President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

Weather, and Policy Uncertainty Converge on Farmers’ Planting Decisions

Ongoing wet weather in the Corn Belt, along with uncertainty associated with recent executive and legislative branch policy related actions, have converged on U.S. farmers as planting deadlines loom. With June just days away, producers are sorting though both known, and significant unknown variables, in an effort to figure out how to maximize returns on their operations. Today’s update highlights some of these issues in more detail.

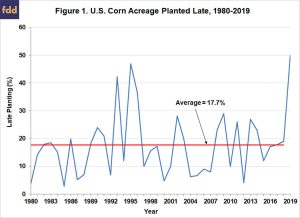

Unprecedented Weather Issues, Late Planting

The USDA’s Agricultural Marketing Service (AMS) noted in its Weekly National Grain Market Review on Friday that, “Monday’s planting progress report for the week ending May 19th revealed that planting pace for corn is now 29 percent behind a year ago and 31 percent behind the the 5 year average. Notable states and their progress behind the 5 year average; Illinois-65 pct, Indiana-59 pct, Ohio-53 pct, Iowa-19 pct and Nebraska-16 pct.”

The AMS update added that, “Soybean acres planted are 34 percent behind a year ago and 28 percent behind the 5 year average.”

Friday’s Market Review also explained that, “Analysts are now very much concerned about how many acres will either go through a prevented planting scenario or move from corn to soybean production this growing season.”

Meanwhile, Bloomberg News weather reporter Brian K Sullivan indicated on Friday that,

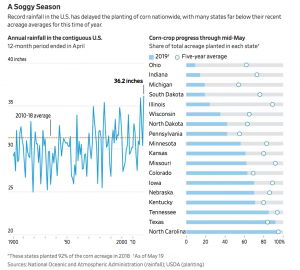

The rain across the Midwest and Great Plains that’s closed refineries, flooded streets and snarled Mississippi River traffic shows no sign of abating, adding to the U.S.’s wettest 12-month stretch on record.

The Bloomberg article stated that, “The 12 months ending in April have been the contiguous U.S.’s wettest yearlong stretch on record, according to the National Centers for Environmental Information.”

Friday’s article added that, “‘Planting across key areas of the corn belt has been seriously hampered,’ said Jim Rouiller, chief meteorologist at the Energy Weather Group. ‘The near-term to medium-range weather models point to this weather pattern persisting into mid June.'”

Here is the latest precipitation forecast for the next 7 days. The persistent wet pattern will continue across the Plains and Midwest, with heavy rain also possible across the Northern Rockies early this week. https://t.co/47M8fG8wb3 pic.twitter.com/1lL6E3daoy

— NWS WPC (@NWSWPC) May 26, 2019

Also last week, Wall Street Journal writers Jesse Newman and Jacob Bunge reported that, “The dismal weather is another blow to farmers and agricultural companies during a prolonged slump in the U.S. farm economy. Six straight years of bumper crops have swelled grain supplies and pushed down prices for farmers, while protracted trade disputes have slowed crop exports, further pressuring farm income and agribusiness profits.”

And New York Times writers Julie Bosman and Manny Fernandez reported Friday that, “This spring has been a season of record-breaking floods across the Midwest, submerging farms, businesses and houses. Scientists have predicted that the flooding this year could be worse than the historic floods of 1993, which devastated the region.”

Decisions in an Uncertain Environment- MFP Payments, Disaster Aid, Prevented Plant

As producers grapple with planting under these difficult weather conditions, the U.S., China trade war continues to percolate; which prompted the Trump administration last week to announce a $16 billion proposal to help offset the adverse financial impacts of the ongoing trade conflict on American farmers.

Recall that farmers will have to plant a crop this spring to be eligible for the market facilitation program (MFP) payments and that the USDA has not disclosed what the MFP payment rates will be. The payments will not be based on a specific crop, will vary by county, and will be based on the number of acres planted.

Adding to the developments affecting producers, New York Times writer Emily Cochrane reported last week that, “The Senate on Thursday passed a long-delayed disaster relief package, a step toward ending a monthslong impasse that had prevented the release of billions of dollars in aid for farmers and communities struggling to recover from an onslaught of natural disasters over the last two years.”

Senate just passed supplemental disaster bill Includes my amendment to cover grain lost from busted grain bins due to flooding & $$ available to Iowans affected by flooding etc More disaster $$ will b needed after all flood assessments are complete but this is good start

— ChuckGrassley (@ChuckGrassley) May 23, 2019

“The delay has been particularly hard on farmers, already bruised by the administration’s trade war and reluctant to move forward in the middle of planting season without the promise of federal aid,” the Times article said.

The measure was blocked by Texas GOP Rep. Chip Roy in the House on Friday.

While political games over disaster assistance continue as a Member from TX blocked a package from getting to @POTUS desk today, one thing is clear: This bill has broad support & will advance when the House reconvenes & will be signed into law by POTUS the first week of June.

