A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Corn Exports: Chinese Pigs, American Crops- “Increasingly Interdependent”

On Monday, Reuters writer Dominique Patton reported that, “Behind the walls of a hulking industrial compound in rural China, top pig producer Muyuan Foods is trying to raise more hogs on a single site than any company in the world – a risky investment with deadly African swine fever lingering.

“The new farm, which began construction in March and started operations at the first of its 21 buildings in September, epitomises the breakneck pace at which huge, industrialised hog breeding facilities are replacing small, traditional farms, many of which were wiped out by the worst animal disease outbreak in recent history.

“The shift, under way for years, has accelerated sharply, fuelled by huge profits at corporate producers since African swine fever ravaged the country’s herd and sent pig prices soaring to double the previous record.”

The Reuters article noted that, “Muyuan’s new mega farm near Nanyang, which will eventually house 84,000 sows and their offspring, is by far the largest in the world, roughly 10 times the size of a typical breeding facility in the United States. It aims to produce around 2.1 million pigs a year.”

Monday’s article added that, “Muyuan will spend about 40 billion yuan this year on new pig farms, [Qin Jun, Muyuan’s vice general manager] said, about eight times what it spent two years ago, and roughly double the capital automaker Tesla is projected to spend.”

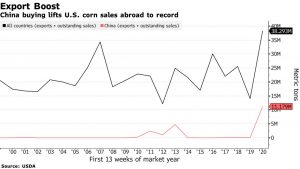

With this background on Chinese pork production in mind, Bloomberg News reported on Monday that, “Measured by the bushel, the U.S.-China relationship has never been stronger.

Through the trade war and open hostilities at the highest political levels, pig farmers in China and crop farmers in the U.S. have become increasingly interdependent.

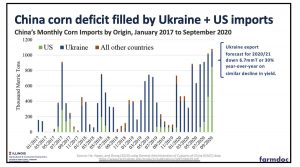

“Already America’s biggest customer of soybeans and sorghum, for this season China bought an unprecedented 11.2 million metric tons of corn, up nearly 1,300% compared with pre-trade-war purchases.”

“For the moment, both sides seem happy. The American imports have helped China feed its hog herd, which is recovering faster than expected after the African swine fever outbreak created a shortage of the country’s most staple protein. Meanwhile, U.S. farm profits are at a seven-year high, riding China’s demand and additional support from federal aid to agriculture.”

Top 10 U.S. export markets for #corn, by volume https://t.co/V85OpkE44w @USDA_ERS

— Farm Policy (@FarmPolicy) December 7, 2020

* #China pic.twitter.com/22ktKYTx73

The Bloomberg article pointed out that, “China’s bought nearly 30 million metric tons of U.S. soybeans, the most for this point in the season since 1991 and 57% of America’s export sales. For sorghum, which is also a substitute for corn, China accounts for 80% of sales. Corn purchases, once negligible, rocketed to almost 30%.”

The Bloomberg article added that, “‘Everybody focuses on soybean trade, but as the Chinese livestock industry is professionalizing their feeding practices, it means not only the soybean meal demand will grow, but it also means the corn demand grow as well too,’ Greg Morris, president of Archer-Daniels-Midland Co.’s Ag Services and Oilseeds unit, said at a recent investment conference.”

Amid high domestic prices, surging local feed demand and against the backdrop of the early-2020 US-China trade deal, #maize (#corn) imports by China in 2020/21 (Jul/Jun) are forecast at a record level and more than double y/y. pic.twitter.com/NCbdWIQhvc

— International Grains Council (@IGCgrains) December 1, 2020

Meanwhile, earlier this week, Reuters News reported that, “China’s soybean imports in November jumped from the previous year, customs data showed on Monday, as cargoes booked from the U.S. following the Phase 1 trade deal cleared customs.

“China, the world’s top soybean buyer, brought in 9.59 million tonnes, up from 8.28 million tonnes in the same month a year earlier, data from the General Administration of Customs showed, as more American cargoes arrived in the fourth quarter.

“November imports were also up from 8.7 million tonnes in October.”

Top 10 U.S. export markets for #soybeans, by volume https://t.co/V85OpkE44w @USDA_ERS pic.twitter.com/7zoIDQ0hsj

— Farm Policy (@FarmPolicy) December 7, 2020

The Reuters article pointed out that, “Chinese buyers stepped up purchases of U.S. farm produce including soybeans to fulfill China’s pledge in the initial trade deal it signed with the United States in January this year.”