As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Farmers Unsettled by U.S. Tariff Threats, While USDA Projects Lower Agricultural Exports

Recent news articles point to a feeling of unease among U.S. farmers regarding President Trump’s threat late last week to impose import tariffs on Mexican goods. Mexico is a top export market for U.S. corn and pork, and additional complications with ratifying the USMCA trade pact are unwelcome while trade negotiations continue with China, the European Union, and Japan. Meanwhile, the U.S. Department of Agriculture released its quarterly projections for U.S. agricultural trade last week. Today’s update highlights these issues in greater detail.

Threat of Tariffs on Mexican Imports Raises Alarms

Yen Nee Lee reported on Friday at CNBC Online that, “The fate of the updated trade deal between the U.S., Mexico and Canada was thrown into question after President Donald Trump threatened to impose a 5% tariff on all Mexican imports starting June 10.”

“John Negroponte, the U.S. ambassador to the United Nations during the second Bush administration and now vice chairman of consultancy McLarty Associates, said on CNBC’s ‘Street Signs’ that Trump’s announcement was ‘ill-timed,’ given that the process to ratify the three-country trade deal — the United States-Mexico-Canada Agreement — has just kicked off.”

New York Times writers Carlos Tejada and Amie Tsang reminded readers on Friday that, “Just eight months ago, Mr. Trump’s negotiators struck a deal with Mexican and Canadian officials that they said would replace the North American Free Trade Agreement. His new threat comes even before Congress has approved the deal, and signals to American partners that continuing disputes and threats are now the norm in global trade — at least as long as Mr. Trump is in office.”

Nonetheless, Anthony Harrup reported at The Wall Street Journal Online on Friday that, “President Andrés Manuel López Obrador said Mexico would continue with the process of approving a trade agreement with the U.S. and Canada despite President Trump’s plan to impose escalating tariffs on all Mexican imports beginning June 10.”

“Mexican officials delivered documents to the Mexican Senate on Thursday to start the process of ratifying the U.S.-Mexico-Canada Agreement, known as USMCA, which was negotiated last year to replace the North American Free Trade Agreement. That process will continue, Mr. López Obrador said.”

And Josh Zumbrun and Yoko Kubota reported on the front page of Monday’s Wall Street Journal that, “Mexico, meanwhile, rushed a delegation to the U.S. to discuss immigration issues, following the Trump administration’s threat last week to impose tariffs on all Mexican goods entering the U.S. if the Mexican government fails to take aggressive measures to stem the flow of immigrants through Mexico and into the U.S.”

Mexico is sending a big delegation to talk about the Border. Problem is, they’ve been “talking” for 25 years. We want action, not talk. They could solve the Border Crisis in one day if they so desired. Otherwise, our companies and jobs are coming back to the USA!

— Donald J. Trump (@realDonaldTrump) June 2, 2019

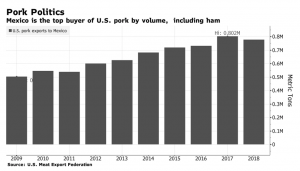

Bloomberg writers Mike Dorning and Shruti Singh reported on Friday that, “U.S. farm groups are complaining about President Donald Trump’s decision to announce new tariffs on a top buyer of their pork, corn and wheat.”

The article indicated that, “Trade disputes with Mexico and China already have cost U.S. pork producers $2.5 billion over the past year, [David Herring, president of the National Pork Producers Council] said.”

Friday’s article added that, “‘Amid a perfect storm of challenges in farm country, we cannot afford the uncertainty this action would bring,’ National Corn Growers Association President Lynn Chrisp said in an emailed statement. He said the president should ‘reconsider using tariffs to address non-trade issues.'”

Wall Street Journal writers Jacob Bunge and Jesse Newman reported on Friday that, “Farm groups warned the White House against proposed new tariffs on Mexico, predicting they could trigger retaliatory trade actions from Mexico and again impede exports to one of the top markets for U.S. crops and meat.”

The Journal writers pointed out that, “The broader U.S. agricultural sector over the past year has endured lower crop prices and commodity-market swings driven by trade disputes.

#Iowa:

— Farm Policy (@FarmPolicy) May 31, 2019

The April 2019 average price received by #farmers for #soybeans, at $8.25 per bushel, was down 21 cents from the March price and $1.50 below the April 2018 price, @usda_nass pic.twitter.com/0Hcub4rVUr

“Farmers have been counting on stability from the new trade deal, the U.S.-Mexico-Canada Agreement (or USMCA), which they expect to protect the annual flow of billions of dollars in agricultural goods that cross the countries’ borders.”

Sen. Chuck Grassley (R., Iowa) said late Thursday that new tariffs would undermine work toward the new trade deal. ‘Following through on this threat would seriously jeopardize passage of USMCA,’ he said.

Also Friday, Bloomberg’s Erik Wasson and Steven T. Dennis reported that, “Grassley of Iowa had led the successful campaign to get Trump to end earlier tariffs on Mexican and Canadian steel and aluminum imports, using the threat of holding up the U.S.-Mexico-Canada Agreement. Grassley wasn’t notified in advance of Trump’s announcement of the new tariffs, said the senator’s spokesman, Michael Zona.

“The House Ways and Means Committee’s top Republican, Kevin Brady of Texas, called for a resolution between the U.S. and Mexico to head off the tariffs.