— Rep. Austin Scott (@AustinScottGA08) May 24, 2019

AP writer Andrew Taylor explained last week that, “Democrats said the House might try to again pass the measure next week during a session, like Friday’s, that would otherwise be pro forma. If that doesn’t succeed, a quick bipartisan vote would come after Congress returns next month from its Memorial Day recess.”

President Trump supports the bill.

Title I of the Senate disaster aid measure, which covers agriculture, stated in part that, “For an additional amount for the ‘’Office of the Secretary’’, $3,005,442,000, which shall remain available until December 31, 2020, for necessary expenses related to losses of crops (including milk, on-farm stored commodities, crops prevented from planting in 2019, and harvested adulterated wine grapes), trees, bushes, and vines, as a consequence of Hurricanes Michael and Florence, other hurricanes, floods, tornadoes, typhoons, volcanic activity, snowstorms, and wildfires occurring in calendar years 2018 and 2019 under such terms and conditions as determined by the Secretary…”

4. Call me a cynic, but I don't think it was an accident that this provision was in a disaster bill with $3B passed yesterday afternoon! Hmmm. PP acres not eligible for MFP, but then bam, a bill appears with mucho funding and PP acres are eligible for disaster payments. pic.twitter.com/8PuVT8sdw4

— Scott Irwin (@ScottIrwinUI) May 24, 2019

Richard Fordyce, the Administrator of USDA’s Farm Service Agency (FSA), spoke with Mike Adams on Friday’s Adams on Agriculture radio program about variables associated with trade aid, and the disaster bill (audio replay here (MP3- 7:30); transcript here).

With respect to the MFP payments, Mr. Fordyce noted that, “And so producers need to know that they are also…that they’re going to be paid by planted acres, so it’s not going to matter if it’s a Title 1 or some other crops that’ll probably be included in that as well, that if they are planted, they will get a payment per acre. So folks shouldn’t think that one crop is going to pay more than another because there will be a specific payment per acre by county based on planted acres, no matter what that’s planted to as far as a Title 1 crop.”

Mr. Adams asked, “But prevent acres, which will be many this year, it looks like, will not be part of this. That will be covered under the disaster aid package, is that correct?”

Mr. Fordyce indicated that, “It could be, Mike. And I think that we’re still trying to understand what that is and what that’s going to be at this point. But at this time the MFP Part 2 will pay on planted acres only at this point.”

Meanwhile, Bloomberg writer Michael Hirtzer, reporting last week within the context of the planting requirement for MFP payments, explained that, “That seems simple enough, except that after heavy rains and flooding in the American heartland this spring farmers were expected to discontinue their planting plans. Speculation was mounting that growers would instead opt to make claims for so-called prevented plant insurance.”

“If the aid prompts farmers to go for plantings instead of the insurance payments, it could end up hurting crop markets in the long run since that would mean more production at a time when prices have been weighed down for years by ample supplies,” the article said.

10. Bottom-line is that MFP and plant/no plant decision are coupled and increases incentive for planting by some amount. Is this really sound policy in a year when tens of millions of acres may be considered for PP?

— Scott Irwin (@ScottIrwinUI) May 24, 2019

In a separate Bloomberg article last week, Mr. Hirtzer reported that, “Worries over tighter supplies due to the soggy weather drove Chicago corn futures to surge as much as 3.9% on Friday, topping $4 a bushel and rising to the highest level in almost a year.

May 24: CBOT #corn futures top $4 per bushel in the front month for the first time since May 29, 2018. Just 11 days ago, corn had bottomed out at $3.35-1/2. Delays for #plant19 remain in focus and the forecast is still wet for most areas. pic.twitter.com/lKv0QimemQ

— Karen Braun (@kannbwx) May 24, 2019

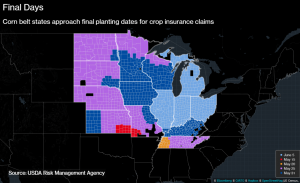

“The wet weather’s showing no signs of easing, and the insurance deadline for sowing has already passed for some farmers in southwestern Missouri, southeastern Kansas and western Tennessee. They now have to decide whether to plant with less coverage, or make prevented-plant claims.”

And DTN writer Katie Dehlinger reported on Friday that, “This spring’s planting decisions may be as clear as mud, yet they carry heavy financial consequences.

‘You couldn’t have planned this to be more confusing,’ said University of Illinois economist Gary Schnitkey. ‘The falling out of the trade deal happened right when we were getting to the point of planting corn.’

“Then, persistent heavy rains across wide swaths of the Corn Belt kept farmers from their fields, forcing many producers to weigh their options: take a prevented planting payment from crop insurance, plant corn but with lower insurance coverage levels or switch to soybeans.

“‘So it just becomes a point of looking for the alternative that you think has the highest expected return, even though it’s probably not the return that you’d like,’ he said. Many farmers will still be looking at negative incomes as they put pen to paper.”