the short term, they hurt profitability going forward because of the downward effect on prices. In turn, years of sluggish profits have forced more farmers to take out loans to finance their operations.

In the second quarter of 2018, agricultural bankers across the Midwest reported elevated demand for farm loans, as well as a modest increase in problems with loan repayment, amid reduced agricultural profitability.

And a separate report from the Federal Reserve Bank of St. Louis (“Soybeans, the Eighth District’s No. 1 Crop, Caught in Trade Tussle“) explained recently: “With lower prices of soybeans and other grains, many U.S. farmers have struggled to break even in recent years. While there haven’t been any indications of major reductions in farming activity up to this point, there have been several reports of farmers’ equity shrinking significantly. Thus, farm consolidation and outright closing are expected if prices remain low.”

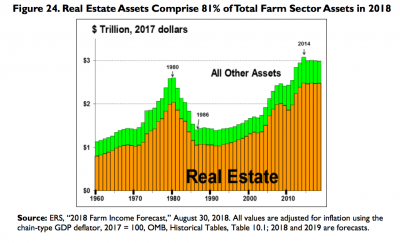

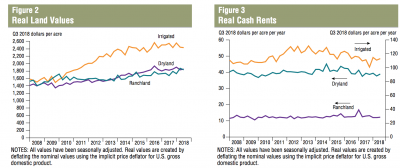

Nonetheless, Jenkins and Kauffman stated that, “Farmland values appear to have remained relatively steady during all of this volatility. Farmland values can comprise more than 80 percent of the total value of farm assets; so, the debt-to-asset ratio, a common measure of solvency, is an important measure.”

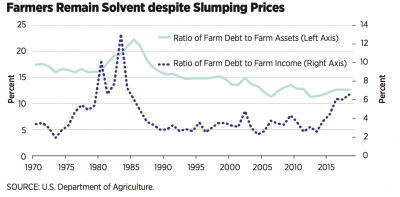

“As shown in [the figure below], the farm sector appears to remain relatively well insulated from potential solvency impacts because the debt-to-asset ratio remains relatively low by historical standards.”

More specially with respect to farmland values, on Monday, the Federal Reserve Bank of Dallas released its Agricultural Survey for the third quarter of 2018.

The Survey stated that, “District dryland values ticked up this quarter, while irrigated cropland and ranchland values declined. According to bankers who responded in both this quarter and third quarter 2017, Texas nominal dryland and ranchland values increased year over year. Southern New Mexico respondents indicated an increase in cropland and ranchland values, and northern Louisiana respondents reported an increase in dryland and ranchland values but a slight decline in irrigated cropland values.”

The Dallas Fed update added, “The anticipated trend in the farmland values index was positive for a sixth consecutive quarter, inching up to its highest value since 2014 and suggesting continued expectations for farmland values to trend up in the upcoming months.”