“Joining Grassley in opposition to the tariffs were pro-trade Senate Republicans Pat Toomey of Pennsylvania, Martha McSally of Arizona, John Cornyn of Texas, Joni Ernst of Iowa and Rob Portman of Ohio, whose votes Trump will need to pass the USMCA.”

“Tariffs are a good way to get a trading partner’s attention and apparently it did,” Kellyanne Conway told us in a driveway gaggle, referring to Trump’s controversial new Mexico tariffs.

— Jennifer Jacobs (@JenniferJJacobs) May 31, 2019

Mexico says there will be a summit in DC on Wednesday “to resolve differences” with the US. pic.twitter.com/f8rjodf0b3

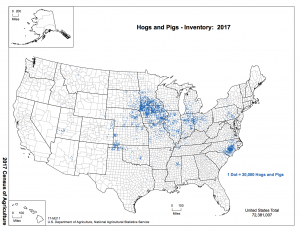

From a political standpoint, Bloomberg’s Mike Dorning and Keith Naughton reported on Saturday that, “Iowa, which voted for Trump in 2016 after supporting Democrat Barack Obama in 2008 and 2012, is the largest U.S. producer of hogs and of corn. North Carolina, another electoral battleground, is the nation’s second-largest hog producer.”

And Reuters writer Sharay Angulo reported on Sunday that, “On Friday, Mexico’s top farm lobby said [Mexican President Andres Manuel Lopez Obrador] should target agricultural goods from states that support Trump’s Republican Party if the U.S. president carries out his threat.”

Anthony Harrup and José de Córdoba reported on the front page of Tuesday’s Wall Street Journal that, “Mexico is exploring possible retaliation to the threat of U.S. tariffs on all of its exports but would rather convince the Trump administration that a negotiated solution is in both countries’ best interest, senior officials said Monday.”

Meanwhile, Washington Post writers Erica Werner, Seung Min Kim and Damian Paletta reported on Tuesday that, “Congressional Republicans have begun discussing whether they may have to vote to block President Trump’s planned new tariffs on Mexico, potentially igniting a second standoff this year over Trump’s use of executive powers to circumvent Congress, people familiar with the talks said.

Mick Mulvaney on the President's threat to impose tariffs on Mexico:

— FoxNewsSunday (@FoxNewsSunday) June 2, 2019

He is absolutely, deadly serious. I fully expect these tariffs to go on to at least the 5 percent level on June 10th the President is deadly serious about fixing the situation at the southern border. #FNS pic.twitter.com/edZNTteiEW

“The vote, which would be the GOP’s most dramatic act of defiance since Trump took office, could also have the effect of blocking billions of dollars in border wall funding that the president had announced in February when he declared a national emergency at the southern border, said the people, who spoke on the condition of anonymity because the talks are private.

“Trump’s plans to impose tariffs on Mexico — with which the United States has a free-trade agreement — rely on the president’s declaration of a national emergency at the border. But the law gives Congress the right to override the national emergency determination by passing a resolution of disapproval.”

The Post article also stated that, “On Monday, lawmakers from both parties, including several top Republicans, warned that Trump was risking the destruction of a pending trade deal with Mexico and Canada by preparing to slap import penalties on Mexican goods.”

USDA Agricultural Trade Projections

On Thursday, USDA’s Economic Research Service (ERS) released its quarterly Outlook for U.S. Agricultural Trade report, which stated that, “U.S. agricultural exports for fiscal year (FY) 2019 are projected at $137.0 billion, down $4.5 billion from the February forecast, due to reductions in grains, oilseeds, and livestock and products. Corn and wheat exports are forecast down $1.4 billion and $1.2 billion, respectively, on lower volumes and unit values.

Soybean exports are forecast down $1.5 billion to $17.0 billion, driven by lower demand due to African Swine Fever, weak prices, and continuing trade tensions with China.

The ERS update stated that, “FY 2019 grain and feed exports are forecast at $31.0 billion, down $2.7 billion from the February forecast. Corn exports are forecast at $10.4 billion, down $1.4 billion on both lower volumes and unit values. U.S. corn continues to be less price-competitive than South American corn…[and]…Wheat exports are forecast at $6.3 billion, down $1.2 billion on lower volumes and unit values, which are pressured by the sluggish pace of shipments in recent months and projections for large new-crop supplies in major exporting countries.”

Last week’s report added that, “Oilseeds and oilseed product exports are projected at $26.4 billion, down $1.4 billion from the February forecast, driven by lower soybean volumes and unit prices. Soybean volumes are down in part due to lower demand caused by African Swine Fever (ASF) in China and continued duties on U.S. soybeans. The price premium for South American soybeans temporarily evaporated between early January and mid-May, eliminating the price advantage that U.S. soybeans had in markets outside China. Weaker soybean demand in China also has contributed to price weakness as U.S. producers continue to hold large stocks.”

The livestock, poultry, and dairy export forecast is reduced $500 million to $29.9 billion on declines for virtually all products except dairy, which is forecast higher.

“Beef exports are forecast $300 million lower on softer prices and volumes. However, the United States is poised to expand market share in Asia as competitor Australia struggles with weather-related production impacts and lower exportable supplies. The pork export forecast is lowered $100 million on lower volumes. The slow start to FY 2019 will be mostly offset in the second half, as stronger global demand, due to the spread of ASF in Asia, boosts prices,” ERS said.